Are you ready to explore today’s gold market? Gold prices are influenced by global events and economics. Wondering how to understand these changes? Let’s explore the world of gold investing and discover today’s gold price secrets.

In Coimbatore, gold prices are changing fast. They are affected by global economics and local demand. Gold is more than just jewelry here; it’s a financial safety net for many.

Gold prices are falling globally, the biggest drop in over three years. This is due to slower Federal Reserve rate cuts and a stronger dollar. It shows how gold is linked to the economy.

In the UAE, this volatility brings both challenges and chances. Gold is not just about its price. It’s a safe choice, a cultural treasure, and a path to financial security.

Want to start trading gold? Open an account with ICM Capital, Equiti, or ATFX. These brokers, approved by UAE authorities, let you trade gold live and make the most of market changes.

Key Takeaways

- Gold prices are experiencing significant fluctuations globally

- Local factors in Coimbatore influence gold rates alongside global trends

- Political outcomes can impact gold prices, with historical data showing party-specific trends

- Retail demand for physical gold bullion has declined in recent years

- Silver demand, specially from the solar sector, remains strong and may influence gold prices

- UAE-authorized brokers offer opportunities to trade live on gold

- Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE (ADGM).

- Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

- Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE (SCA).

Understanding Today’s Gold Price Trends

Gold prices are changing fast in today’s market. It’s important to know about gold market trends to make good investment choices. Let’s explore the current gold pricing and what’s causing these changes.

Overview of Current Gold Prices

Gold has gone up a lot, rising over 23% since 2024 started. On November 21, 2024, the gold spot price was $2,668.81 per ounce. This rise shows gold’s lasting value as a safe investment.

| City | 22 Carat (per 8 grams) | 24 Carat (per 8 grams) |

|---|---|---|

| Delhi | Rs 57,992 | Rs 61,864 |

| Mumbai | Rs 57,744 | Rs 61,864 |

| Chennai | Rs 56,816 | Rs 60,584 |

Key Factors Influencing Gold Prices

Many things are affecting gold futures trading. The U.S. Federal Reserve’s interest rate, now at 5.5%, is very important. Inflation rates, which were 3.5% in March and April, then dropped to 3.4% in May, also play a big role.

Global economic conditions and world tensions are pushing investors towards gold. China, Australia, and Russia are leading in gold production. Turkey, China, and India are the biggest importers. These factors offer great chances for smart investors in gold futures trading.

The Influence of Global Events on Gold Prices

Global events shape gold demand and supply. Economic stability and geopolitical tensions affect gold prices. It’s key for investors to know about world events.

Economic Stability and Gold Investments

Economic stability impacts gold prices. When times are uncertain, investors choose gold. This can increase gold demand and prices.

Gold investment options range from 50g to 12.5kg. Investors pick based on their money and risk level.

To stay ahead in the gold market, open an account with ICM Capital, Equiti, or ATFX. These global brokers, approved by UAE regulatory bodies, let you trade live on gold. This way, you can take advantage of these market changes.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Geopolitical Tensions and Market Reactions

Geopolitical tensions cause gold price swings. Conflicts and political instability make markets uncertain. Investors then buy gold, pushing prices up.

“Gold remains a trusted asset during times of crisis, with its historical resilience and value stability attracting investors worldwide.”

Here’s how global events affect gold prices:

| Global Event | Impact on Gold Price | Market Reaction |

|---|---|---|

| Economic Recession | +15% | Increased demand for gold bars and coins |

| Political Conflict | +10% | Surge in gold ETF investments |

| Currency Devaluation | +8% | Higher interest in gold as a hedge |

| Trade War | +6% | Increased gold purchases by central banks |

To deal with market changes, open an account with ICM Capital, Equiti, or ATFX. These global brokers offer live gold trading. They help you make the most of gold investment opportunities.

How to Track Gold Market Fluctuations

For smart investors, keeping up with gold prices is essential. Gold prices reached $2790.07 in October 2024. It’s important to stay updated. Let’s look at ways to stay ahead in the gold market.

