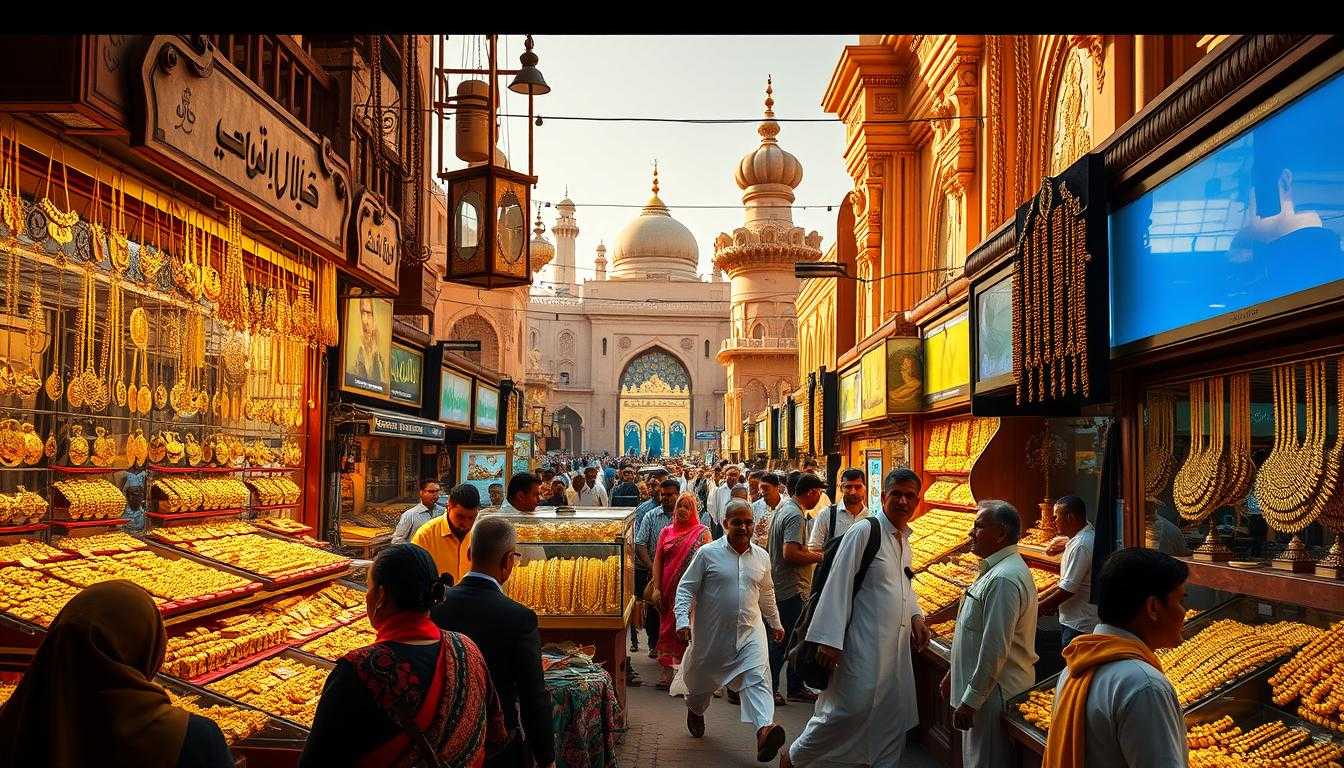

Are you looking to make money in Dubai’s gold market? Dubai is known as the “City of Gold.” It offers many chances for investors to grow their wealth in precious metal investing. With good trading rules and a regulated gold market, Dubai is a top spot for gold lovers and smart traders.

When you start exploring Dubai’s gold market, knowing what affects gold prices is key. Things like global market trends, currency changes, and local demand are important. Keeping up with these can help you make smart trading choices.

Dubai’s gold market has something for everyone, no matter your budget. You can find gold products like 24K, 22K, 21K, and 18K gold. Whether you’re new to investing or have experience, there are many ways to grow your portfolio with gold.

To get the most out of Dubai’s gold market, it’s important to know the latest news and trends. Gold prices have seen a -1.07% change in the last 30 days. But over the past year, they’ve gone up by +29.87%. These changes show why making timely and smart trading choices is so important.

When trading gold online, think about opening an account with trusted brokers like ICM Capital, Equiti, or ATFX. These brokers are authorized by the Abu Dhabi Global Markets (ADGM) and the Securities and Commodities Authority of the UAE. They give you the tools and platforms you need to trade gold well.

