Did you know that in 2023, central banks bought 1,037 tons of gold? This is the second-highest amount ever. Gold remains a safe choice during tough economic times. In Dubai, knowing the Gold Rate In Dubai is key for investors.

The UAE’s gold market combines tradition and modernity. It’s important for both culture and the economy. Gold prices in Dubai are shaped by global trends and local demand. This makes it crucial to have up-to-date information.

Investors have several options to consider. They can buy physical gold, invest in gold ETFs, or use trading platforms. Knowing the current gold rate in Dubai is the first step to a smart investment. Companies like ICM Capital and Equiti offer tools and data to help investors make informed choices.

Key Takeaways

- Global economic trends and local demand heavily influence Dubai’s gold rates.

- Gold is a tangible asset offering physical ownership and can be securely stored.

- ETFs and trading platforms like ICM Capital and Equiti provide real-time data and advanced tools for trading gold.

- Gold is often considered a good hedge against inflation and currency fluctuations.

- Understanding the live gold rate in Dubai is crucial for making informed investment decisions.

For more information on investing in gold, check out invest in gold. Open your account with ICM Capital and trade Live on gold. They are licensed by the Abu Dhabi Global Market UAE. Or open your account with Equiti and trade Live on gold. They have international licenses and approval from the Securities and Commodities Authority of the UAE.

Understanding Dubai’s Gold Market

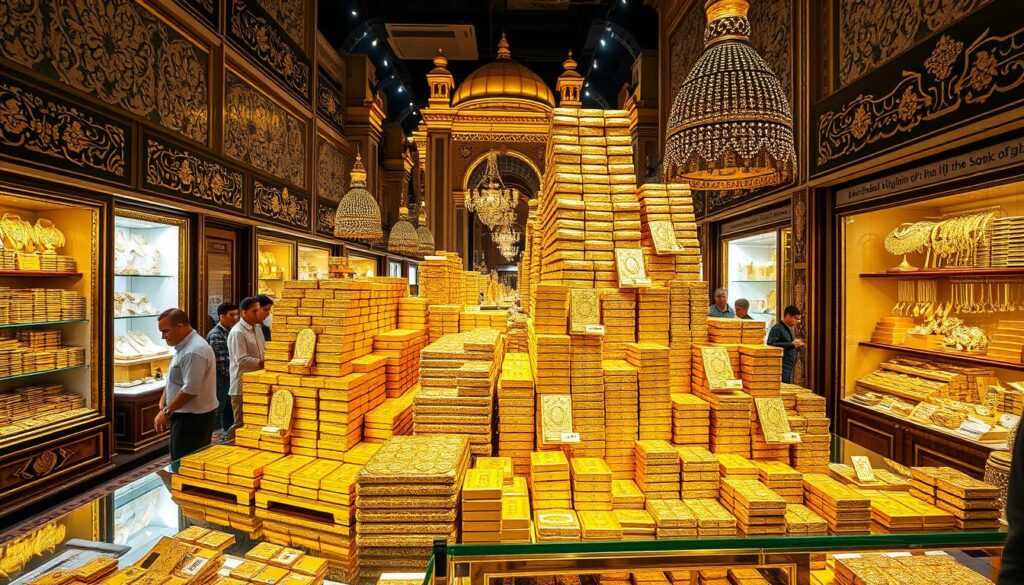

Dubai is known as the “City of Gold” because of its long history in gold trade. The Dubai Gold Souk and other markets show the UAE’s rich gold history. This section explores how Dubai became a key player in the global gold market today.

The Historical Significance of Gold in Dubai

Gold’s importance in Dubai dates back to ancient times. It was a sign of wealth and prosperity in the UAE. The Dubai Gold Souk, started in the 1940s, is a key part of this history.

This market has drawn traders and tourists for years. It’s a symbol of Dubai’s rich gold culture.

Modern Dubai: A Hub for Gold Trade

Today, Dubai’s gold market combines old traditions with new trade practices. Buying gold here is tax-free, attracting investors looking to save on taxes. Gold prices in Dubai are also lower than in major Indian cities.

