Did you know 82% of retail CFD accounts lose money? This fact shows why knowing Dubai’s gold market is key. We’ll look into how Dubai’s gold rates work and what affects them.

Recently, gold prices in Dubai have hit new highs. This is because of Middle East tensions and U.S. election worries. The price of 22K gold has reached AED308.75 per gram. Spot gold has gone up 0.5% to $2,734.38 an ounce, and gold futures have risen 0.4% to $2,748.40 an ounce.

Dubai is known as the “City of Gold.” It’s a great place for gold lovers and investors. The prices here are competitive, drawing buyers from all over. Knowing Dubai’s gold market is essential for investing or trading in gold.

For those into gold CFDs, leverage is between 1:20 and 1:500. This means big wins and losses, so managing risk is key.

To trade gold in Dubai, think about opening an account with ICM Capital. They’re a global broker with Abu Dhabi Global Markets (ADGM) approval. Or, you could try Equiti for live gold trading. They have many international licenses and are approved by the Securities and Commodities Authority of the UAE.

Key Takeaways

- Dubai’s gold market is experiencing record-high prices due to global factors.

- 22K gold in Dubai currently costs AED308.75 per gram.

- Safe-haven demand is driving gold prices upward globally.

- Dubai’s competitive gold prices attract both local and international buyers.

- CFD gold trading involves high leverage, potentially amplifying gains and losses.

- Reputable brokers like ICM Capital and Equiti offer platforms for gold trading in Dubai.

Understanding Dubai’s Gold Market Dynamics

Dubai’s gold market is a global leader, drawing in investors and fans. Its strategic spot and tax-free rules make it a top spot for gold trading. Let’s explore this shiny market’s details.

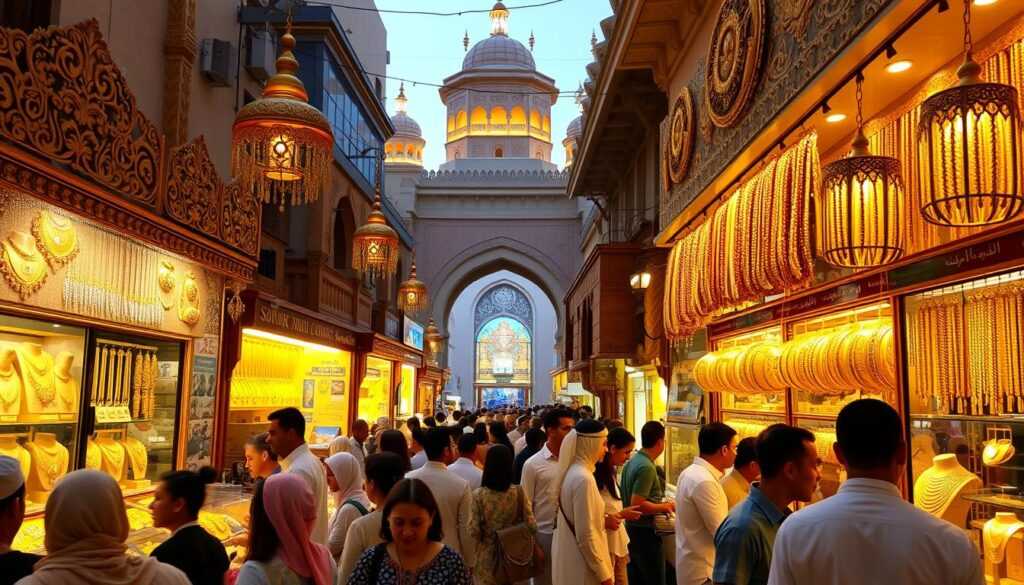

The Dubai Gold Souk: A Global Gold Hub

The Dubai Gold Souk is at the heart of Dubai’s gold scene. This lively market offers a wide range of gold jewelry, coins, and bars. It has designs and purity levels for everyone, meeting different tastes and investment goals.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Factors Influencing Gold Prices in Dubai

Gold prices in Dubai are influenced by many things. Local demand, global supply issues, and economic growth are key. For example, gold prices in India have doubled in five years, showing the market’s fast-changing nature.

Impact of Global Economic Events on Local Gold Rates

Global events greatly affect Dubai’s gold prices. Tensions can push investors towards gold, making prices go up. The recent gold price rise is due to global tensions, US rate cuts, and weak growth. Trading gold in the UAE means knowing these complex market factors.

Central banks’ growing gold interest, despite tough times, is expected to keep going. Economic boosts in China and changes in India’s gold rules could also shape Dubai’s gold market.

Current Trends in Dubai’s Gold Prices

Dubai’s gold market is seeing big changes, thanks to global economic shifts. We’ve noticed important trends in Dubai gold prices that are changing the industry.

