Gold has long been a symbol of wealth and security, drawing the attention of investors worldwide. As we look at the gold rate in Dubai today, many wonder if gold is a safe investment choice amidst current economic uncertainties. Indeed, gold remains a reliable safe-haven asset, offering protection against inflation and currency fluctuations.

Dubai, often referred to as the “City of Gold,” offers a vibrant market for gold with competitive prices attractive to both local and international buyers. The city’s economic policies and stability have enhanced trust among investors, making gold an appealing option for portfolio diversification. Our focus is not just on today’s gold rate, but also on how it fits into the broader investment landscape.

Investment in gold also involves understanding market dynamics and pricing structures, including the impact of currency exchange rates. As we navigate through this article, we’ll explore these elements in detail, providing insights that can help inform your investment decisions.

Key Takeaways

- Gold is a reliable safe-haven investment.

- Dubai offers competitive gold pricing and a stable market.

- Economic factors influence gold’s investment value.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE

⇒ Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Current State of Gold Rates in Dubai

Gold rates in Dubai are shaped by various factors, providing a dynamic environment for investors. Economic shifts, geopolitical events, and the broader global market trends influence how these rates change day by day.

Factors Influencing Gold Prices

Our analysis shows several key elements impacting gold prices in Dubai. Economic growth can boost consumer purchasing power, making gold more attractive. Geopolitical factors, such as regional tensions, often drive investors towards gold as a safe haven.

In addition to these, local demand coupled with international supply disruptions can alter gold’s value. Monitoring these factors helps us understand the fluctuations in Dubai’s gold market.

Analysis of Live Gold Price Trends

Today’s gold rate in Dubai is critical for traders and investors. As seen from recent charts, 24K gold is priced at approximately AED 332.75 per gram. Such tools offer a visual representation of how prices ebb and flow.

Tracking these trends allows us to make informed decisions, especially when it comes to short-term investments. It’s evident that gold’s value can change rapidly, requiring a keen eye on both historical data and live updates.

Impact of Global Markets on Dubai’s Gold Rate

Global markets play a significant role in determining Dubai’s gold rates. For instance, international bullion prices and currency exchange rates can directly affect local costs. When markets are volatile, gold tends to become a preferred investment globally.

This impact extends to Dubai, where gold continues to be a trusted investment option. By understanding global influences, we are better equipped to navigate the complexities of gold investments in Dubai.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Investment Perspective

Investing in gold can provide stability in uncertain economic times. Its value as a hedge against inflation and its various investment strategies cater to different investor needs.

Gold as a Hedge Against Inflation

Gold’s stability makes it a preferred choice during economic instability. When inflation rises, currency values can drop, but gold often holds or increases its value. This makes it an effective way for us to protect our wealth. Institutional investors frequently opt for gold to shield portfolios from inflationary pressures. We see this as a practical approach, particularly in markets sensitive to currency fluctuations. The steady demand for gold in Dubai ensures that it remains a reliable option for investors aiming to preserve purchasing power.

Don’t miss out: ⇒ Blog ⇒ YouTube Videos ⇒ Telegram Channel

Retail Gold Investment Strategies

Retail investors have several ways to engage with gold. Physical gold, such as bars and coins, is popular among those who prefer tangible assets. Exchange-traded funds (ETFs) offer a more accessible entry, allowing us to buy shares that represent gold without needing storage. Additionally, gold mining stocks present another avenue, linking returns to the performance of mining companies. For those interested in the Dubai market, acquiring a National Investor Number (NIN) is necessary to trade efficiently. Evaluating the retail gold rate when investing can optimize our entry points and maximize potential returns. We should consider our risk tolerance and investment goals when choosing the most suitable strategy.

Understanding Gold Quality and Pricing

Gold quality and pricing are crucial when considering investments or purchasing jewelry. We explore the differences between various karat levels, emphasizing how purity and value are interconnected in gold transactions.

24K vs. 22K vs. 21K Gold

When assessing gold quality, karats are key. 24K gold is the purest form, consisting of about 99.9% gold. It’s often used in investments and some high-end jewelry.

