Did you know gold prices have jumped by 28% in the last year? Today, the gold rate in Dubai starts at AED 320.25 per gram for 24K gold. This surge has made gold a hot choice for investors. Dubai, known for its lively market, draws both new and experienced traders.

These traders aim to make the most of the changing gold prices. But, it’s not easy. With the right knowledge, your gold investment in Dubai could be very profitable.

Gold prices can change a lot, influenced by many things. This includes the world’s economic health and the US dollar’s strength. In Dubai, local gold prices also follow global trends. This is because Dubai plays a big part in the global gold market.

Today, there are many chances to invest in gold, whether for the long or short term. We want to give you the best tips and strategies to succeed in this market.

Key Takeaways

- Gold prices in Dubai have increased by 28% in the past year.

- Current gold rate for 24K gold in Dubai: AED 320.25 per gram.

- Dubai’s gold market reacts strongly to international gold rates and global economic changes.

- Essential trading strategies can help mitigate the risks and maximize returns.

- Both ICM Capital and Equiti offer robust platforms for trading gold in Dubai, with international and local licenses.

Current Gold Rate Today In Dubai

The gold market in Dubai is very active, drawing in traders and investors. It’s important to watch the Gold Rate Today In Dubai for those involved. The market is currently booming, thanks to both local and international factors.

Understanding Gold Price Metrics

Looking at the Gold Rate Today In Dubai, we need to know how gold prices are set. Here are the current gold prices in the UAE:

| Karat | Price (AED/gram) |

|---|---|

| 24K | 320.25 |

| 22K | 296.50 |

| 21K | 287.25 |

| 18K | 246.00 |

Also, global factors like a possible rise to $3,000 by 2025 affect gold prices. Central bank buying and U.S. rate cuts also play a role.

Factors Influencing Gold Price in Dubai

The gold market in Dubai is influenced by many factors. The recent sharp increase in gold prices is due to global trends and local market conditions. Knowing these factors is key for accurate insights:

- Geopolitical Events: Global tensions and uncertainties push gold prices up.

- Currency Fluctuations: Changes in currency values, especially against the U.S. Dollar, affect the Gold Rate Today in Dubai.

- Supply and Demand: Demand changes at Dubai’s Gold Souk are also important.

- Central Bank Policies: Central bank decisions on interest rates and gold purchases influence prices.

Both global and local factors mix to shape the buying and selling of Gold Bullion Dubai. It’s wise to keep up with the latest gold price metrics and understand the factors behind them for smart trading.

Top Tips for Trading Gold in Dubai

Trading gold in Dubai can be rewarding if you’re well-prepared. Here are some key tips to help you succeed in the gold market.

Choosing the Right Broker

Finding a good broker is essential for trading gold. Look for brokers like ICM Capital, who are regulated by the Dubai Financial Services Authority (DFSA). They should offer tight spreads, good trading platforms, and customer support.

Make sure the broker has tools like one-click trading and platforms like MetaTrader 4 or 5. Stay away from unregulated brokers to protect your money.

| Broker | Regulatory Authority | Minimum Deposit | Trading Platform | Spread |

|---|---|---|---|---|

| ICM Capital | ADGM | $200 | MetaTrader 4+5, cTrader | 1.2 – 2.6 points |

| Equiti | SCA | $500 | MetaTrader 5 | 1.9 – 4.8 pips |

| IG Limited | DFSA | $300 | MetaTrader 4, Proprietary | 2.0 – 6.0 pips |

Open your account now with ICM Capital and trade live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE. Similarly, open your account now with Equiti and trade live on gold with a global broker who holds international licenses and is licensed by the Securities and Commodities Authority of the UAE.

Timing Your Trades

Timing is crucial when buying or selling gold in Dubai. Watch global economic news and local trends to make smart choices. Gold prices often go up during economic uncertainty or geopolitical issues.

Keep an eye on market forecasts, like Goldman Sachs’ prediction of gold reaching $2,900 per troy ounce in 2025. Also, monitor gold ETF inflows and central banks’ gold purchases.

It’s predicted that the gold price will trade above $3,500 over the next five years, highlighting the importance of strategic timing in maximizing your returns.

By using these tips, you can improve your gold trading strategy and succeed in Dubai’s dynamic gold market.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market ⇐

Gold Trading Strategies

Investing in Gold in Dubai requires a solid strategy. Knowing how to trade gold can help you make the most of your investments. This knowledge is key to success in the gold market.

