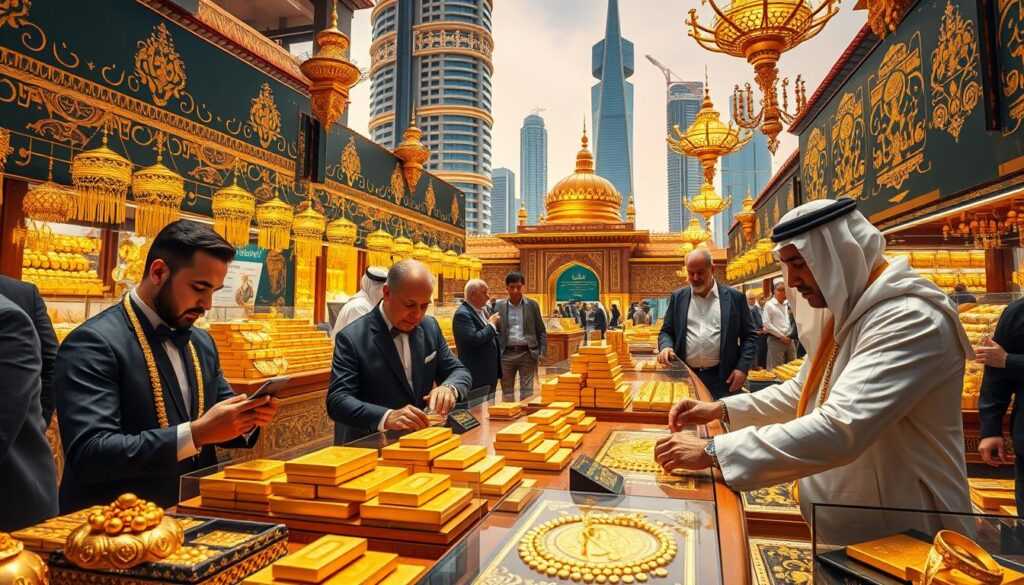

Ever wondered how to get into gold trading in the UAE? Dubai, known as the “City of Gold,” is a great place. It offers tax-free trading and modern facilities. This is your chance to join smart investors in this global center.

The UAE’s gold market is growing fast. Prices for 24K gold have reached ₹8,040 per gram in Dubai. This is a great time to check out top gold trading platforms and start investing in gold.

Are you ready to start? Consider opening an account with ICM Capital, a global broker with Abu Dhabi Global Markets (ADGM) approval. Or look at Equiti, licensed by the Securities and Commodities Authority of the UAE, with spreads as low as 0.1 pips for EUR/USD. ATFX is also a good choice, with multiple licenses and SCA authorization.

These platforms let you start trading with just $100. Dubai’s 5% VAT and tax benefits also attract traders from around the world. Are you ready to explore UAE’s top gold trading platforms?

Key Takeaways

- Dubai offers tax benefits and modern infrastructure for gold traders

- Top platforms like ICM Capital, Equiti, and ATFX are regulated and authorized

- Minimum deposits start at $100 for some platforms

- Dubai’s 5% VAT makes gold trading more cost-effective

- The UAE gold market shows significant price variations and growth

- Regulatory bodies ensure market integrity and investor protection

- Gold rates in the UAE vary by karat, with 24K at AED 319.25 per gram

Understanding Gold Trading in the UAE

Gold trading is big in the UAE. Dubai’s gold market is a key place for gold trading companies and online bullion dealers. People love gold for more than its beauty. It attracts investors and traders.

The Growth of Gold Trading

The UAE’s gold trade has grown a lot. In 2022, gold imports hit USD $28.5 billion. This is more than crude oil imports. It shows the UAE is a big player in gold trading.

Gold exports from the UAE were USD $16.2 billion. This shows the UAE’s big role in the global market.

Factors Driving Gold Prices

Gold prices change for many reasons. Global economy, supply and demand, and local market all affect it. On June 2, 2023, gold prices changed by 1.8%.

The Dubai Gold and Commodities Exchange (DGCX) helps with futures trading. It lets investors protect against price changes.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Popular Gold Trading Methods

There are many ways to trade gold in the UAE. Physical gold is still popular. Many choose reputable gold brokerage firms.

