Did you know gold prices have jumped by 28% in the last year? This is a 2024 record, with 24K gold hitting $2,685 per ounce in Dubai. Gold is seen as a solid investment, especially when the economy is shaky. In Dubai, known as the “City of Gold,” the current prices are 24K gold at Dh321.50 per gram, 22K at Dh297.75 per gram, 21K at Dh288.25 per gram, and 18K gold at Dh247.00 per gram. It’s crucial to keep an eye on the gold rate today for those thinking about investing in Dubai gold.

Gold is a top choice in Dubai for protecting against inflation and keeping wealth safe. The city’s big role in the global gold market means knowing what affects Dubai’s gold prices is key for investors. Keep up with the latest gold rates on trusted sites like iGold to follow daily prices. This knowledge can lead to big gains and help shield against market ups and downs.

Key Takeaways

- The 24K gold rate today in Dubai is Dh321.50 per gram.

- Investing in Dubai gold provides a hedge against inflation and economic instability.

- Stay informed about the gold rate today and global economic factors to make wise investment decisions.

- Dubai offers a tax-free environment for gold trading, adding to its attractiveness as an investment hub.

- Monitoring platforms like iGold can keep you updated on real-time gold prices.

Open your account now with ICM Capital and trade live on gold with a global broker licensed by the Abu Dhabi Global Market UAE. For an alternative platform, consider Equiti, which is licensed by the Securities and Commodities Authority of the UAE.

Why Dubai is the “City of Gold”