Analysis of Recent Gold Price Fluctuations

Gold prices in Dubai have seen big swings lately. Indian gold prices have doubled in five years, with a 24% jump this year. Despite a drop in Chinese demand, experts think prices will go back up because of economic boosts.

“Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

Comparing 24K, 22K, and 21K Gold Rates

It’s key to know the difference in gold karats for smart investing. Here are the current prices:

| Karat | Purity | Price per gram (AED) |

|---|---|---|

| 24K | 99.9% | 332.75 |

| 22K | 91.6% | 305.00 |

| 21K | 87.5% | 291.25 |

Predictions for Future Gold Price Movements

Experts say gold prices will likely go up. They suggest buying at Rs 75,500-76,000, with targets of Rs 85,300-87,000. Ventura Securities sees a chance for gold to hit Rs 85,700 per 10 grams.

Silver might hit Rs 1,06,000 to Rs 1,20,000. For live gold trading, think about opening an account with ICM Capital or Equiti. Both are approved by UAE’s regulatory bodies.

“Gold ETF folios in India have grown 7.5 times in the past four years, indicating rising investor interest.”

These trends show gold’s lasting appeal as a safe investment in uncertain times.

Gold as a Safe-Haven Investment in Uncertain Times

In today’s shaky economy, gold stands out as a solid safe-haven. It has seen a near 12% price jump recently. This shows its strength when times are tough. Gold mixes stability with growth, making it a great choice for diversifying your portfolio.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE

⇒ Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Gold’s success as a shield against inflation and market ups and downs is clear. It has given a 30.6% return in just one year. Over five years, it’s up 103.5%, and over 20 years, a whopping 1103.1%. These numbers highlight gold’s power to keep wealth safe over time.

Our study shows that central banks are buying more gold, adding over 1,000 tonnes in 2023. This move shows they trust gold’s long-term worth. For those investing on their own, experts suggest putting 5-10% of your portfolio in gold. This balance of safety and growth is key.

“Gold prices may reach $3000 in the next 6 months due to strong investment demand.”

We suggest looking into different ways to invest in gold. Sovereign Gold Bonds (SGBs) are tax-friendly and offer extra interest. Gold ETFs let you invest in high-quality bullion without the costs of physical gold. These options can be better than owning gold directly.

Open your account now with ICM Capital or Equiti to trade gold. These global brokers are approved by UAE regulatory bodies. As global tensions rise and economic doubts grow, gold shines as a steady light in the financial storm.

The Role of Currency Exchange Rates in Gold Pricing

Currency exchange rates are key in setting gold prices, notably in Dubai. The interaction between forex and gold markets opens doors for smart investors. Let’s dive into how these elements influence gold prices in the UAE.

- Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.

- Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

AED-USD Relationship and Its Effect on Gold Rates

The UAE Dirham (AED) is tied to the US Dollar (USD), making gold pricing unique. When the USD gets stronger, gold in AED tends to go up. This affects both buying physical gold and trading CFDs.

For those into gold CFD trading, knowing broker options is crucial. Here’s a look at top brokers:

| Broker | Avg. Trading Cost | Gold Spreads | Max Leverage | Min Deposit |

|---|---|---|---|---|

| FXTM | $0.18 | N/A | N/A | $200 |

| FP Markets | $0.16 | From 0.0 pips | 1:500 | $100 |

| Eightcap | $0.12 | From 1.9 points | 1:1000 | $100 |

| XM | $0.19 | From 12.0 pips | 1:500 | $5 |

Impact of Other Major Currencies on Dubai’s Gold Market

While AED-USD is key, other currencies also sway Dubai’s gold market. The Euro, Saudi Riyal, and Indian Rupee influence investor actions and gold demand. These forex effects on gold offer a rich field for traders.

Opening an account with ICM Capital or Equiti for gold trading is wise. Both are global, multi-regulated brokers approved by UAE authorities. They offer competitive spreads and a wide range of trading options.

Gold Rate in Dubai: The Best Online Trading Platforms for Gold Investments

Online gold trading is getting more popular in Dubai. The right platforms make it easy to invest in the Dubai gold market. We’ve looked at top brokers to guide your choices.

ICM Capital and Equiti are top choices for gold trading in Dubai. They are global, multi-regulated brokers with great tools for investors. ICM Capital is authorized by the Abu Dhabi Global Markets (ADGM). Equiti is regulated by the Securities and Commodities Authority of the UAE.