Start your journey in Dubai’s gold market with excitement and a focus on making money. With the right strategies, knowledge, and trading partners, you can find great opportunities in this shining city of gold.

Key Takeaways

- Dubai, known as the “City of Gold,” offers a thriving gold market with favorable trading policies and government regulation.

- Understanding the factors influencing gold prices, such as international market trends, currency fluctuations, and local demand, is crucial for making informed trading decisions.

- Dubai’s gold market caters to various preferences and budgets, offering a range of gold products, including 24K, 22K, 21K, and 18K gold.

- Staying updated on the latest trends and market insights is essential for maximizing returns in the Dubai gold market.

- Opening an account with reputable global brokers, such as ICM Capital, Equiti, or ATFX, provides access to the tools and platforms necessary for effective gold trading in Dubai.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Understanding the Gold Market Dynamics in Dubai

The gold market in Dubai is always changing. Many factors affect gold’s price and trading trends. Knowing these details is key for investors and traders to make smart choices and increase their profits.

The Influences on Gold Prices

Several important factors shape gold prices in Dubai. Economic data like inflation, interest rates, and job reports play a big role. When the economy is shaky or there’s global tension, gold becomes a safe choice. This boosts demand and prices.

Gold’s physical demand also matters. It’s used in jewelry and for industrial purposes. This demand affects gold’s value in the market.

- Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE (ADGM).

- Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

- Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE (SCA).

Importance of Currency Fluctuations

Currency changes, like the AED-USD rate, deeply impact gold prices in Dubai. The UAE Dirham is tied to the US Dollar. So, any Dollar value changes affect gold prices in Dubai.

If the US Dollar weakens, gold prices go up. This makes gold cheaper for people with other currencies. But, a stronger Dollar can lower gold prices.

| Factor | Impact on Gold Prices |

|---|---|

| Weak US Dollar | Gold prices rise |

| Strong US Dollar | Gold prices decrease |

| Economic uncertainty | Increased demand for gold |

| Geopolitical tensions | Higher gold prices |

Current Trends in Gold Trading

Gold trading in Dubai is moving online. This makes it easier and more flexible for investors and traders. The global pandemic has made digital trading even more important.

Choosing a reliable online platform is crucial. It should meet your trading needs.

Open your account now with ICM Capital and trade Live on gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM)

Understanding the gold market in Dubai is key to success. Know the factors that influence gold prices and the importance of currency changes. Stay updated and make smart decisions to increase your profits in this exciting market.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

⇒ Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

Essential Online Trading Tools and Platforms

To succeed in online gold trading, you need the right tools and platforms. The best trading platforms in the UAE offer real-time pricing and advanced tools. They make it easy to navigate the market and make informed decisions.

Best Trading Platforms for Gold in UAE

Choosing the best trading platforms for gold in the UAE is important. You have several top options:

- ICM Capital – Authorized by the Abu Dhabi Global Markets (ADGM), ICM Capital offers a robust platform for gold trading. Open your account now and trade live on gold with this global multi-regulated broker.

- Equiti – As a global broker holding multiple licenses, including authorization from the Securities and Commodities Authority of the UAE, Equiti provides a reliable platform for gold trading. Start trading live on gold today by opening your account with Equiti.

- ATFX – Another global broker authorized by the Securities and Commodities Authority of the UAE, ATFX offers a user-friendly platform for gold trading. Open your account now and begin trading live on gold with ATFX.

- Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE (ADGM).

- Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

- Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE (SCA).

Essential Features You Should Look For

When evaluating online trading platforms, look for these essential features:

- Real-time pricing – Stay on top of the market with up-to-the-minute gold prices.

- Advanced charting tools – Analyze market trends and patterns with sophisticated charting capabilities.

- User-friendly interface – Navigate the platform with ease, even if you’re new to gold trading.

Security Measures in Online Trading

Security is key in online gold trading. Look for platforms with strong security measures:

- Encryption – Ensure your personal and financial data is protected with state-of-the-art encryption technology.

- Two-factor authentication – Add an extra layer of security to your account with two-factor authentication.

- Segregated accounts – Verify that your funds are held in segregated accounts, separate from the broker’s operational funds.