Travelers can bring more gold duty-free, making Dubai a great place to buy gold. This includes higher limits for women and children. The lower customs duty and social welfare surcharge make Dubai a cost-effective choice.

Dubai’s gold market is also modern, following international standards. Digital gold platforms and gold ETFs have added new features. These innovations keep Dubai at the forefront of the global gold market.

Factors Influencing Gold Rates in Dubai

The gold rate in Dubai changes due to global and local factors. This makes it a lively market for investors. Knowing these factors is key for those interested in gold in the UAE. Let’s look at the main things that affect gold rates in Dubai.

Global Economic Trends

Global economic stability is a big factor in gold rates. For example, US consumer confidence has dropped, hitting its lowest since August 2021. This drop has led to higher gold prices.

US Treasury yields have fallen to 3.73%, and the US dollar has weakened by 0.42% against major currencies. These changes make gold more attractive to investors.

Experts like Rania Gule think gold might hit $2,740 per ounce by year-end. This is because investors are looking for safety from inflation and economic troubles. The Federal Reserve’s rate cut plans in November could also boost gold demand.

Local Demand and Supply Dynamics

Local factors, like UAE gold supply and demand, also affect gold prices. Gold prices in Dubai have gone up by nearly 20% in six months. They’ve risen 43.17% in a year and 82% in five years.

Dubai’s gold markets are famous, especially during festivals and cultural events. High demand and limited supply push up gold prices.

Gold trading happens for over 23 hours a day on big exchanges. This makes gold prices change often. Places like Comex, MCX, and DGCX play big roles in this.

Currency Fluctuations

The value of the dirham affects dirham and gold prices. The UAE dirham is tied to the US dollar. So, any change in the dollar’s value changes gold prices in Dubai.

When the dollar gets stronger, gold prices fall. But when the dollar weakens, gold prices go up.

Geopolitical tensions have made currency dynamics tricky. This has led investors to turn to gold for stability. For example, Comex Gold has risen over 45% during recent crises, showing gold’s safe-haven role.

Knowing these factors helps investors in Dubai make smart choices. The gold market is influenced by global stability, local supply and demand, and currency changes. It’s both exciting and complex.

Today’s Gold Rates in Dubai

It’s important for investors and buyers to know the current gold price in Dubai. Dubai’s gold market is lively, with prices changing daily. This is due to global trends, local demand, and currency changes. Today, we look at gold prices for different karat grades.

| Karat | Price per gram (AED) |

|---|---|

| 24K | 321.74 |

| 22K | 294.94 |

| 21K | 281.52 |

| 18K | 241.30 |

The gold rate chart UAE shows prices have gone up by 26.37% in a year. Knowing today’s gold prices helps investors make smart choices. Keeping an eye on these rates can lead to profit in gold jewelry and bullion.

22 karat gold, with 91.6% pure gold, is a top pick for jewelry. But 24 karat gold is the purest. The prices of these grades are key for planning purchases and investments.

For up-to-date real-time gold prices, use reliable brokers. Consider opening an account with ICM Capital or Equiti for live gold trading. Both are licensed globally and in the UAE.

- Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE.

- Open your account now with Equiti and trade Live on gold with a global broker who holds international licenses and is licensed by the Securities and Commodities Authority of the UAE.

Investment Options for Gold in Dubai

Dubai has many gold investment choices for different needs. You can buy physical gold Dubai or look into gold ETFs Dubai. There are lots of options to choose from.

Buying physical gold Dubai is a classic choice. It’s something you can hold in your hand. You can find gold bars or coins at over 4,000 businesses in Dubai. The Dubai Multi Commodities Centre (DMCC) supports 267 gold businesses and jewelers, making the market strong and reliable.

- Physical Gold: Buying gold bars and coins from trusted dealers gives you peace of mind and real ownership.

- Gold ETFs: Gold ETFs Dubai let you invest in gold easily without having to store it.

