Did you know gold prices hit $2,685 per ounce in 2024? This shows how much the gold spot price can change. It’s a key part of the commodity market.

Gold spot prices are vital for investing in precious metals. They change due to many things. These include the economy, world events, demand, and the U.S. dollar’s value. People also see gold as a safe place to put money when things get tough.

In the last 20 years, gold has done better than usual. It’s shown it’s a strong choice for investors around the world.

Now, let’s explore gold spot prices more. Knowing how they change is important for anyone interested in the commodity market. The LBMA Gold Price is known worldwide. It affects markets everywhere, showing gold’s big impact.

Key Takeaways

- Gold spot prices reached a record high of $2,685 per ounce in 2024.

- Fluctuations driven by economic conditions, geopolitical events, and market demand.

- Gold is often viewed as a safe-haven asset during economic uncertainty.

- Investment sentiment significantly influences gold prices.

- Understanding price trends is crucial for informed investing decisions.

What is the Gold Spot Price?

The gold spot price is the current market rate for gold. It’s the price at which gold can be bought or sold right away. It’s key for investors to know, as it shows gold’s real-time value. It helps guide trading and investment choices.

Definition and Importance

The gold spot price changes based on many factors. These include supply and demand, global economic conditions, and world events. The LBMA Gold Price, set through daily auctions, plays a big role in this.

Knowing the spot price is vital for smart gold trading. It helps investors make better buying or selling decisions. But, retail prices are often higher due to extra costs like making and selling gold.

Difference Between Spot Price and Futures Price

The spot price is for gold to be delivered now. Futures prices are for gold to be delivered later. Futures markets, like COMEX, help set the spot price.

Spot and futures prices can differ, offering chances for investors. Spot trading is riskier but can be more rewarding. Futures trading helps manage risks over time.

Historical Perspective on Gold Prices

To understand gold prices, we must look at key trends and events. These have shaped gold’s value over time. Knowing these trends helps us make smart investments during uncertain times.

Gold Price Trends Over the Years

Gold prices have changed a lot, influenced by big economic and political events. In the Great Depression, prices jumped from under $21 to $35, a 67% rise. The 1970s saw a big increase, with prices hitting over $120 per ounce by 1976 and over $800 in 1980.

Recently, gold’s value as a safe asset was clear during the 2008 financial crisis and the European debt crisis. Prices reached about $1,825 per ounce in August 2011. By April 2024, gold hit a record of $2,265 per ounce, thanks to Chinese demand and inflation worries.

Factors Influencing Historical Price Movements

Several factors have shaped gold prices:

- Economic Uncertainty: Times of financial trouble, like the Great Depression and 2008, made investors turn to gold, raising its value.

- Interest Rates: Central bank actions, like the Federal Reserve’s, have greatly affected gold prices. For example, the end of quantitative easing in 2013-2014 led to a 29% drop in gold prices.

- Global Events: Big world events, like the end of the Bretton Woods system in 1971, have also played a big role. This event led to a record price of about $665 per ounce in January 1980.

- Currency Strength: The U.S. dollar’s strength often affects gold prices. A strong U.S. economy in 1999 led to gold’s lowest price in years, about $253 per ounce.

Let’s look at some key data:

| Year | Event | Gold Price |

|---|---|---|

| 1929–1935 | Great Depression | $21 to $35 (67% increase) |

| 1976 | Gold price peak in 70s | Over $120 per ounce |

| 1980 | End of Bretton Woods system | Above $800 per ounce |

| 1999 | Strong U.S. economy | About $253 per ounce |

| 2011 | European sovereign debt crisis | About $1,825 per ounce |

| 2013-2014 | Tapering of quantitative easing by Federal Reserve | From $1,695 to $1,200 (29% decline) |

| 2020 | COVID-19 pandemic | January: $1,575, Summer: over $2,000 |

| 2024 | Increased Chinese demand, inflation | All-time high nominal price of $2,685 per ounce |

For more on using gold to secure your finances, check out this article on current gold rates.