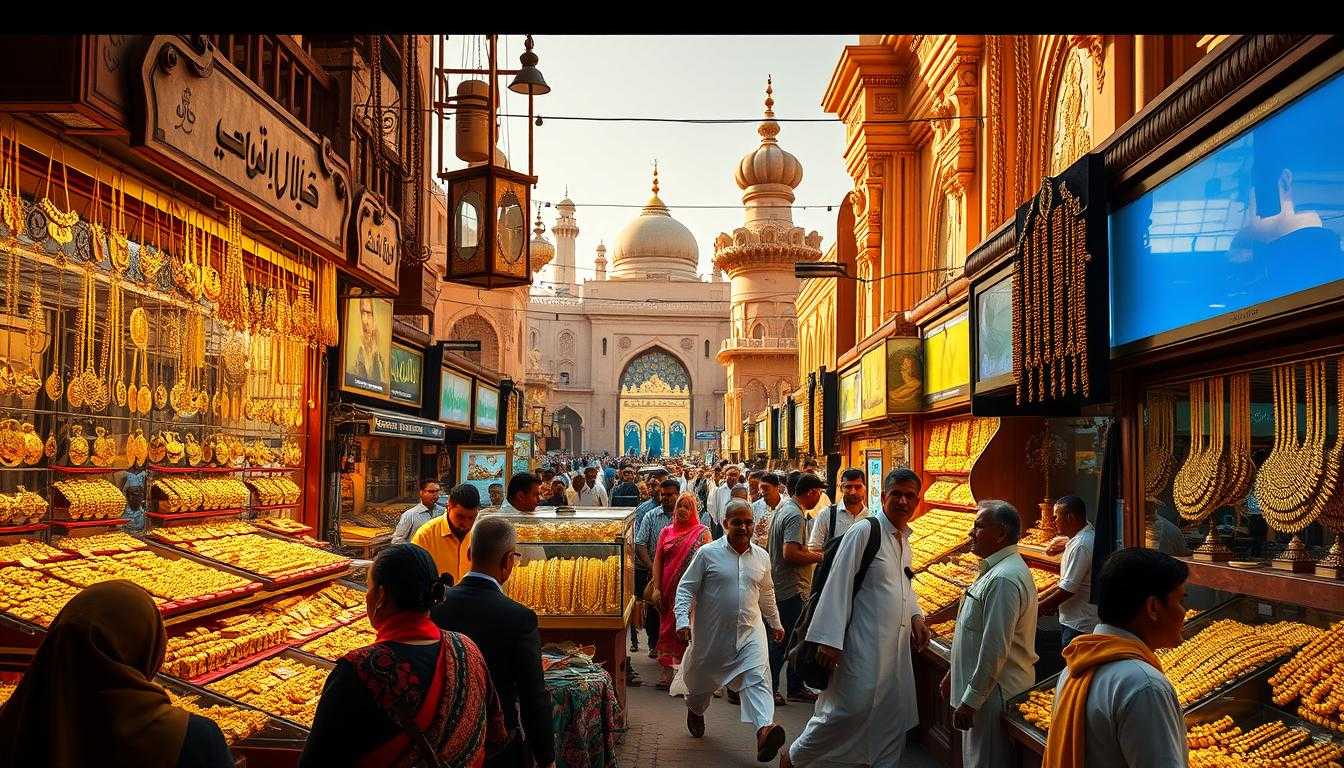

Dubai is known as the “City of Gold” for good reasons. It has a rich history with gold, a strategic location, and great trading conditions. This title shows Dubai’s deep connection to gold and its key role in the global market. Let’s look at why Dubai is a top place for gold trading.

Historical Significance of Gold in Dubai

The gold souk in Dubai started in the 1940s. Traders from India and nearby countries came here because of Dubai’s tax-free status on gold. Over time, it grew into a famous gold trading center.

Today, Dubai’s gold souk is a big draw for traders and tourists. It offers gold jewelry and bullion bars. The souk is known for its quality and purity, thanks to official stamps.

Current Market Trends in Dubai’s Gold Industry

Dubai’s gold market is always changing. Right now, 24K gold costs AED 320.66 per gram in Dubai. This is cheaper than in major Indian cities.

Dubai offers many investment options, like bullion bars and gold coins. These items are very pure, making Dubai a great place for investors.

Dubai is also a big player in the global gold trade. In 2021, the UAE was the 4th largest gold importer. Dubai supports over 4,000 gold businesses, making it a key center for gold trade.

Dubai’s gold market is attractive because of its low costs and high-quality products. Whether you’re new to investing or experienced, Dubai offers great opportunities for gold investments.

Understanding Gold Price Dynamics in Dubai

The gold price in Dubai is shaped by global and local factors, and big geopolitical events. Let’s see how these elements affect the gold market in this lively city.

Global Factors Impacting Gold Prices

Global gold prices are key in setting Dubai’s rates. Recently, global gold prices have been near $2,650 an ounce. This is due to investors betting on more interest rate cuts.

Experts think gold prices could go up to $2,800 an ounce early next year. Gold has risen about 26% this year. Central banks buying more and traders expecting the Fed to ease money have driven this increase.

US Federal Reserve actions, like a 50-basis-point interest rate cut, also affect global gold prices. This change is felt in Dubai’s market too.

Local Factors Influencing Dubai’s Gold Rates

In Dubai, local demand for gold greatly affects its prices. Events like the Dubai Shopping Festival boost demand, raising prices. Right now, 24-karat gold in Dubai costs Dh320.5 per gram.

Other gold types like 22-karat, 21-karat, and 18-karat are priced at Dh290.25, Dh281.00, and Dh240.75 per gram. Dubai’s gold is known for its purity and strict rules, offering competitive prices. Buying gold in Dubai is also tax-free and VAT-exempt, making it attractive for investors.

Geopolitical Events and Their Effects

Geopolitical events also play a big role in gold prices. For example, tensions, like the Israeli military watching Iran, increase gold demand. The ongoing Ukraine conflict adds to the uncertainty, pushing up global gold prices.

Changes in crude oil prices and OPEC+ oil production shifts also affect investor mood. This often leads to a surge in gold demand.

The mix of global and local factors, along with geopolitical events, shapes gold prices in Dubai.