Long-term Investment Strategy

A long-term strategy aims to grow your wealth slowly but surely. Gold is known for protecting against inflation. For example, during the Covid-19 pandemic, gold prices jumped by over 13% in just a few months.

Investors might look into Sovereign Gold Bonds for steady returns. These bonds offer a 2.5% annual interest and can be sold on stock exchanges. Dubai is also a great place to buy physical gold because of its low prices and fees.

Short-term Trading Techniques

If you want to make quick profits, short-term trading is for you. Dubai’s gold market offers opportunities for quick gains through futures and options trading. The city’s tax-free environment helps traders keep more of their earnings.

Using advanced platforms like ICM Capital and Equiti makes trading easier. Dubai’s gold market is also secure, thanks to strict AML laws and blockchain technology. This ensures that all transactions are transparent and trustworthy.

| Aspect | Long-term Strategy | Short-term Techniques |

|---|---|---|

| Goal | Wealth Preservation | Speculative Gains |

| Investment Vehicle | Sovereign Gold Bonds, Physical Gold | Gold Futures, Options |

| Market Environment | Stable | Volatile |

| Risk Level | Low to Medium | Medium to High |

Start trading with ICM Capital today. They offer live gold trading with international licenses. Or choose Equiti for global trading with UAE licenses.

Best Places to Trade Gold in Dubai

Dubai is known as the “City of Gold” and is a top spot for gold trading. It has many places for gold traders, mixing old charm with new ease. We’ll look at the best places for trading gold in Dubai, focusing on the Dubai Gold Souk and the Dubai Gold Market.

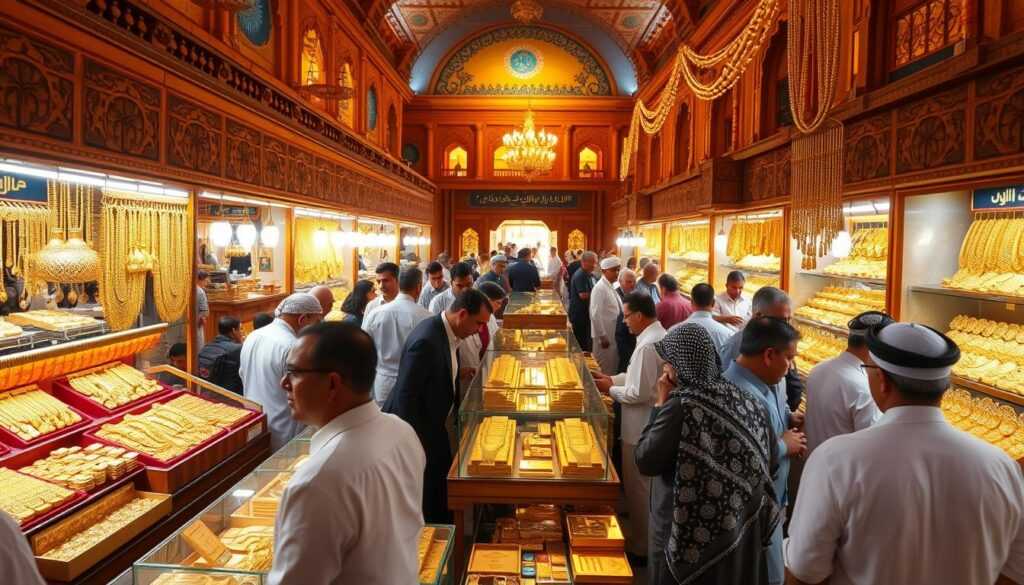

Dubai Gold Souk

The Dubai Gold Souk is in Deira and has hundreds of gold shops. It’s famous for its wide range of gold jewelry and designs. Here, traders can buy gold at good prices and enjoy traditional bargaining.

Many stores also offer certified diamonds, insurance, and loyalty programs. This ensures top service and quality for customers.

Dubai Gold Market

The Dubai Gold Market is bigger than the souk and includes places like the Dubai Gold and Commodities Exchange (DGCX) and the Gold and Diamond Park. The DGCX is a place for trading gold futures, helping traders grow their investments. The Gold and Diamond Park has many shops and workshops for gold and diamond trading.

Traders can find tax benefits and a stable legal system here. This makes trading safe and profitable.