Gold IRA companies help with retirement investments. Digital trading is also growing. More online platforms are available for gold traders.

| Trading Method | Description | Advantages |

|---|---|---|

| Physical Gold | Buying actual gold bars or coins | Tangible asset, no counterparty risk |

| Gold ETFs | Exchange-traded funds backed by gold | Easy to trade, lower storage costs |

| Gold Futures | Contracts for future gold delivery | Leverage, price speculation |

The UAE’s gold market offers great chances for investors. Dubai’s location and tax benefits make it a top place for gold trading.

“Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

“Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

Key Features of Top Gold Trading Platforms

Gold trading platforms in the UAE have changed a lot. They now have features to help investors. Let’s look at what makes these platforms great.

User Experience and Interface

Top platforms focus on easy-to-use interfaces. They have simple navigation, live price updates, and charts you can change. These help you make quick, smart choices in gold trading.

Security Measures to Look For

Security is very important in gold trading. Look for platforms with strong encryption and two-factor login. They should also be checked by trusted groups like the Abu Dhabi Global Markets (ADGM).

Available Trading Tools and Resources

Top platforms have many tools. These include ways to use more money, stop-loss orders, and tools to size your trades. But remember, using more money can also mean more risk. Start small until you get used to it.

| Feature | Benefit |

|---|---|

| Leverage Options | Magnify potential gains |

| Stop-Loss Orders | Limit potential losses |

| Position Sizing Tools | Manage risk effectively |

Choose a platform that fits your trading goals. ICM Capital has good spreads, and Equiti’s are even lower. ATFX, approved by the UAE’s Securities and Commodities Authority, has many tools for gold traders.

“Gold trading involves various financial instruments like physical Gold, futures contracts, CFDs, ETFs, but on a smaller scale compared to forex.”

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

⇒ Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

Knowing these features will help you pick the best gold trading platform in the UAE.

Top Gold Trading Platforms to Explore

In the UAE’s thriving gold market, digital gold trading apps have changed how investors deal with gold. Let’s look at three top platforms known for their features, benefits, and reliability.

ICM Capital: Global Access and Low Spreads

ICM Capital is a global broker with a strong presence in Abu Dhabi. It offers access to over 1500 markets and a low minimum deposit of $200. This makes it great for both new and seasoned traders.

ICM Capital has very low spreads, averaging 0.02 for EUR/USD in their RAW spread account. This low cost is perfect for traders who trade often.

Equiti: Diverse Markets and Competitive Pricing

Equiti is authorized by the UAE’s Securities and Commodities Authority. It gives access to over 1000 markets. With a minimum deposit of $100, it’s open to many investors.

Equiti’s Razor account has spreads as low as 0.1 pips for EUR/USD. This makes it a top choice for those who trade a lot, as it can cut down on costs.

ATFX: Reliable Performance and Extensive Options

ATFX is a global broker with a strong presence in the UAE. It offers access to over 700 markets. Like Equiti, it requires a minimum deposit of $100.

ATFX is known for its reliability and wide range of trading options. It’s a solid choice for traders looking to expand their gold trading strategies.

| Platform | Markets Access | Minimum Deposit | Spreads (EUR/USD) |

|---|---|---|---|

| ICM Capital | 1500+ | $200 | 0.02 (RAW account) |

| Equiti | 1000+ | $100 | 0.1 pips (Razor account) |

| ATFX | 700+ | $100 | Competitive |

These platforms provide safe trading options and tools for successful gold trading in Dubai. When picking a platform, think about regulatory compliance, platform quality, and customer support.

How to Choose the Right Gold Trading Platform

Choosing the right platform for gold investment is important. It affects your trading experience. Let’s look at key factors to help you choose wisely.

Assessing Your Trading Goals

Know what you want before picking a platform. Do you want to invest for the long term or make quick profits? Your goals will help you choose the right platform.

Evaluating Fees and Commissions

Look at the costs of different platforms. Some charge per trade, others have monthly fees. Remember, cheaper isn’t always better. Think about what you get for the price.