Tools for Monitoring Gold Prices

Many online platforms can track gold prices. Financial apps give real-time updates. These tools help you understand trends and make smart choices about gold.

Watch city-specific gold rates. Prices in Coimbatore or Chennai might be different. This can give you good buying or selling chances. Remember, gold prices can change a lot in different places.

Understanding Live Spot Prices

Live spot prices show gold’s current market value. On November 21, 2024, it was $2682.81 per ounce. This means $87.88 per gram or $1073.83 per kilo.

| Measurement | Price (USD) |

|---|---|

| Per Ounce | $2682.81 |

| Per Gram | $87.88 |

| Per Kilo | $1073.83 |

Gold prices change every few seconds during market hours. They update from 6 PM EST to 5:15 PM EST, Sunday to Friday. This shows why it’s key to watch prices closely.

“Gold is more than just a precious metal; it’s a dynamic market that requires constant attention and strategic thinking.”

Want to start trading gold? Open an account with ICM Capital, Equiti, or ATFX. These global brokers are approved by UAE regulators. They offer live gold trading platforms. Begin your gold investment journey today!

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

The Role of Currency Strength in Gold Pricing

Gold bullion rates and precious metals investing are closely tied to currency strength, mainly the US dollar. Knowing this helps you make smart investment choices in the gold market.

US Dollar’s Impact on Gold Rates

The strength of the US dollar greatly affects gold prices. When the dollar weakens, gold becomes more appealing, causing prices to rise. For instance, gold prices jumped 10% in 2010, 5% in 2015, and a whopping 20% in 2020.

Changes in currency value directly influence gold prices. A weaker US dollar means higher gold prices, while a stronger dollar lowers them. This is crucial for investors to watch when planning their precious metals strategies.

“Gold is traditionally seen as a hedge against inflation, but higher interest rates and speculation of inflationary policies could affect its appeal due to the metal’s lack of yield.”

“Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

“Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

Gold prices have been rising, hitting over $2,670 per troy ounce. The 4-hour chart suggests there’s room for more growth. Key resistance areas are $2,673 and $2,700. Support levels are the 100-day Simple Moving Average at $2,557 and $2,536.

| Year | Gold Price Increase | Inflation Rate |

|---|---|---|

| 2010 | 10% | Low |

| 2015 | 5% | Low |

| 2020 | 20% | Low |

To lead in precious metals investing, you need timely data and expert insights. Open your account now with ICM Capital, Equiti, or ATFX. Trade live on gold with global, multi-regulated brokers authorized by UAE regulatory bodies.

Investing in Gold: Risks and Rewards

Gold investments offer unique opportunities in precious metals investing. The allure of gold has captivated investors for generations. Its appeal remains strong in today’s market.

The Benefits of Gold Investments

Gold serves as a powerful hedge against economic uncertainties. Its value often rises during turbulent times. This makes it a safe haven for investors.

In 2024, gold prices surged to ₹78,755 per 10 grams in India, setting new records. This trend underscores gold’s potential for significant returns.

Central banks worldwide hold nearly one-fifth of the global above-ground gold supply. This institutional backing reinforces gold’s status as a stable investment. For individual investors, a 5% to 10% allocation in gold can diversify and strengthen your portfolio.

Common Risks in Gold Trading

While gold offers benefits, it’s not without risks. Price volatility can be significant. This is influenced by factors like geopolitical tensions and economic shifts.

Gold futures trading, while potentially lucrative, requires careful strategy and market understanding.

| Factor | Impact on Gold Prices |

|---|---|

| Economic Downturns | Prices tend to rise |

| U.S. Dollar Strength | Inverse relationship |

| Interest Rates | Lower rates often boost gold |

| Geopolitical Tensions | Increased demand as safe haven |

Physical gold investments come with additional considerations like storage costs and security. Gold ETFs and mutual funds offer alternatives. They provide exposure without direct ownership challenges.

