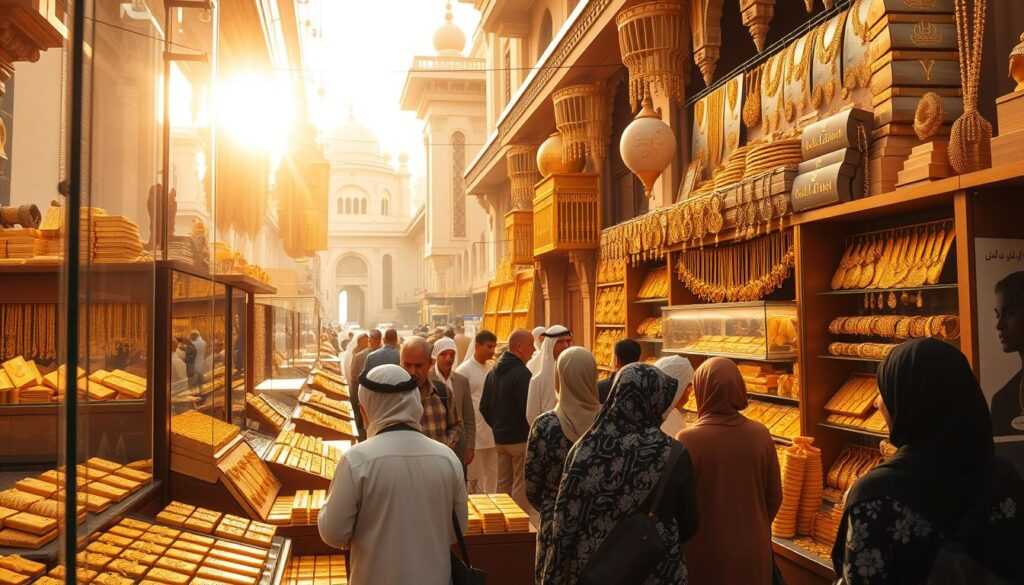

Ever wondered why gold investments shine brighter in Dubai? It’s not just the souks and jewelry that sparkle. A secure gold investment in Dubai is a golden chance for investors around the world. Let’s dive into the treasure that is Dubai’s gold market growth and how you can benefit from it.

TEAL, a Titan subsidiary, shows the power of diversification. Jewelers like Malabar Gold and Diamonds are growing fast. Titan is also expanding globally. These moves highlight the benefits of investing in gold in Dubai.

Open an account with ICM Capital, Equiti, or ATFX. Trade gold live with these global brokers. They’re known for their licenses and being approved by the UAE and Abu Dhabi Global Markets (ADGM).

Key Takeaways

- Diversify your investments like Titan diversifies its portfolio, strengthening your financial security.

- Malabar Gold and Diamonds is an example of high-quality gold products available in Dubai’s prosperous market.

- Benefit from Dubai’s unique position as a tax-free gold purchasing hub.

- Tap into a market that offers direct access to international gold prices.

- Take advantage of Dubai’s dynamic trading environment which supports growth and expansion.

- Utilize the expertise of multi-regulated brokers like ICM Capital, Equiti, and ATFX for secure gold investment in Dubai.

- Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE (ADGM).

- Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

- Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE (SCA).

Why Gold Investment is a Smart Choice in Dubai

Investing in gold in Dubai offers many benefits. Dubai’s strong economy and strategic plans make it great for investors. It’s perfect for both new and experienced investors.

The Economic Stability of the UAE

The UAE’s economic stability draws investors to gold. The country’s financial history and government reserves create a safe investment environment. Gold’s value and the UAE’s stable policies make it a smart choice for wealth preservation.

Historical Performance of Gold

Gold’s history shows its value to investors. During crises like the 2008 financial crisis and COVID-19, gold prices soared. For example, prices went from $300 to over $2790 per ounce from 2000 to 2024. This shows gold’s ability to protect wealth during tough times.