Key Factors Influencing Gold Spot Prices Today

Gold spot prices today are influenced by many things. These include supply and demand, central bank gold reserves, and the value of the U.S. dollar. Global economic factors also play a big role. Knowing these can help investors make better choices.

Supply and Demand Dynamics

The core of gold pricing is precious metal supply and demand. When demand goes up and supply stays the same or goes down, prices go up. Demand comes from consumers, central banks, and industry. On the other side, mining and recycling affect supply.

Central Bank Reserves

Central bank gold reserves greatly influence gold prices. Banks like the Federal Reserve and the European Central Bank buy and sell gold. Their big moves can change market prices a lot.

Value of the U.S. Dollar

The U.S. dollar and gold have a key relationship. A strong dollar makes gold prices go down, and a weak dollar makes them go up. This is because gold is priced in dollars worldwide. Changes in the dollar value, due to things like interest rates and GDP, also affect gold prices.

Global Economic Factors

Gold spot prices are also affected by the world’s economic health. Things like inflation, recessions, and global conflicts make investors see gold as a safe place. This makes gold prices go up when things are tough economically or in the world.

To really get how these factors and others affect gold prices, check out this resource on key factors influencing gold.

Understanding Gold Spot Price Fluctuations for Informed Decision-Making

Knowing how gold spot prices change helps investors make smart choices. It’s key to understand what affects gold prices in the market.

On October 11, 2024, gold’s price was $2,650 per ounce. Several things affect gold prices. For example, how much gold is available and how much people want it matters a lot. Also, the state of the economy plays a big role, as gold is seen as a safe choice when prices rise.

The table below shows what drives gold prices:

| Factor | Impact on Gold Prices |

|---|---|

| Supply and Demand Fluctuations | Directly influence pricing through availability and consumer interest. |

| Economic Conditions | Shape investor behavior and market trends. |

| Inflation | Gold viewed as a hedge, thereby increasing demand. |

| Interest Rates | Inversely related, with high rates typically reducing gold’s appeal. |

| Geopolitical Uncertainty | Often causes price spikes as investors seek stability. |

| Currency Movements | Especially U.S. dollar fluctuations, can drive price changes. |

| Market Sentiment | Speculative trading can lead to volatile price swings. |

| Central Bank Policies | Adjustments in gold reserves can influence market dynamics. |

By understanding these factors, investors can make better choices about buying, selling, or holding gold. Knowing the gold market well helps investors seize chances and avoid risks.

The Role of Geopolitical Events in Gold Price Fluctuations

Gold is often seen as a safe place to invest. It shows a strong link with world events. When things get unstable, investors often choose gold as a safe option.

Impact of Political Instability

When there’s political unrest, like protests or wars, investors seek safety. This leads to more demand for gold, making its price go up. For instance, geopolitical events impact gold prices because it’s a safe choice against uncertainty.

Economic sanctions also play a role. They cut down on trade and economic activities. This pushes investors towards gold. Trade tensions and money policies can also affect gold prices by changing currency values.

Geopolitical Tensions and Market Sentiment

When there are tensions between countries, it affects how people feel about the market. This makes investors and traders react to these risks. The market can get very volatile, leading to big changes in gold prices.

In 2023, gold demand was at 4,448 tons, showing how global events shape gold investments. This rise, partly due to uncertainty, shows gold’s role as a safe investment.

| Geopolitical Event | Influence on Gold Prices |

|---|---|

| Political Instability | Increased demand and higher prices |

| Economic Sanctions | Reduction in trade leading to higher gold demand |

| Trade Tensions | Uncertainty driving investors to hedge with gold |

| Currency Fluctuations | Impact on gold prices due to changing currency strengths |

Looking ahead to 2024, we expect more uncertainty. This includes conflicts, trade issues, and elections. Investors will likely keep turning to gold to protect their money in uncertain times.