Reputable shops like Malabar Gold and Diamonds, Joyalukkas, and Kalyan Jewellers offer both in-store and online buying. They have certified diamonds, insurance, and loyalty programs. They also provide secure vaulting and follow anti-money laundering laws, making trading safe and clear.

| Venue | Highlights | Services | Special Features |

|---|---|---|---|

| Dubai Gold Souk | Hundreds of shops, traditional market | Certified diamonds, insurance, loyalty programs | Competitive prices, traditional bargaining |

| Dubai Gold Market | Includes DGCX, Gold and Diamond Park | Online and in-store purchasing, secure vaulting | Tax benefits, anti-money laundering compliance |

Both the Dubai Gold Souk and the Dubai Gold Market offer great options for gold trading. Traders can find good prices, secure transactions, and a wide range of services and products.

How to Open a Gold Trading Account

Opening a Gold Trading Account Dubai is easy if you follow the right steps. Here’s a simple guide to help you start using the many Gold Investment Opportunities Dubai has.

First, make sure you have all the needed documents. You’ll need your passport or Emirates ID, a utility bill for proof of residence, and your financial statements. Some brokers might also ask for a tax ID or employment details.

It’s important to know the rules. The Dubai Financial Services Authority (DFSA) watches over gold trading in Dubai. Make sure your broker is licensed by the DFSA or other authorities. It’s good to check if they follow international financial rules.

Now, let’s look at the steps to open your gold trading account:

- Choose Your Broker: Pick a trusted broker. Look at options like ICM Capital, licensed by the Abu Dhabi Global Market UAE, or Equiti, licensed by the Securities and Commodities Authority of the UAE.

- Submit Documentation: Give your ID, proof of where you live, and any other needed papers.

- Fund Your Account: Put in the money needed as the broker says. This amount can change based on the broker’s rules.

- Set Up Trading Platform: Get the broker’s trading platform on your device. Learn about its features and tools.

- Start Trading: After your account is set up and funded, start trading. Use charts and market news to make smart choices.

It’s key to keep your account in good shape for success. Watch your trades, follow market trends, and change your plans as needed. Staying updated with market news can help you lead.

Also, using tech like automated trading and portfolio systems can make trading easier. If you’re interested, looking into more Gold Investment Opportunities Dubai is a smart move.

Choosing brokers like ICM Capital or Equiti lets you trade gold live with global licenses. They offer great support and advanced trading tools, helping you get the most out of your gold trading.

Benefits of Trading with ICM Capital

Trading gold can be very profitable, especially with a reliable broker like ICM Capital. ICM Capital Gold Trading offers many advantages in the gold trading world of Dubai.

ICM Capital is regulated by the Abu Dhabi Global Market UAE. This means traders can trust and feel secure. The regulation adds credibility that’s hard to find elsewhere.

ICM Capital also has international licenses, making it a well-known broker worldwide. This global recognition helps us trade gold on a larger scale. It increases our chances of making more money.

The broker provides services for both new and experienced traders. Whether you’re starting or have been trading for years, ICM Capital has what you need. They offer real-time market analysis and advanced trading platforms to improve your experience.

Let’s look at some statistics to see the benefits:

| Aspect | Details |

|---|---|

| Profit Factor | 1.57 |

| Average Annual Gross Profit | 67% |

| Winning Trades | 65 |

| Losing Trades | 35 |

| Return on Investment (ROI) | 67% |

| Duration | 12 months |

| Capital | $10,000 USD |

| Minimum Investment Amount Required | $10,000 USD |

These numbers show the strong potential returns with ICM Capital Gold Trading. Even during market ups and downs, the broker keeps profits high.

ICM Capital also offers excellent customer support. This ensures we get help when we need it, making trading easier.

With the Gold Price Dubai in mind, trading with ICM Capital can boost our success. Open your account with ICM Capital today. Trade gold live with a broker who is recognized globally and regulated by the Abu Dhabi Global Market UAE.

Benefits of Trading with Equiti

Trading gold in Dubai is easy with Equiti. This global broker is licensed by the Securities and Commodities Authority (SCA) of the UAE. Traders get great prices and a safe, clear trading space.

Equiti Gold Trading shines because of its customer support. Equiti’s experts help traders at every step, whether they’re new or experienced.

Equiti also has many trading platforms. These platforms are easy to use and packed with features. They help you trade spot gold, futures, or options well. You can find more information on Gold Trading Dubai.

Here’s what you gain by trading with Equiti:

| Feature | Benefits |

|---|---|

| Regulatory Framework | Licensed by SCA, ensuring robust compliance and security. |

| Competitive Pricing | Access to gold trading with low spreads. |

| Expert Support | Dedicated customer service to assist with all trading needs. |

| Advanced Platforms | State-of-the-art trading tools for various gold trading options. |

Open your account with Equiti today. Trade Live on gold with a broker known worldwide. This means you trade efficiently and safely, making your Gold Trading Dubai journey rewarding.