“Gold is a way of going long on fear,” said Warren Buffett. This highlights both its appeal and the emotional factors that can drive its market.

To navigate gold’s complex landscape, consider opening an account with reputable brokers like ICM Capital, Equiti, or ATFX. These UAE-authorized firms offer platforms for gold futures trading and precious metals investing. They help you capitalize on gold’s potential while managing its inherent risks.

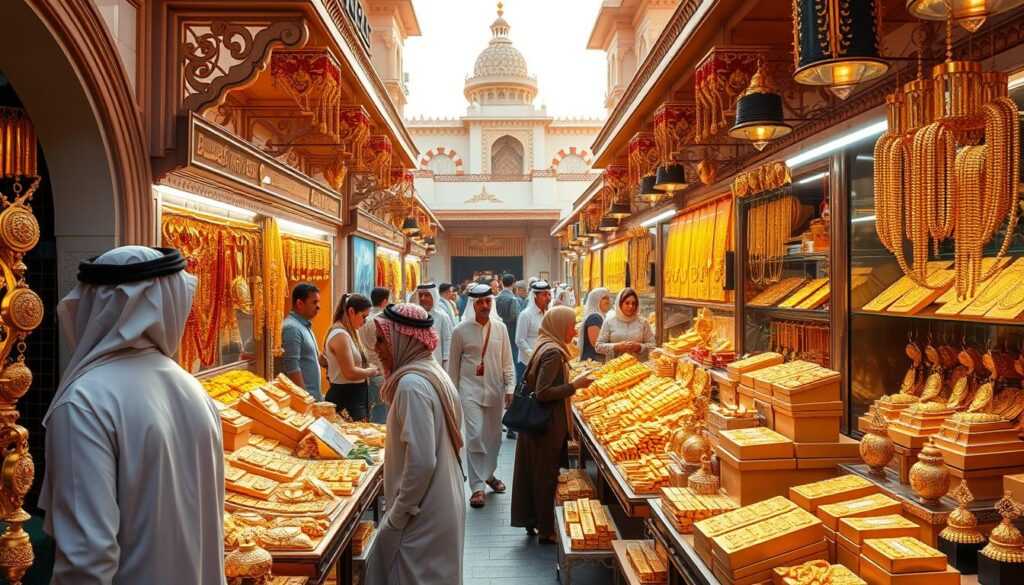

The Gold Market in the UAE: A Local Perspective

The UAE gold market is a lively place. It mixes old traditions with new trading ways. The Dubai gold rate changes every day. It shows what’s happening globally and what people locally want.

Key Players in the UAE Gold Market

ICM Capital, Equiti, and ATFX are big names in the UAE gold market. They let you trade gold live. They are all well-regulated.

ICM Capital is backed by the Abu Dhabi Global Markets (ADGM). It’s a strong place for gold investments. Equiti and ATFX, both licensed by the Securities and Commodities Authority of the UAE, give you many trading choices.

| Broker | Regulatory Authority | Trading Features |

|---|---|---|

| ICM Capital | ADGM | Live gold trading, Multi-asset platform |

| Equiti | SCA UAE | Diverse gold products, Advanced tools |

| ATFX | SCA UAE | Competitive spreads, Educational resources |

Cultural Significance of Gold in the UAE

Gold is very important in UAE culture. It’s used in jewelry and as an investment. The demand for gold jewelry is high, showing its value in celebrations and as a sign of wealth.

- Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE (ADGM).

- Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

- Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE (SCA).

When you look into the UAE gold market, knowing the economic and cultural sides helps. Whether you’re experienced or new, the UAE is a great place to grow your portfolio.

“Gold in the UAE is not just a commodity; it’s a cultural heritage that shapes our market.”

Start trading with ICM Capital, Equiti, or ATFX today. They are global brokers with the tools and knowledge you need to trade gold confidently.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

Strategies for Gold Investment

Gold investments offer many chances for both short-term and long-term plans. It’s key to know the gold market trends and price forecasts to make smart choices.