By choosing a reputable online trading platform, you can confidently navigate the gold market. This helps you maximize your returns.

| Broker | Regulation | Spread (EUR/USD) | Minimum Deposit |

|---|---|---|---|

| Pepperstone | ASIC, FCA, DFSA, CMA, BaFin, CySEC | 0.1 pips (Razor Account) | $200 |

| AvaTrade | ASIC, FSCA, ADGM, CBI, FSA, FFAJ | 0.9 pips (fixed) | $100 |

| IG Group | FCA, ASIC, FINMA, FMA, JFSA, MAS | 1.13 pips (no commission) | $0 |

Strategies to Maximize Your Returns

Maximizing returns in gold trading requires understanding different strategies. Whether you’re investing for the long term or trading short term, there are ways to improve your gold portfolio’s success.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

⇒ Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

Long-Term vs. Short-Term Trading Strategies

Long-term strategies mean holding onto gold investments for years. It’s best for those who trust gold’s long-term value and can handle market ups and downs. Short-term strategies, on the other hand, aim to profit from quick price changes. They require more active trading and analysis.

Diversification in Your Gold Portfolio

Diversifying your gold portfolio is key to managing risk and boosting returns. Invest in different types of gold, like:

- Physical gold (bullion, coins)

- Gold ETFs

- Gold mining stocks

Spreading your investments across various gold assets helps reduce the impact of market volatility on your portfolio.

Timing Your Trades: When to Buy or Sell

Timing your trades well is crucial for high returns. Analyze the market and forecast trends. Consider economic indicators, global events, and expert opinions to decide when to buy or sell gold. Look at these factors:

| Factor | Impact on Gold Prices |

|---|---|

| Market Volatility | High volatility can lead to increased demand for gold as a safe-haven asset |

| Currency Fluctuations | A weaker US dollar typically boosts gold prices |

| Central Bank Policies | Monetary policies, such as interest rate changes, can influence gold prices |

| Global Events | Geopolitical tensions and economic uncertainties can drive demand for gold |

“The key to successful gold trading is to stay informed, diversify your portfolio, and make strategic decisions based on thorough analysis and forecasting.”

“Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

“Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

Risk Management in Gold Trading

Starting your gold trading journey in Dubai means you must focus on risk management. This helps protect your investments and increase your returns. Understanding how market volatility affects gold prices is key to making smart choices.

By keeping an eye on market changes, you can trade gold more confidently and quickly.

Setting Realistic Profit Targets

Setting realistic profit targets is a crucial part of managing risk. It’s okay to dream big, but your goals should match your risk level and the market. Achievable targets help you stay focused and avoid taking too much risk.

Consistency and patience are important for building a strong gold trading portfolio.

Protecting Your Investment with Stop-Loss Orders

Using stop-loss orders is a smart way to manage risk. These orders sell your gold automatically if the price falls below a certain level. This helps limit losses and keeps your capital safe during market ups and downs.

As you explore gold trading in Dubai, remember that managing risk is key to success. Open an account with trusted brokers like ICM Capital, Equiti, or ATFX. They are authorized by the Abu Dhabi Global Markets (ADGM) and the Securities and Commodities Authority of the UAE. Their expertise and strong platforms will help you achieve your gold trading goals while protecting your investments.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

What factors influence gold prices in Dubai?

Gold prices in Dubai are affected by many things. Global economic conditions and geopolitical events play a big role. So does investor sentiment and the balance between gold supply and demand.

Currency changes, like the AED-USD rate, also impact prices. These factors all work together to shape gold prices in Dubai.

How can I choose the right online trading platform for gold in the UAE?

To pick the best online trading platform for gold in the UAE, look for ADGM and UAE SCA approval. ICM Capital, Equiti, and ATFX are good examples.

Make sure the platform offers real-time pricing and advanced charting tools. It should also have a user-friendly interface and strong security.

What are the differences between long-term and short-term gold trading strategies?

Long-term strategies involve holding gold for a long time. They aim to profit from long-term price growth.

Short-term strategies, by contrast, aim to make money from quick price changes. They require more active trading and analysis.

How can I diversify my gold portfolio to mitigate risk?

Diversifying your gold portfolio can reduce risk. Invest in different types of gold, like physical gold, ETFs, and mining stocks.

This spreads your risk across various investments. It can help protect your portfolio from market ups and downs.

What role does risk management play in successful gold trading?

Risk management is key to gold trading success. It’s important to understand market volatility and set realistic profit goals.

Using stop-loss orders can also help limit losses. By managing risk well, you can trade gold more confidently and protect your investments.