Hedge Against Inflation

Gold is a strong defense against inflation. Its value isn’t tied to other investments like real estate or stocks. This means gold keeps its worth even when others decline. It’s a safe choice during economic downturns, keeping your buying power.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

The Dubai Shopping Festival (DSF) shows the lively gold market. In DSF 2019, discounts were 10% to 30%. Special deals made gold more appealing, showing its financial and fun sides.

| Year | Gold Price Increase | Notes |

|---|---|---|

| 2000 | $300 to $400 (pre-crisis) | Stable rise preceding economic downturn |

| 2008 | $400 to over $1,000 | Significant increase during financial crisis |

| 2024 | $2700 (during COVID-19) | Peaked during global pandemic |

Experts say put 5%-15% of your portfolio in gold. This diversifies and protects against financial risks. Platforms like ATFX, Equiti, and ICM Capital provide safe places to trade gold in the UAE. They help grow and diversify your portfolio.

“Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

“Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

Dubai’s Unique Gold Market Advantages

Investing in gold in Dubai offers unmatched chances to diversify your portfolio. The city’s gold market is booming. It provides a tax-free gold investment environment, boosting your returns.

Don’t miss out: ⇒ Blog ⇒ YouTube Videos ⇒ Telegram Channel

Tax-Free Status for Gold Purchases

Imagine buying gold without any taxes. In Dubai, this is a reality. This makes Dubai a top spot for gold investments. No taxes mean higher profits and easier investing.

Access to International Gold Prices

Dubai connects you to the international gold market. Here, you can invest with confidence. You get real-time prices and market data.

A Flourishing Trading Environment

Investing in Dubai is like joining a fast-growing company. The gold market is dynamic, full of opportunities. The city’s infrastructure and location make it a prime trading hub.

Consider working with brokers like ICM Capital, Equiti, and ATFX. They offer regulated environments and global market access. This boosts your investment confidence.

Adding gold to your assets can be smart. Gold funds and ETFs have seen big returns lately. For example, Gold ETFs have risen by 21.94% on average.

| Fund Name | Return Last Year | Type |

|---|---|---|

| UTI Gold ETF FoF | 21.80% | ETF |

| SBI Gold Fund | 21.66% | Gold Fund |

| ICICI Pru Regular Gold Savings Fund (FOF) | 21.65% | Gold Fund |

| LIC MF Gold ETF | 22.19% | ETF |

| UTI Gold ETF | 22.11% | ETF |

| Quantum Gold Fund ETF | 21.64% | ETF |

Adding gold to your portfolio can be a smart move. It adds value, thanks to Dubai’s tax-friendly environment. Seize this golden opportunity!

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

⇒ Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

How to Start Your Gold Investment Journey

Thinking about why invest in gold in Dubai is a smart first step. Dubai is a top place for gold investment because of its strong economy and global trade role. Knowing the basics is key for a successful investment.

Selecting the Right Gold Type

Looking into different gold investments starts with choosing the right gold investment. You might be interested in fancy jewelry, coins, or bullion. Each has its own benefits and investment needs.

Investing in high-purity gold, like 24k gold chains, is often advised. It’s seen as a safe financial choice.

Choosing Reliable Dealers in Dubai

It’s important to find gold dealers in Dubai that match your investment goals. Dealers like ICM Capital, Equiti, and ATFX are licensed and secure. They ensure your investment is safe and clear.

Choosing a well-known dealer can also protect you from fake gold jewelry.

Understanding Gold Quality and Purity

Knowing about gold’s quality and purity is as important as knowing about diamonds. For example, 24k gold is best for investing because it’s very pure. Other types, like 10k or 18k, are better for jewelry that’s worn often.

| Type of Gold Investment | Quality | Purity | Preferable Use |

|---|---|---|---|

| Gold Bullion | Highest | 24k | Financial Investment |

| Gold Coins | High | 22k | Savings & Collectibles |

| Gold Jewelry | Variable | 18k-24k | Adornment & Investment |

- Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE (ADGM).

- Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

- Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE (SCA).

Starting your gold investment journey in Dubai means understanding the market well. It also means knowing how to pick the right gold and reliable dealers. With good planning and smart choices, you’re on your way to a successful investment in Dubai’s leading gold market.

Diversifying Your Investment Portfolio with Gold

Starting your journey with portfolio diversification with gold in Dubai brings balance and security. Dubai’s economy is strong, thanks to tech and tourism, making up 80 percent of its GDP. Adding gold to your investments can be the foundation for a strong portfolio.

The Middle East is moving from oil to diverse fields, like Saudi Arabia’s Vision 2030. Just as they diversify, you can too by adding gold to your investments.