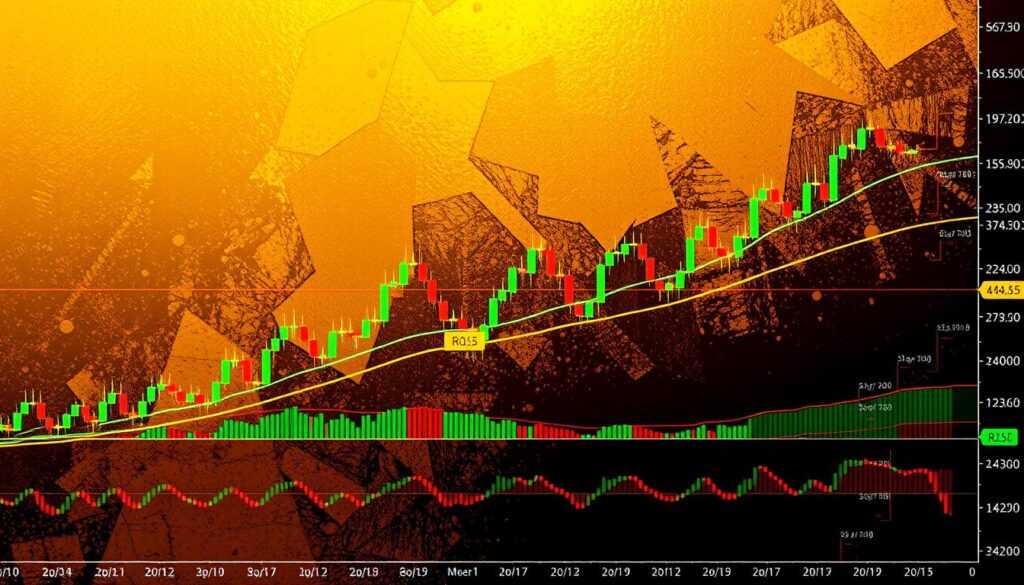

Technical Analysis Indicators for Gold Prices

Investors use technical analysis indicators to predict gold prices. These tools help understand market trends and make smart trading choices. Let’s look at some key indicators like RSI, MACD, and Moving Averages.

Popular Indicators: RSI, MACD, Moving Averages

Many indicators are popular for gold price forecasting. The Relative Strength Index (RSI) shows when gold is overbought or oversold. An RSI above 70 means gold might be too expensive, while below 30 it’s too cheap.

The Moving Average Convergence Divergence (MACD) helps spot changes in momentum. It’s the difference between two moving averages, showing when trends might change.

Moving averages smooth out price swings to show trends. They help traders understand gold price trends over time.

Using Technical Analysis to Predict Market Movements

Technical analysis in gold trading is all about understanding market trends. By using RSI, MACD, and moving averages, traders can spot important changes. For example, MACD divergences can signal price changes, and moving average crossovers show trend shifts.

Tools like Bollinger Bands® also play a role. They show price ranges and potential breakouts. This approach helps traders analyze the gold market from different angles, improving their ability to predict price changes.

Table of Technical Analysis Indicators and Their Functions:

| Indicator | Function |

|---|---|

| Relative Strength Index (RSI) | Identifies overbought (RSI > 70) and oversold (RSI < 30) conditions |

| Moving Average Convergence Divergence (MACD) | Determines changes in momentum and trend direction; calculated as 12-day EMA minus 26-day EMA |

| Moving Averages | Smooth out price fluctuations to reveal trends over specific periods |

| Bollinger Bands® | Define price ranges and highlight potential breakouts |

Hedging Techniques and Risk Management Strategies

Managing risk in our investment portfolios is key, and gold is a great solution. Using risk management strategies like gold ETFs can bring stability to an unpredictable market. These tools help protect our investments from economic shocks.

Gold ETFs and Their Role in Diversification

Gold ETFs play a big role in investment diversification. They let us invest in gold without owning physical gold. This makes it easy to get into gold prices. Adding gold ETFs to our investments spreads risk, making our portfolios more stable.

This diversification is crucial when markets are volatile. It helps keep our risk-to-reward balance in check.

Gold prices soared during the 2008 financial crisis as investors sought safety in the metal while stock markets were collapsing.