- Mutual Funds: These funds invest in different gold-related assets, offering a wide range of exposure.

- Gold Futures: For experienced investors, gold futures offer a chance to make more money with a bit of risk.

Dubai’s gold investment options are vast, showing the city’s big role in the global gold trade. In 2021, the UAE was the 4th biggest gold importer, buying $46 billion worth. It was also the 2nd biggest gold exporter, with $32.8 billion in exports. This lively market offers many benefits, like no taxes on imports and exports, and no income taxes for businesses.

| Investment Option | Advantages |

|---|---|

| Physical Gold | Tangible asset, high demand |

| Gold ETFs | Convenience, no storage issues |

| Mutual Funds | Diversified portfolio |

| Gold Futures | High potential returns, speculative |

Knowing all the investment options in Dubai’s gold market helps us plan better. It lets us match our strategies with our financial goals and how much risk we can take. For trading, good brokers like ICM Capital and Equiti offer great platforms.

Start now with ICM Capital and trade Live on gold. They are a global broker with international licenses and are licensed by the Abu Dhabi Global Market UAE.

Start now with Equiti and trade Live on gold. They are a global broker with international licenses and are licensed by the Securities and Commodities Authority of the UAE.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market ⇐

Gold Bullion Investment: A Detailed Overview

Gold bullion is highly valued for its purity and weight. It’s a key investment in the UAE’s gold market. This section covers the reasons to invest, how to do it, and the risks and rewards.

Why Invest in Gold Bullion?

Gold bullion offers many benefits. It holds value well during inflation, providing stability. It acts as a hedge against economic turmoil. As a tangible asset, it ensures a physical store of wealth, safe during market volatility.

Gold bullion UAE markets are robust. They have a well-established infrastructure supporting gold trade.

How to Invest in Gold Bullion?

There are several ways to invest in gold bullion. We can buy physical gold bars from reputable dealers. This ensures direct ownership of the asset.

Alternatively, we can invest indirectly through gold ETFs or futures contracts. These track gold prices and are traded on stock exchanges. It’s important to consider storage and security costs, as keeping physical gold safe incurs costs for rent, insurance, and security.

Risks and Rewards of Gold Bullion Investment

Investors must carefully consider the rewards and risks of gold bullion. Gold offers stability and can hedge against inflation. However, it does not generate income like stocks or bonds.

Capital gains taxes may apply when selling gold bullion. This can affect overall returns. Market volatility and liquidity issues are also significant factors to consider when investing in gold bullion UAE.

| Advantages | Disadvantages |

|---|---|

|

|

Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE. Alternatively, you can open your account with Equiti and trade Live on gold with a global broker licensed by the Securities and Commodities Authority of the UAE.

Gold Jewelry Investment in Dubai

Investing in Dubai gold jewelry combines smart money moves with cultural traditions. It’s not just about looking good. The *gold cultural value* adds to its financial appeal.

Cultural Importance

Gold is a big deal in Dubai, tied to wealth, status, and good fortune. It’s passed down through generations. Gold jewelry is key at weddings and festivals, making it even more valuable.

- The emotional and heirloom value of a diamond ring with higher gold grams is substantial.

- Prestige and perception of luxury are enhanced with rings carrying higher gold grams.

- Rings with higher gold content have higher resale value and market liquidity.

Market Trends and Popular Designs

The *market trends Dubai* feature many styles, influenced by South Asian and Middle Eastern tastes. The demand for certain designs and purity levels affects value. This makes Dubai’s gold jewelry market lively and attractive for investors.

| Benefit | Description |

|---|---|

| Customization | Greater customization and unique design opportunities with rings having higher gold gram weight. |

| Durability | Heavier gold rings are generally more resistant to bending, denting, or breaking. |

| Craftsmanship | Rings with higher gold content often exhibit superior craftsmanship and design versatility. |

| Dual Appreciation | Gold and diamonds in a ring with high gold content offer dual value growth. |

Dubai’s tax-free gold purchases are a big plus, especially for expats and tourists. It helps them get the most from their investments.