Reading User Reviews and Experiences

User feedback is very helpful. It tells you about a platform’s ease of use, customer support, and reliability. Look for reviews that talk about these things.

“I chose my gold trading platform after reading numerous user reviews. It helped me avoid potential pitfalls and find a reliable service.” – UAE Gold Trader

Think about using ICM Capital, Equiti, or ATFX. They are approved by UAE regulators and have good gold trading options.

- Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE (ADGM).

- Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

- Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE (SCA).

| Platform | Minimum Deposit | Leverage Maximum | Currency Pairs |

|---|---|---|---|

| ICM Capital | $200 | 1:500 | 60+ |

| Equiti | $100 | 1:400 | 50+ |

| ATFX | $100 | 1:200 | 40+ |

Remember, 69% of retail investors lose money trading CFDs. Always think about your risk and invest wisely in gold.

The Future of Gold Trading in the UAE

The UAE’s gold trading scene is changing fast. Dubai is becoming a key player worldwide. In 2023, the UAE became the second-largest gold trade center, beating the UK. The total trade hit $129 billion, a 36% jump from the year before.

This growth hints at a bright future for gold trading.

Trends Influencing the Market

The UAE’s location and trade policies are boosting its gold market. India’s lower import duty on UAE gold is helping trade. India can import up to 160 tonnes of gold from the UAE in 2024-2025.

This is good news for physical gold marketplaces.

The Role of Technology in Trading

Technology is changing gold trading. Digital platforms make it easier for investors to get into the market. Gold IRA companies are using these tech advances to improve their services.

The DMCC’s 2024 Future of Trade report has been downloaded over 1.9 million times. It shows more people are interested in tech-driven trading.

Your Next Steps in Gold Trading

When you start trading gold, think about opening an account with a regulated firm. ICM Capital, authorized by Abu Dhabi Global Markets, offers live gold trading. Equiti and ATFX, both licensed by the UAE Securities and Commodities Authority, have strong platforms for your journey.

Choosing a reputable broker will help you make the most of the UAE’s booming gold market.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

Why is Dubai called the “City of Gold”?

Dubai is called the “City of Gold” because of its big gold market. It also has good tax rules and modern facilities. These draw traders from everywhere, making it a key place for gold trading.

What regulatory bodies oversee gold trading in Dubai?

The Dubai Financial Services Authority (DFSA) and the Securities and Commodities Authority (SCA) watch over gold trading in Dubai. They make sure the market is fair and safe for traders.

How can I start gold trading in Dubai?

To start trading gold in Dubai, open an account with a good broker. Brokers like ICM Capital, Equiti, or ATFX are great choices. They are approved by important groups like the Abu Dhabi Global Markets (ADGM).

What factors influence gold prices in Dubai?

Gold prices in Dubai change for many reasons. These include world economic news, how much gold is available, and what’s happening in the local market. Knowing these things can help you make smart trading choices.

What are the tax advantages of trading gold in Dubai?

Dubai has low taxes for gold traders, with only a 5% VAT. This makes gold cheaper in Dubai than in other places. It draws investors from all over.

What should I consider when selecting a gold broker in Dubai?

When picking a gold broker in Dubai, look at a few things. Check if they follow the rules, if their platform is good, and if they have helpful customer support. Also, see if they offer good prices and a wide range of gold products.

What are some popular gold brokers in Dubai?

Some top gold brokers in Dubai are ICM Capital, Equiti, and ATFX. They are all regulated by important groups. They offer great features and prices for gold traders.

What documentation is required to start gold trading in Dubai?

To start trading gold in Dubai, you’ll need to show your ID and where you live. You’ll also need to say where your money comes from. The exact papers needed might differ by broker, so ask your broker for details.

What’s the difference between trading physical gold and paper gold?

Trading physical gold means dealing with real gold bars or coins. It’s about owning something real and possibly keeping its value over time. Paper gold, like CFDs or futures, is more liquid and offers more ways to use leverage. Pick what fits your goals and how much risk you can take.

How can I stay updated on the Dubai gold market?

To keep up with the Dubai gold market, read financial news from trusted sources. Use tools and resources from your broker. Also, watch global economic news that can change gold prices.