Let’s compare some key features of top gold trading platforms:

| Platform | Year Established | Minimum Deposit | Average Gold Trading Cost |

|---|---|---|---|

| FXTM | 2011 | $200 | $0.18 |

| FP Markets | 2005 | $100 | $0.16 |

| AvaTrade | 2006 | $100 | $0.29 |

| Eightcap | 2009 | $100 | $0.12 |

| XM | 2009 | $5 | $0.19 |

ICM Capital is great for a full trading experience. It won the Best Overall Trading Platform in the Online Money Awards 2024. It has high customer ratings and fast withdrawals. also offers up to 200:1 leverage on gold CFDs and 75 analysis indicators. It’s a strong tool for online gold trading.

When picking a platform, think about regulatory compliance, trading costs, and tools. Each platform has its own features. Choose one that fits your investment goals and trading style.

Don’t miss out: ⇒ Blog ⇒ YouTube Videos ⇒ Telegram Channel

Expert Strategies for Gold Investment in Dubai

Gold investment strategies in Dubai offer diverse opportunities for investors. We’ll explore key approaches to maximize your gold investments in this dynamic market.

Physical Gold vs. Digital Gold: Pros and Cons

Investors in Dubai can choose between physical and digital gold. Physical gold, like bars and coins, offers tangible ownership. Digital gold, including ETFs and gold mining stocks, provides easier trading and storage.

| Investment Type | Pros | Cons |

|---|---|---|

| Physical Gold | Tangible asset, No counterparty risk | Storage costs, Less liquid |

| Digital Gold | Easy to trade, No storage issues | Counterparty risk, Market volatility |

Timing Your Gold Investments

Investment timing is crucial in the gold market. Short-term traders often look for price corrections before entering. Long-term investors focus on gradual accumulation, adding to positions during price dips.

Diversification Techniques Using Gold

Portfolio diversification with gold helps balance risk and returns. We recommend allocating 5-10% of your portfolio to gold investments. This approach can provide a hedge against market volatility and currency fluctuations.

- Combine physical gold with gold ETFs

- Mix gold with other precious metals

- Include gold mining stocks for added exposure

For expert guidance on gold investments, consider opening an account with ICM Capital or Equiti. These globally regulated brokers offer robust platforms for trading gold in Dubai’s market.

Conclusion: Navigating Dubai’s Gold Market in 2024 and Beyond

The Dubai gold market looks promising for 2024 and the future. Dubai is becoming a key place for gold worldwide, with the Dubai Gold Souk at its center. Investors should watch market trends and adjust their plans as needed.

Investing in gold in Dubai means keeping an eye on local and global news. The price of gold in Dubai can change quickly due to currency rates, world events, and economic signs. This makes it crucial to have good advice on investing.

To succeed in Dubai’s gold market, think about opening an account with a trusted broker. ICM Capital, approved by the Abu Dhabi Global Markets (ADGM), offers live gold trading. Equiti, licensed by the UAE’s Securities and Commodities Authority, is another good choice for gold investments. By staying informed and choosing reliable platforms, you can confidently explore Dubai’s gold market.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

What is the Dubai Gold Souk, and why is it significant?

The Dubai Gold Souk is a famous marketplace known as the “City of Gold.” It offers a wide range of gold purity levels and unique designs. Dubai’s tax-free policies and strategic location make it a top choice for gold shopping.

What factors influence gold prices in Dubai?

Several factors affect gold prices in Dubai. These include economic growth, geopolitical factors, and local demand. International supply disruptions, global bullion prices, and currency exchange rates also play a role.

How have recent geopolitical tensions and economic uncertainties affected gold prices in Dubai?

Recent gold price changes in Dubai have been influenced by geopolitical tensions and economic uncertainties. For example, 24K gold is now priced at about AED 332.75 per gram.

What is the difference between 24K, 22K, and 21K gold in terms of purity?

The karat system measures gold purity. 24K gold is the purest, with 99.9% gold content. 22K gold has 91.6% gold, and 21K has 87.5% gold content.

Why is gold considered a safe-haven investment?

Gold is seen as a reliable safe-haven asset. It protects against inflation and currency fluctuations. It often holds or increases its value when currency values drop, making it a preferred choice during economic instability.

How does the AED-USD relationship affect gold prices in Dubai?

The UAE Dirham (AED) is pegged to the US Dollar (USD). Changes in the USD’s value can impact gold prices in Dubai. When the USD strengthens, gold prices in AED might increase, and vice versa.

What are some reputable online trading platforms for gold investments in Dubai?

ICM Capital and Equiti are global multi-regulated brokers. They are authorized by the Abu Dhabi Global Markets (ADGM) and Securities and Commodities Authority of the UAE, respectively. They offer opportunities to trade live on gold.

What are some investment strategies for gold in Dubai?

Investment strategies for gold in Dubai include physical gold (bars and coins) and digital options like exchange-traded funds (ETFs) and gold mining stocks. Diversification techniques using gold in portfolios are also available. The approach depends on an investor’s risk tolerance and investment goals.