Gold ETFs and Trading Platforms in Dubai

Gold ETFs have become more popular in Dubai. They offer a flexible way to invest in gold without owning it. This is great for diversifying your portfolio and taking advantage of gold’s stable value.

Understanding Gold ETFs

Gold ETFs track the price of gold. They let you invest in gold without the hassle of physical storage. This makes it easy to trade gold ETFs in Dubai on well-known markets.

Recommended Trading Platforms

Dubai has many platforms for trading Gold ETFs. Top brokerages like ICM Capital and Equiti offer advanced trading tools. They meet all the necessary regulations.

- ICM Capital: Open your account now with ICM Capital and trade live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE.

- Equiti: Open your account now with Equiti and trade live on gold with a global broker who holds international licenses and is licensed by Securities and Commodities Authority of the UAE.

How to Get Started with Gold ETFs?

Starting with Gold ETFs is easy. Here’s how to begin:

- Open an Investment Account: Give your personal details and fund your account.

- Leverage Digital Gold Investment Platforms: Use robo-advisors for advice or talk to financial advisors for personal guidance.

- Diversification: Spread your investments to reduce risks.

| Comparison of Investment Options | Trading Gold ETFs |

|---|---|

| Buying shares directly | Hands-on approach, time-intensive, requires research |

| Share-based ETFs | Straightforward method to gain exposure |

| Investment funds | Pooled investment managed by professionals |

Gold ETFs are traded like stocks. You sell shares, specify the amount, and get cash. This makes it easy to invest in gold. For those new to trading gold ETFs, these platforms offer live data and easy-to-use interfaces.

Gold Rate In Dubai Ultimate Guide to Investing in Gold

Investing in gold is a popular choice for many. Dubai’s gold market is dynamic, making it key to understand gold investment well. Our Gold Rate In Dubai Ultimate Guide to Investing in Gold offers deep insights into the Dubai gold market. It covers today’s rates, historical trends, and investment tips.

Gold bars in Dubai can be bought through Gold Souks, local jewelers, online retailers, and banks. Each source has its own benefits:

- Gold Souks: Known for competitive pricing and a wide variety of designs and weights.

- Local Jewelers: Trusted for their reputation and adherence to stringent quality standards.

- Online Marketplaces: Offer convenience, transparent pricing, and the ability to quickly compare different offers.

- Banks and Financial Institutions: Provide secure storage options and expert guidance to help navigate the gold buying process.

Top gold dealers in Dubai, like Dubai Gold and Jewellery Group, Al Etihad Gold, and Emirates Gold, are known for fair prices and reliability. They help make the most of Dubai’s unique investment landscape.

Keeping up with real-time data and insights is crucial. Tracking gold rate trends helps make informed investment choices. Understanding market patterns can lead to better returns and a stronger portfolio.

Investing through gold investment companies offers strategic benefits. They provide market knowledge, help diversify, and protect against economic risks. Before investing, check licenses, get proper documents, and understand taxes and duties to avoid surprises.

| Gold Buying Options | Advantages |

|---|---|

| Gold Souks | Competitive pricing, variety of designs and weights |

| Local Jewelers | Trusted reputation, stringent quality standards |

| Online Retailers | Convenience, transparent pricing, easy comparison |

| Banks & Financial Institutions | Secure storage, expert guidance |

Dubai’s gold market offers many opportunities for both short-term gains and long-term stability. For live trading, consider opening an account with ICM Capital or Equiti. These brokers provide secure platforms for trading, helping you maximize your gold investment.

Stay updated with our updated gold investment guide to explore the complex yet rewarding world of gold investment in Dubai. Our aim is to equip you with the knowledge for wise and forward-thinking investment decisions.

Top Gold Bullion Dealers in Dubai

Dubai is a great place to invest in gold. It has many gold bullion dealers Dubai offering high-quality bars and coins. These dealers follow international standards and are very reliable.