For those looking to trade gold in the UAE, ICM Capital and Equiti offer great chances. Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE. Or open your account now with Equiti and trade Live on gold with a global broker who holds international licenses and is licensed by the Securities and Commodities Authority of the UAE.

| Gold Type | Price per Gram (Dh) |

|---|---|

| 24-karat | 313.5 |

| 22-karat | 290.25 |

| 21-karat | 281.00 |

| 18-karat | 240.75 |

The Benefits of Investing in Physical Gold in Dubai

The charm of investing in physical gold in Dubai lies in its profit potential and economic stability. Dubai’s close ties to gold-producing countries and its lively trading scene boost the Dubai gold market advantages. Buying gold here comes with the assurance of a regulated market, making it a great place for bullion, coins, and bars.

Gold bullion is seen as a safe investment, helping investors protect against inflation, currency changes, or economic downturns. Its value is based on its inherent worth and demand, acting as a shield in tough times. For example, gold prices in Dubai hit a record $2,650 after the US Federal Reserve cut interest rates by 50 basis points. This shows gold’s role as a safe haven during economic instability.

Gold bullion is available in various sizes, from small coins or bars to larger ones. Its tangible nature offers physical gold investment benefits, allowing investors to hold a real asset. Gold also tends to increase in value when currency values drop, making it a solid inflation hedge.

In Dubai, the gold market’s status as a global trading hub adds to its appeal. The UAE’s Central Bank saw a 12% increase in gold reserves, reaching Dh20.36 billion ($5.5 billion) in April 2024. The World Gold Council also notes that 29% of central banks plan to boost their gold reserves, showing ongoing trust in gold. With over 1,000 tonnes of gold bought annually, the demand for gold remains strong.

Dubai’s strategic role in the gold market offers a wide range of investment options. This ensures a secure and diversified portfolio. So, we recommend exploring the Dubai gold market advantages for more stable and profitable investments.

Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE.

Open your account now with Equiti and trade Live on gold with a global broker who holds international licenses and is licensed by the Securities and Commodities Authority of the UAE.

Gold Exchange-Traded Funds (ETFs) and Mutual Funds in UAE

Investors in the UAE are turning to gold ETFs in Dubai and gold mutual funds. These options are more liquid and easier to access than physical gold. They offer a way to diversify your portfolio.

Gold mutual funds are key for a balanced portfolio in the UAE. Funds like the Axis Gold Fund and SBI Gold Fund are popular. They help investors manage risk and balance their investments.

Dubai’s strong financial system makes it great for trading gold ETFs and mutual funds. These investments are simpler than physical gold. They offer a secure way to profit from gold prices.

Here is a detailed table showcasing comparative performance metrics for the HDFC Gold Exchange Traded Fund:

| Metric | Fund | Category Avg |

|---|---|---|

| Standard Deviation | 11.10 | 10.91 |

| Sharpe Ratio | 0.95 | 0.96 |

| Treynor’s Ratio | 10.64 | 10.84 |

| Jensen’s Alpha | -0.93 | -0.72 |

| Mean Return | 16.23 | 16.18 |

We suggest investors use Dubai’s resources. Open your account with ICM Capital and trade Live on gold. They are a global broker with international licenses. Equiti also offers a great trading experience, licensed by the Securities and Commodities Authority of the UAE.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market

Gold has a proven track record of beating equities and offering strong returns during inflation. Adding gold ETFs in Dubai and gold mutual funds to your portfolio is a smart move for your financial future.

How to Invest in Gold Futures and Contracts

Gold futures investment can be a great way to grow your portfolio and manage risk. The Dubai Gold and Commodities Exchange (DGCX) offers a solid platform for trading gold futures. This lets investors track gold prices without owning the metal physically. Let’s explore how to understand gold futures and trade on the DGCX.

Understanding Gold Futures

Gold futures are contracts that require the buyer to buy and the seller to sell gold at a set price on a future date. They help investors speculate on price changes or protect against market swings. Knowing the contract details, like expiry dates and lot sizes, is key for those new to gold futures.

Trading Gold on the Dubai Gold and Commodities Exchange (DGCX)

The DGCX is a top platform for trading gold futures. To start trading, you need an account with a registered broker like ICM Capital or Equiti. Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE. Or, open your account now with Equiti and trade Live on gold with a global broker who holds international licenses and is licensed by the Securities and Commodities Authority of the UAE.