Combining Gold with Other Asset Classes

Mixing gold with assets like stocks and real estate can protect against inflation. This strategy can also help with private equity and debt, which are expected to grow by 9 percent over time. Gold’s value remains strong, even when paper money loses value.

Experts suggest keeping gold in 5-10 percent of your portfolio. Dubai’s growing FDI and new ownership laws offer great opportunities for growth.

Long-Term vs. Short-Term Strategies

Gold is best for long-term investments. It has grown from under $300 per ounce in 2000 to new highs during the pandemic. Yet, it’s wise to use dollar-cost averaging to handle price swings.

By investing in gold regularly, you reduce timing risks and benefit from growth over time. Remember, waiting for the right moment can mean missing out on gains, as gold’s steady rise from $600 in 2006 shows.

When planning your investment journey, consider opening an account with trusted brokers like ICM Capital, Equiti, or ATFX. These regulated firms can help you navigate the markets. Combining long-term gold investment with other assets can be key to a strong portfolio in today’s UAE economy.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

What are the benefits of investing in gold in Dubai?

Investing in gold in Dubai has many benefits. The market is growing and offers a tax-free status on gold purchases. It also gives exposure to international gold markets and a safe investment climate.

The city’s economic stability and no Value Added Tax (VAT) on gold purchases increase investment returns. This makes Dubai a great place for gold investors to protect against inflation.

Why is gold investment considered a smart choice in Dubai?

Gold investment in Dubai is smart because of the UAE’s financial stability and history. Gold has always been a reliable asset, protecting against inflation. Dubai’s focus on diversified supply chains adds to its economic stability.

Can you discuss the economic stability of the UAE in relation to gold investment?

The UAE’s economy is diverse, strategically positioned globally, and has strict fiscal policies. This stability means less economic risk for gold investors. The UAE’s strong economy provides a solid base for gold investments.

How does gold historically perform as an investment?

Gold has always been a reliable investment, increasing in value during tough economic times. It has been a store of wealth for centuries. Gold balances portfolios, provides a safe haven, and protects against currency devaluations and inflation.

Why is gold an effective hedge against inflation?

Gold’s value tends to rise with the cost of living, making it a good hedge against inflation. When currencies lose value, gold keeps its worth. This protects investors’ wealth and stabilizes portfolios.

What are the unique advantages of Dubai’s gold market?

Dubai’s gold market offers unique benefits like tax-free buying and access to international gold prices. It has a robust trading infrastructure. Its strategic location makes it a hub for gold traders worldwide, creating a dynamic market.

How does the tax-free status for gold purchases in Dubai benefit investors?

The tax-free status for gold purchases in Dubai saves investors money. They don’t have to pay tax on their gold acquisitions. This can lead to higher net returns compared to markets with taxes.

How do investors in Dubai gain access to international gold prices?

Investors in Dubai get access to international gold prices through the city’s trade links and modern infrastructure. This allows them to trade at the latest and most competitive prices, like in major international gold markets.

What makes Dubai’s trading environment favorable for gold investors?

Dubai’s trading environment is favorable for gold investors. It has a wide network of dealers, modern storage facilities, and a clear regulatory framework. Dubai’s status as a leading logistics and commerce hub makes its gold market vibrant and efficient.

What factors should be considered when starting a gold investment journey in Dubai?

When starting a gold investment in Dubai, consider the type of gold, your investment goals, and the dealer’s reputation. Also, understand the quality and purity of the gold. Familiarize yourself with the local market and regulations.

How can one assure the quality and purity of gold investment in Dubai?

Investors can ensure the quality and purity of their gold in Dubai by buying from reputable dealers. Look for certified gold products. Certifications from the International Gemological Institute (IGI) or the Gemological Institute of America (GIA) for jewelry and LBMA for bullion are good indicators of quality and authenticity.

Why is diversifying your investment portfolio with gold in Dubai advantageous?

Diversifying with gold in Dubai is beneficial. It adds a proven asset to your portfolio that can balance performance during market ups and downs. Gold’s tangible nature tends to move inversely to other assets, reducing risk and smoothing returns over time.

What is the difference between long-term and short-term gold investment strategies?

Long-term gold investment strategies focus on preserving wealth and gradual growth. Short-term strategies aim to profit from market timing and gold price fluctuations. Long-term investors hold gold as a hedge against economic risks, while short-term traders seek quick profits.