22K gold contains about 91.6% gold, mixed with other metals like copper or silver for added strength. This type is common in jewelry as it’s durable yet still maintains a rich gold hue.

21K gold features approximately 87.5% gold content. It balances gold purity with increased durability, making it suitable for various jewelry designs.

The Karat System Explained

The karat system measures gold purity, where 24 karats represents pure gold. Each karat level indicates a percentage of actual gold content out of 24 parts.

For instance, 22 karat gold contains about 22 parts pure gold and 2 parts alloying metals. Similarly, 21 karat gold comprises 21 parts gold.

This system helps us assess gold quality and value whether investing or buying jewelry. Understanding these distinctions ensures informed decisions when engaging with gold in Dubai’s dynamic market.

- Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.

- Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

Dubai’s Gold Market Dynamics

Dubai has firmly established itself as a major hub in the global gold market. Known for its vibrant trading scene and competitive prices, Dubai attracts both tourists and investors. Understanding Dubai’s Gold Souk and the city’s role in global gold imports and demand offers valuable insights into its market dynamics.

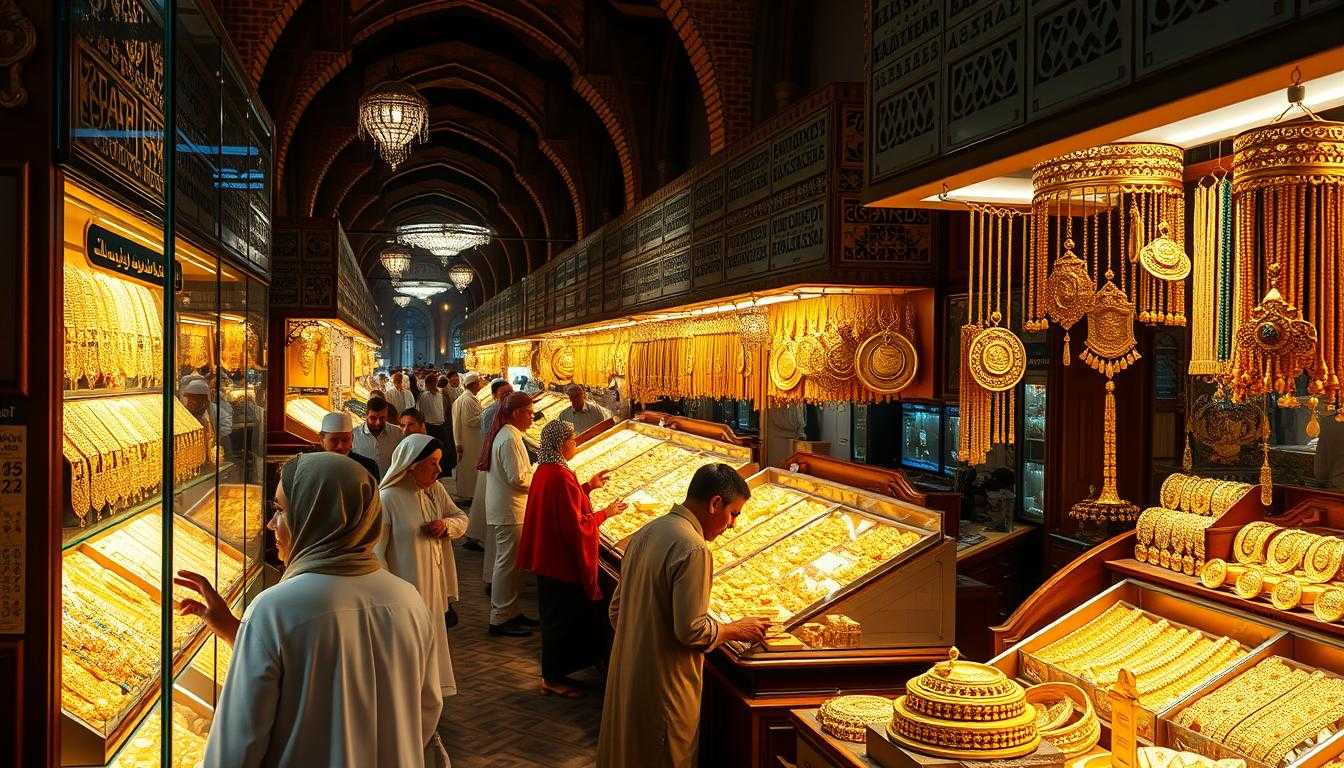

Dubai Gold Souk: The City of Gold

The Dubai Gold Souk is an iconic marketplace often referred to as the “City of Gold.” Here, countless shops line the bustling street, filled with gold jewelry and ornaments. This vibrant market is a key attraction for travelers and locals alike.