Trading on the DGCX offers several benefits:

- Access to a regulated and transparent trading environment

- Competitive pricing structures

- High liquidity, allowing for quick execution of trades

- Diverse contract options suitable for both speculative gold investments and hedging strategies

Before investing in gold futures on the DGCX, consider market trends and your financial goals. Working with brokers like ICM Capital, Equiti, and ATFX Markets can improve your trading experience. They are known for their comprehensive services and competitive pricing.

| Broker | Regulators | Minimum Deposit | Trading Costs (Gold) | Platforms |

|---|---|---|---|---|

| ICM Capital | Abu Dhabi Global Market, FCA | $200 | $0.05 | MetaTrader 4, MetaTrader 5, Web-based, cTrader |

| Equiti | Securities and Commodities Authority of the UAE, FCA | $100 | $0.15 | MetaTrader 4, MetaTrader 5, cTrader |

| ATFX | Central Bank of Ireland, ASIC | $100 | $0.12 | MetaTrader 4, MetaTrader 5 |

Each broker has its own strengths, such as regulatory oversight and platform offerings. Choosing the right one depends on your trading needs and goals.

The Significance of Gold Purity and Measurement Units

Gold trading in Dubai focuses on precise purity and measurement. Knowing gold purity standards in Dubai is key for investors and traders. We explore the different karat levels and gold measurement units used in the market.

Different Karat Purity Levels

Gold purity is measured in karats, with 24K being the purest. 24K gold is 99.9% pure. Other karats like 22K, 18K, and 14K mix gold with other metals. Each purity level meets different needs, from investment to jewelry.

Key Measurement Units: Ounce, Gram, and Tola

Knowing gold measurement units is vital for trading. The main units are ounces, grams, and tolas. The international market often uses ounces, with prices between $2,600 and $2,660 per ounce.

In India, grams are common, with prices between Rs 74,800 and Rs 76,500 per 10 grams. The tola, used in South Asia, is about 11.66 grams.

These units and standards are crucial for accurate gold trading in Dubai. Knowing them improves trading efficiency and ensures following gold purity standards Dubai. They help tap into 24K gold trading opportunities.

Investing in Sovereign Gold Bonds (SGBs) also requires understanding these units. SGBs are available in gram denominations. Investors can buy from 1 gram to 4 KG per fiscal year. SGBs offer a 2.50% annual interest rate, paid semi-annually.

Knowing gold purity standards and measurement units is crucial for 24K gold trading. This knowledge helps make informed decisions and use Dubai’s gold market opportunities.

For real-time updates and more information, check resources for live gold rate updates. This can improve your trading strategies.

Recommended Trading Platforms in Dubai: ICM Capital and Equiti

Investors in Dubai looking to trade gold safely and efficiently have two top choices. ICM Capital and the Equiti trading platform are known for their strong offerings and licensed UAE brokers.

ICM Capital and Equiti are well-respected in the trading world. They offer advanced tools and follow strict security rules in the UAE.

When you open an account with ICM Capital, you get access to over 1000 trading instruments. You can start trading with competitive spreads from 0 pips. Plus, there are more than 10 trading platforms to choose from. ICM Capital is also licensed internationally, including in the Abu Dhabi Global Market UAE.

The Equiti trading platform also offers a wide range of trading instruments and good trading conditions. With licenses from the Securities and Commodities Authority of the UAE, Equiti provides a safe and regulated trading space.

Here’s a closer look at what these platforms offer:

| Feature | ICM Capital | Equiti |

|---|---|---|

| Number of Trading Instruments | 1000+ | 1000+ |

| Competitive Spreads | As low as 0 pips | As low as 0 pips |

| Number of Trading Platforms | 10+ | 10+ |

| Industry Awards | 30+ | 30+ |

| UAE Licensing | Abu Dhabi Global Market | Securities and Commodities Authority |

Both ICM Capital and Equiti focus on making clients happy. They offer personal account managers, daily market updates, and educational materials. This makes trading better for everyone.

Ready to start trading gold? Open your account with ICM Capital and trade with a global broker licensed by the Abu Dhabi Global Market UAE. Or open your account with Equiti to trade with a broker licensed by the Securities and Commodities Authority of the UAE.