Short-Term vs. Long-Term Investing

Short-term gold investing might include trading futures or ETFs. The SPDR Gold Shares (GLD) sees 6.5 million shares traded daily, making it very liquid. For those who like more action, the VanEck Gold Miners ETF (GDX) has bigger daily swings.

Long-term investors might like physical gold or gold-backed securities. With gold prices hitting $2,600 per ounce in November 2024, many predict it will go up to $3,000 by the end of the year.

Tips for New Investors

New gold investors should keep these tips in mind:

- Keep a 5-10% gold share in your portfolio

- Use dollar-cost averaging to buy fixed amounts regularly

- Rebalance holdings during market corrections

- Explore gold mining stocks when prices dip

Keep up with global economic signs and world events that affect gold prices. Remember, gold hit a low of $1,727 in October 2024 before rising to $2,600. This shows how volatile it can be.

“Gold investments need careful thought about market trends and economic factors. Always match your strategy with your financial goals and risk level.”

Ready to begin your gold investment journey? Open an account with ICM Capital, Equiti, or ATFX – all approved by UAE regulators. This lets you trade gold with trusted global brokers.

Conclusion: Your Next Steps in Gold Investment

Starting your gold investment journey is exciting. You need to know how to handle changes in gold prices. The gold market is always changing because of world events and economic shifts.

Making Informed Decisions

Keep an eye on gold prices today and how they change. Gold is now around $2,650 and at a high for eight days. This is a great time for investors.

Things like inflation, interest rates, and currency strength affect gold prices. These factors are important to watch.

Resources for Staying Updated on Gold Prices

Use good sources to track gold prices. Open an account with ICM Capital, Equiti, or ATFX. They are all approved by UAE regulators.

These platforms give you live updates on gold prices. This helps you make quick decisions in the fast market.

Remember, gold investment can protect you from economic uncertainty. Experts think gold prices could go up by 10%. Your gold investment journey could be both rewarding and exciting. Keep learning, stay informed, and invest with confidence.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

What factors are currently influencing gold prices?

Several things are affecting gold prices. These include the Russia-Ukraine conflict and the Gaza situation. Also, the US Dollar’s strength and global economic worries are playing a role.

These factors are making people want gold as a safe place to put their money. This is causing big changes in the market.

How can I stay updated on current gold rates?

To keep up with gold rates, use online tools from financial services. For example, the Bajaj Finserv App gives you updates on gold prices. It’s important to watch live spot prices and rates in your city.

This helps you make smart choices about buying, selling, or using gold.

How does the US Dollar affect gold prices?

The US Dollar’s strength really affects gold prices. Gold prices are set in US dollars worldwide. So, changes in the INR-USD exchange rate change local gold prices.

A weaker rupee means higher gold prices. Keep an eye on the US Dollar Index (DXY) for gold price changes.

What are the benefits and risks of investing in gold?

Investing in gold has its pluses. It can protect against inflation and economic ups and downs. But, there are downsides like price swings and the hassle of storing physical gold.

Gold futures trading on places like MCX offers chances for investors. But it’s key to know the market and risks.

Who are the key players in the UAE gold market?

The UAE gold market has big names like ICM Capital, Equiti, and ATFX. These global brokers are approved by bodies like the Abu Dhabi Global Markets (ADGM). They let investors trade gold live and benefit from their regulated status.

What strategies should I consider for gold investment?

You can pick between short-term and long-term gold investment plans. Short-term might mean trading gold futures. Long-term could be owning physical gold or gold-backed securities.

Think about global economic signs, world events, and currency changes when deciding.

How can I make informed gold investment decisions?

For smart gold investment choices, use tools like the ICM Capital App for gold price updates. Keep up with gold price forecasts and market trends. Consider options like gold loans for financial needs.

Always know today’s gold rates in your city for informed financial choices.

What is the cultural significance of gold in the UAE?

Gold is very important in UAE culture. It affects local demand and the market. This cultural value changes prices and investment chances in the region.