Discover more about gold trading and investing. This will help you grow in the financial markets.

Risks Involved in Gold Trading

Gold trading comes with its own set of risks. Market volatility and leverage risks are two major concerns. Without understanding these, you could lose a lot of money.

Market Volatility

Gold prices can change quickly due to market ups and downs. These changes are influenced by things like world events, economic news, and interest rates. For example, gold prices might go up by 10% to USD 2,917.40 an ounce by late October next year.

But, these predictions can change a lot. So, traders need to keep up with the market and adjust their strategies.

Leverage Risks

Leverage can increase your profits, but it also increases your losses. This makes it a risky tool in gold trading. If the market goes against you, the losses can be huge.

For example, silver might go up by over 40% to USD 45 an ounce. But, if you use too much leverage and the market doesn’t go your way, you could lose a lot.

It’s important to know how to use leverage wisely to avoid big losses.

We suggest traders open accounts with trusted brokers. ICM Capital, a global broker licensed by the Abu Dhabi Global Market UAE, is a good choice for trading gold live. Equiti, regulated by the Securities and Commodities Authority of the UAE, also offers a safe and efficient platform for trading gold.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market ⇐

Conclusion

The world of gold trading in Dubai is always changing. It’s key to stay up-to-date to get the best from your investments. We looked at the Gold Trading Insights Dubai, showing how global trends and politics affect prices here.

We also shared tips and strategies to improve your trading. This includes picking the right broker and using both long-term and short-term plans.

Places like the Dubai Gold Souk and Dubai Gold Market are great for trading. They let you connect with the vibrant gold market in Dubai. Setting up a gold trading account is easy, opening doors to this profitable market.

Trading with trusted brokers like ICM Capital and Equiti adds security. They are licensed in the UAE, making your trades safer.

Trading gold comes with risks like market ups and downs and leverage risks. But, with the right knowledge and strategies, you can handle these. Gold has seen a 26% increase this year and could hit $3,000 in five years.

Central banks and ETFs are betting on gold, showing market optimism. So, whether you’re new or experienced, Dubai’s gold markets are full of chances to grow and succeed.

FAQ

What is the gold rate today in Dubai?

The gold rate in Dubai changes daily. It depends on global markets, local demand, and currency rates. For the latest rate, check the Dubai Gold & Commodities Exchange (DGCX) or local news.

How can I understand the metrics used to price gold in Dubai?

Gold prices in Dubai are given in AED per gram or ounce. The spot price shows current market rates. The premium is an extra cost by retailers. Knowing these helps in making smart investment choices.

What are the main factors influencing gold prices in Dubai?

Several things affect gold prices in Dubai. Global events, currency changes, especially USD to AED, and supply and demand are key. Also, big economic changes and gold market trends play a role.

How do I choose the right broker for trading gold in Dubai?

Pick a broker authorized by the Dubai Financial Services Authority (DFSA) or Abu Dhabi Global Market. IG Limited and ICM Capital are known for their good services and strict rules.

What are the best practices for timing gold trades?

Good timing means knowing market cycles and economic signs. Use historical data to spot market swings. This helps in buying low and selling high for better returns.

What are some popular long-term investment strategies for gold trading in Dubai?

Long-term strategies focus on keeping wealth safe. Buy and hold physical gold or invest in gold ETFs. Regular, disciplined investment can protect against inflation and secure wealth.

What are effective short-term trading techniques for gold in Dubai?

Short-term trading uses market swings for profit. Spot trading, futures, and CFDs are good options. Quick action and monitoring are crucial for short-term gains.

Where are the best places to trade gold in Dubai?

The Dubai Gold Souk and Dubai Gold Market are top spots. They offer a wide range of gold and competitive prices. The Gold Market is also very secure and regulated.

What steps are required to open a gold trading account in Dubai?

To open an account, you need a passport or UAE ID, proof of address, and sometimes income proof. Working with reputable places like ICM Capital or Equiti ensures you follow the rules.

What are the benefits of trading gold with ICM Capital?

ICM Capital offers a safe trading space with international and UAE licenses. They have good spreads, educational tools, and customer support.

Why should I consider trading gold with Equiti?

Equiti has a strong regulatory base in the UAE. They offer competitive prices and expert help. This helps traders reach their goals.

What are the risks involved in gold trading?

Gold trading has risks like market volatility and leverage impact. These can cause big price changes and losses. Understanding these risks and managing them well is key.