- J. Rotbart & Co. is a leader in Dubai’s gold market. They provide top-notch precious metals and have advanced security systems. They also offer safe storage and logistics for metals.

- They are known for their secure services and are a top choice among trusted gold merchants UAE. They also offer loans using bullion as collateral and have individual safe deposit boxes.

J. Rotbart & Co. is known for its excellent service in precious metals. They help you buy gold worldwide, ensuring it’s safe and private. This makes them a great option for those wanting to buy gold bars Dubai from a trusted source.

These dealers also are regulated by top authorities like CMA, CySEC, FCA, ADMG and DFSA. They have been in business since 2005 to 2011. They offer different types of execution and have low minimum deposits.

| Broker | Regulatory Bodies | Year of Establishment | Execution Types | Trading Platforms |

|---|---|---|---|---|

| ICM Capital | CMA, CySEC, FCA, DFSA,ADMG | 2006 | ECN/STP, | MetaTrader 4, MetaTrader 5, cTrader, Proprietary platforms |

| Equiti | FSCA, ASIC, BVI, Central Bank of Ireland | 2009 | ECN | Web-based platforms, MetaTrader 4, MetaTrader 5 |

Choosing the best gold bullion dealers Dubai needs careful thought. Look at their offerings, reliability, and if they follow the rules. Whether you want to buy gold bars Dubai or find trusted gold merchants UAE, pick companies with high standards of security and service.

Investment Strategies for Gold in Dubai

Investing in gold in Dubai means looking at different ways to make money and avoid losses. You can choose long-term investments or use hedging techniques. Knowing these strategies is key to doing well in the gold market.

Long-term vs. Short-term Gold Investment

When you think about gold investment strategies, it’s important to know the difference between long-term and short-term. Long-term investments aim to keep your wealth safe over time. They use gold’s ability to handle economic ups and downs.

Short-term gold investments, however, try to make money from quick price changes. This method needs a good understanding of market trends. It’s riskier because of the fast price swings.

Hedging and Diversification

Gold investment strategies also include using gold as a hedge and for diversification. Gold can protect your investments from inflation and economic downturns. Its value often goes up when the dollar goes down, making it a key part of a balanced portfolio.

In Dubai, you can also look into precious metals IRA Dubai for retirement planning. This option is tax-friendly and safe. It’s becoming more popular for adding physical gold to retirement savings.

Gold ETFs and digital gold offer flexible ways to invest. They make it easy to buy and sell gold. Whether you prefer traditional gold bullion or digital transactions, there’s a way to fit your investment goals and risk level.

Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE.

Open your account now with Equiti and trade Live on gold with a global broker who holds international licenses and is licensed by Securities and Commodities Authority of the UAE.

The Role of Brokerages in Gold Trading

Choosing the right brokerage is key in gold trading. Firms like ICM Capital and Equiti, licensed in the UAE, offer great platforms. They provide essential services like market analysis, live prices, and advice. Working with these brokerages means you get security, compliance, and the tools to succeed in Dubai’s market.

Choosing the Right Brokerage

When picking a brokerage, look at regulation, reputation, services, and fees. It’s important to choose licensed UAE brokers for a safe trading space. ICM Capital and Equiti are known for following international and local rules. Using their platforms in Dubai can greatly improve your trading.

Services Provided by Leading Brokerages

Top UAE brokerages, like ICM Capital and Equiti, offer many services. They provide detailed market analysis, live prices, and expert advice. Their platforms are easy to use and support trading in various currencies, including XAU/USD, XAU/GBP, and XAU/EUR.