Hedging Against Inflation and Currency Devaluation

Gold is seen as a shield against inflation and currency loss. When inflation rises, gold often gains value, keeping our buying power intact. Gold price changes often mirror economic conditions, guiding our risk management.

Using hedging techniques like stop-loss orders and gold ETFs can protect our investments. This is especially true during economic downturns.

In short, adding gold to our portfolios through ETFs and smart risk management boosts our investment strength. As we face economic ups and downs, these tools shield our assets and open up financial opportunities.

How to Invest in Gold in the UAE

Investing in gold in the UAE is a smart move for those looking to grow their wealth. Brokers like ICM Capital and Equiti offer safe and reliable platforms for trading gold. They are licensed and regulated, ensuring a secure environment for your investments.

Opening an Account with ICM Capital

Starting an account with ICM Capital is easy and fast. They are regulated by the Abu Dhabi Global Market, promising a trustworthy trading experience. Their platform is user-friendly, providing real-time data to aid in your trading decisions.

Using a strategy like Dollar-Cost Averaging (DCA) can be beneficial. It helps you find the best times to enter the market.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market

Trading Gold with Equiti

Equiti is a top choice for trading gold in the UAE. They are regulated by the Securities and Commodities Authority of the UAE, ensuring your investments are safe and follow local laws. Equiti offers tools and resources to help you understand market trends.

By keeping up with gold rates and market trends, you can improve your investment strategies. Check out this article on gold rate strategies for more insights.

Conclusion

In this article, we explored the world of gold spot prices. It’s key for those looking to invest in gold. We saw how prices have changed over time, from $18.93 per ounce in the 1800s to $1,934.86 in 2023. This history helps us make better choices for the future.

Today, many things affect gold prices. These include central bank actions, the U.S. dollar’s value, and global economic conditions. When money loses value or inflation rises, gold often becomes a safe choice. This makes it important to make smart choices.

Events around the world also play a big role. They show why gold is a reliable asset when things are uncertain. By using technical analysis and careful planning, investors in the UAE and worldwide can handle the gold market’s ups and downs.

The prices for 2024 are expected to be between $2,550 and $2,700 per ounce. This shows the potential for smart investing. As we look ahead, knowing about gold prices is key to successful investing and protecting our money.

FAQ

What is the gold spot price?

The gold spot price is the current market rate for buying or selling gold right away. It’s a key price for gold and helps investors make smart choices. It shows the gold’s real-time value.

How does the gold spot price differ from the futures price?

The spot price is for gold delivered now. Futures prices are for gold to be delivered later. These differences can offer chances for investors.

What are the key factors influencing the gold spot price?

Many things affect the gold spot price. These include supply and demand, central bank gold, the U.S. dollar’s value, and world economics. Also, global events and what investors think matter a lot.

Why is understanding gold spot price fluctuations important for investors?

Knowing about gold spot price changes is key for smart investing. It helps investors decide when to buy, sell, or hold gold.

How do geopolitical events impact gold prices?

Global events like political troubles or wars make investors want gold. This demand can raise gold prices a lot during such times.

What technical analysis indicators are commonly used to understand gold price trends?

Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages are used. They help predict gold price trends and understand market feelings.

What are some effective risk management strategies for investing in gold?

Good strategies include using gold ETFs to diversify and protect against inflation and currency loss. These methods can keep investment portfolios steady during economic ups and downs.

How can I invest in gold in the UAE?

To invest in gold in the UAE, open an account with trusted brokers like ICM Capital or Equiti. They offer platforms for live trading. These brokers are licensed and regulated, making trading safe and efficient.

What role do central bank reserves play in gold pricing?

Central banks buy gold as part of their financial plans. This can change gold’s market value. Big gold buys or sells by central banks can shift supply and demand, affecting gold prices.

How does the value of the U.S. dollar affect gold prices?

The U.S. dollar’s value often goes against gold prices. A strong dollar means lower gold prices, and a weak dollar means higher prices. This is important to know when looking at gold market trends.