Gold Rate Today in Dubai Safe Haven Investment

Today, gold in Dubai is a strong sign for investors looking for financial safety. Even with changing market trends and digital deals, investing in Dubai gold is a smart move. It helps spread out investments and keep wealth safe.

Looking at the current gold value in UAE shows its lasting appeal. The price per gram is 317.37 AED, per 10 grams is 3,053.75 AED, and per tola is 3,561.83 AED. The price per troy ounce is 9,498.19 AED, showing its big investment potential.

Gold’s trustworthiness is boosted by central banks buying more of it. In 2022, they bought 1,136 tonnes, worth about $70 billion. This is the most they’ve bought in one year. Countries like China, India, and Turkey are buying more gold, showing they trust it as a safe investment.

Gold has always moved in the opposite direction of the US Dollar and US Treasuries. This makes gold a good choice when the economy is shaky. With low interest rates and a clear link to risk assets, gold stays attractive.

To make the most of these chances, opening an account with trusted brokers is wise. Open your account now with ICM Capital and trade live on gold with a globally recognized broker. Or, open your account with Equiti and trade live on gold with a broker licensed by the Securities and Commodities Authority of the UAE.

Investors should keep an eye on gold investment security to protect their money. The steady value of gold in the UAE promises good returns, even with global economic ups and downs. Investing in gold in Dubai is a smart choice for both new and experienced investors.

Conclusion

Dubai is a top spot for investing in gold, thanks to its lively gold market. This market is rich in history and has great conditions for investing. You can invest in physical gold, ETFs, or futures contracts, making it perfect for both quick trades and long-term gains.

Gold prices have gone up a lot, with a 26% jump in 2024. Gold prices hit $2,685 an ounce, a record high. The price of 24K gold in Dubai is Dh320.25 per gram, showing strong demand. Experts think prices could hit $3,000 an ounce in the future, thanks to global trends and local demand.

Investing in gold futures and contracts is a smart move to diversify your portfolio. Sites like ICM Capital and Equiti offer live trading in gold. They have advanced tools and strong security, making them great for both new and experienced investors.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market

FAQ

What is the current gold rate today in Dubai?

Today, 24K gold in Dubai costs Dh317.25 per gram. This makes Dubai a prime spot for gold investments.

Why is Dubai often referred to as the “City of Gold”?

Dubai is called the “City of Gold” for its rich Gold Souk and favorable market. It also has no VAT on bullion and is strategically located. This attracts both retail and institutional investors.

What are the global factors that influence gold prices in Dubai?

Global trends, the London Bullion Market Association, and geopolitical events affect gold prices in Dubai. These factors often lead to increased gold demand as a safe investment.

How do local factors in Dubai affect gold prices?

Local demand spikes during events like the Dubai Shopping Festival. This, along with Dubai’s lively trading scene, impacts gold prices.

What are the benefits of investing in physical gold in Dubai?

Investing in physical gold in Dubai offers stability and profit potential. It also has no VAT on bullion. The market is well-regulated, and it’s close to gold-producing countries.

What are gold ETFs and mutual funds, and how do they differ from physical gold investments?

Gold ETFs and mutual funds are flexible and liquid. They allow diversification and trading through financial instruments, unlike physical gold.

How does one invest in gold futures and contracts in Dubai?

Gold futures in Dubai involve speculation or hedging against price changes. The Dubai Gold and Commodities Exchange (DGCX) is a key platform for these transactions.

What are the different gold purity levels and measurement units used in Dubai?

Gold purity ranges from different karats, with 24K being highly sought. Dubai uses ounces, grams, and tolas for precise trading.

What trading platforms are recommended for investing in gold in Dubai?

ICM Capital and Equiti are top choices in the UAE. They offer advanced tools, strong security, and reliable platforms for gold trades.

Why is gold considered a safe haven investment in Dubai?

Gold keeps its value in economic downturns and inflation. Dubai’s strong fiscal setup and market advantages make gold investments secure.