Visitors can find a wide variety of gold purity levels and unique designs. The market’s competitive prices are due to Dubai’s tax-free policies and strategic location, making it a preferred destination for gold shopping.

The Gold Souk is also a significant indicator of market trends, reflecting changes in consumer preferences and economic influences. It serves as both a shopping hotspot and an essential part of the city’s cultural heritage.

Gold Imports and Demand

Dubai plays a crucial role in the global gold trade, importing large amounts of gold to meet both local and international demand. The city’s strategic location at the crossroads of Europe and Asia makes it an ideal trading hub.

Imports are driven by market demands and the city’s reputation as a key player in the gold industry. The consistent demand for gold in Dubai is influenced by several factors, including investor interest, cultural significance, and economic conditions.

Adjustments in global gold prices also impact local prices. This dynamic environment helps Dubai maintain its status as a leading gold trading center. The constant flow of imports ensures that gold remains readily available to traders and buyers.

Currency and Exchange Rate Considerations

Gold prices in Dubai are significantly affected by exchange rate fluctuations, especially the relationship between the AED and USD. Understanding the dynamics between these currencies is crucial for evaluating gold as an investment.

Influence of AED and USD on Gold Prices

The UAE Dirham (AED) is pegged to the US Dollar (USD). This fixed exchange rate means that any changes in the USD’s value can impact the gold prices in Dubai. When the USD strengthens, gold prices in AED might increase. Conversely, a weaker USD can lead to lower gold prices in dirhams.

Currency Exchange is central to understanding gold pricing. Besides USD, other major currencies like the Euro, Saudi Riyal, Indian Rupee, British Pound, and Australian Dollar also play roles in the market. These currencies influence investor behavior and the relative demand for gold. As a result, any change in exchange rates involving these currencies can directly affect our investments in gold.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Frequently Asked Questions

In this section, we address common questions about gold rates and investment in Dubai. We explore how local prices are set, their relation to international rates, and the benefits of investing in gold.

What determines the gold rate in Dubai today?

The gold rate in Dubai is influenced by international gold prices and local supply and demand. Economic indicators, geopolitical events, and currency fluctuations also play crucial roles. The Dubai Gold and Jewellery Group also regularly updates rates to reflect these changes.

How does the gold rate in Dubai compare to international gold prices?

Dubai often offers competitive gold prices due to low taxes and duties compared to other global markets. The absence of VAT on investment gold like bars and coins makes it an appealing option, often aligning closely with, or even below, international spot prices.

What are the advantages of investing in gold in Dubai?

Investing in gold in Dubai offers tax benefits, competitive pricing, and a wide variety of options. The city’s reputation as a gold trading hub ensures transparency and reliability. Investors can choose from physical gold, ETFs, and gold mining stocks for greater flexibility.

Can you explain the difference between 22-carat and 24-carat gold rates in Dubai?

22-carat gold contains 91.6% pure gold, making it more durable and slightly cheaper than 24-carat gold, which is 99.9% pure. This purity difference is reflected in their pricing: 24-carat is priced higher due to its higher purity, appealing to those seeking quality.

What historical trends have been observed in Dubai’s gold prices?

Gold prices in Dubai have generally followed international trends with fluctuations due to global economic factors. Over the years, prices have seen significant rises during uncertain economic times. Historically, Dubai’s gold market has remained robust, attracting investors worldwide.

What factors should be considered when buying gold in Dubai as an investment?

When investing in gold in Dubai, consider current market trends, purity levels, pricing, and taxes. It’s crucial to conduct thorough research and understand global economic influences. Choosing the right form of gold, whether physical or digital, can impact return on investment.