Licensed Brokers: ICM Capital and Equiti

ICM Capital and Equiti are well-respected, licensed UAE brokers. ICM Capital is licensed by the Abu Dhabi Global Market, offering global access and strong platforms. Equiti, licensed by the Securities and Commodities Authority of the UAE, provides advanced platforms for gold trading in Dubai. Both offer CFDs with leverage from 1:20 to 1:500, enhancing trading chances.

| Brokerage | License | Key Features | Opening Account |

|---|---|---|---|

| ICM Capital | Abu Dhabi Global Market | Global reach, Robust platforms, Live price feeds | Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market UAE |

| Equiti | Securities and Commodities Authority | Advanced gold trading platforms, Market analytics | Open your account now with Equiti and trade Live on gold with a global broker who holds international licenses and is licensed by Securities and Commodities Authority of the UAE |

Deciding between ICM Capital and Equiti depends on your needs and preferences. Working with either ensures you have the tools and support for successful gold trading.

To learn more about gold trading and using gold rates for financial growth, check out this guide.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market ⇐

Conclusion

As we wrap up our guide on investing in gold in Dubai, it’s important to highlight the market’s unique benefits. Dubai’s gold market is known for its favorable gold rate overview. This is because it doesn’t charge Value Added Tax (VAT) on some gold transactions. This makes it attractive for investors looking for high-quality gold at good prices.

Dubai is a major player in the global gold trade. It combines cultural heritage with modern finance. The 24K gold market in Dubai offers tax-free purchases and high liquidity. It also has strict quality standards.

Investors can take advantage of gold price changes. These changes are influenced by global markets and local demand. Digital platforms like EE Gold make it easier to track prices and store gold securely.

The future of gold investing in Dubai looks bright. It’s shaped by market insights and smart investment choices. Keeping up with gold rates and trends is key to finding good opportunities.

For those looking to improve their investment strategy, working with licensed brokerages is beneficial. Open an account with ICM Capital or Equiti to trade gold with global brokers. For more tips on using today’s gold rates in your financial plans, check out our guide here.

FAQ

What factors influence the gold rate in Dubai?

The gold rate in Dubai is affected by many things. Global economic trends and local demand and supply play big roles. Also, changes in the U.S. dollar’s value, which the UAE dirham is pegged to, matter a lot.

Where can I access real-time gold prices in Dubai?

You can find real-time gold prices in Dubai online. Websites and digital trading platforms like ICM Capital and Equiti offer live updates. They also provide market analytics to help investors stay informed.

What are the different gold investment options available in Dubai?

Dubai offers many gold investment choices. You can invest in physical gold, like bars and coins, or in gold ETFs and mutual funds. Gold futures are also an option. Each choice has its own benefits and risks, fitting different investment plans.

Why is gold bullion considered a valuable investment in Dubai?

Gold bullion is prized for its purity and weight. It’s a solid asset that can protect against inflation and economic troubles. It’s a reliable way to diversify your investments and keep your wealth safe.

How can I start investing in gold ETFs in Dubai?

To invest in gold ETFs in Dubai, start by opening an account with a regulated broker like ICM Capital or Equiti. These platforms make it easy to buy and sell gold ETFs. They’re great for beginners looking to get into the market.

What should I consider when investing in gold jewelry in Dubai?

Investing in gold jewelry in Dubai involves considering cultural value, market trends, and design popularity. The purity of the gold and demand for certain styles can impact its resale value and investment potential.

Who are the top gold bullion dealers in Dubai?

Dubai’s top gold bullion dealers are known for their reliability and adherence to international standards. They offer high-quality bars and coins, ensuring authenticity and quality for investors.

What should I look for when choosing a brokerage for gold trading in Dubai?

When picking a brokerage for gold trading in Dubai, look for licensed and regulated firms like ICM Capital and Equiti. Make sure they have strong trading platforms with live price feeds, market analytics, and good customer support.

What are the benefits of including gold in a precious metals IRA?

Adding gold to a precious metals IRA brings diversification benefits. It acts as a hedge against economic downturns and inflation. This can make your retirement portfolio more stable and secure.

How do global economic trends affect gold prices in Dubai?

Global economic trends, such as U.S. retail sales changes and Federal Reserve policies, affect gold prices worldwide, including Dubai. These trends can cause demand and price fluctuations, influencing investment strategies.