Did you know that gold prices in Dubai are now over $2,680 per ounce? This is a new record in 2024. The UAE is a top place for gold bullion investing because of its tax-free rules and advanced markets. Dubai, known as the “City of Gold,” is a key player in the UAE gold market.

It offers many chances for both new and experienced investors. We will look into the many ways to invest in the UAE. This will help you make the most money.

Key Takeaways

- Dubai’s gold prices exceed $2,680 per ounce, marking new record highs.

- The UAE offers diverse gold investment options, including ETFs, digital products, and traditional bullion.

- Dubai is renowned as the “City of Gold” and is a key hub in the global gold market.

- Tax-free regime in the UAE enhances competitive gold pricing.

- ISA Bullion provides transparent pricing aligned with international standards.

Understanding the UAE Gold Market

The UAE is a key player in the global gold market. Its location at the intersection of Asia, Africa, and Europe makes it a major hub for gold trading. Dubai, in particular, is a standout, hosting the largest derivatives exchange in the Middle East, the Dubai Gold and Commodities Exchange (DGCX).

The Strategic Importance of Dubai

Dubai’s location at the crossroads of continents is crucial for the gold market. It’s home to DGCX, offering unmatched convenience for gold trading. Modern digital platforms have also made trading more efficient and easy to use.

UAE’s Tax-Friendly Environment

The UAE’s tax-free environment is a big draw for investors. There’s no VAT on gold bullion and coins, offering significant tax benefits. This makes the UAE a top choice for both short-term and long-term investments.

Traditional Markets and Modern Infrastructure

Dubai combines its rich trading history with modern infrastructure. The historic Gold Souk in Deira is a bustling marketplace. At the same time, digital systems and regulations ensure transparency and follow anti-money laundering (AML) policies. This mix of old and new makes Dubai a unique place for gold investors.

Here’s a detailed look at the UAE’s gold trading and what makes it strong:

| Factor | Details |

|---|---|

| Strategic Location | Connects Asia, Africa, and Europe; essential for global trade. |

| Tax Benefits | No VAT on gold bullion and coins; attractive for investors. |

| Modern Platforms | Advanced digital trading platforms enhance accessibility. |

| Traditional Souks | Historic marketplaces offer a blend of heritage and opportunity. |

| Regulation and Transparency | DMCC ensures compliance with AML policies, safeguarding the market. |

Different Types of Gold Investments in UAE

In the UAE, investors have many gold investment choices. These options suit different risk levels and goals. From buying physical gold to investing in gold ETFs, there’s something for everyone.

Buying Physical Gold

Buying physical gold is a timeless choice in the UAE. Gold bars and coins are valuable and stable investments. Dubai, known as the City of Gold, offers high-quality gold with tax benefits.

Physical gold is popular due to its cultural value and history as a safe asset.

Gold ETFs and Mutual Funds

Gold ETFs and mutual funds are great for those who don’t want physical gold. These options let investors join the gold market easily. They offer liquidity and need less capital.

Gold ETFs are backed by real gold, so investors can enjoy gold price changes without extra costs.

Gold Mining Stocks

Gold mining stocks let investors buy shares in gold mining companies. This way, they can profit from the success of these companies and gold price increases. However, these stocks can be risky due to market volatility.

Futures and Options

Futures and options are for experienced investors. Futures contracts let investors agree to buy or sell gold at set prices. This helps manage price risks.

Options give the right to buy or sell gold at set prices. They offer flexibility and risk management. These tools can help maximize returns and manage risks.

| Investment Type | Advantages | Considerations |

|---|---|---|

| Physical Gold Purchase | Tangible asset, high quality, cultural significance | Storage and security costs |

| Gold ETFs and Mutual Funds | No physical storage needed, liquidity, lower capital | Management fees, market risk |

| Gold Mining Stocks | Potentially high returns, exposure to gold industry | Stock market volatility, company performance |

| Futures and Options | Hedging, flexibility, high potential returns | Complexity, high risk, requires expertise |

Maximizing Profit Through Gold Bullion Investment Opportunities

To make money in the UAE gold market, you need to find the best gold bullion investments. Start by knowing when and how to enter the market. Use strategies like holding gold for a long time or trading it short-term. Gold’s strong value makes it a solid choice for investing.

Gold ETFs and mutual funds are cheap, with fees around 0.61%. Investing in gold bullion lets you directly see the value of gold. By watching market trends, you can find the best times to invest and make more money.

Gold jewelry often costs a lot more than its value, sometimes up to 300% more. But, gold coins bought from private sellers usually have a small premium, about 1% to 5%. Knowing the details, like futures contracts, helps avoid problems and makes your investment better.

If you want to get into the gold market, using resources like this guide to gold trading is smart. It helps you make informed choices. Gold mining companies can also be a safer option, with global operations and ways to protect profits from price changes.

In conclusion, knowing about gold trading and improving your bullion investment strategies can lead to big gains. Even with market ups and downs, there are chances to make smart investments in the UAE gold market.

Analyzing Gold Price Trends in UAE

Gold price trends in the UAE are shaped by global markets, local demand, and geopolitical factors. These elements change gold prices daily. Investors can make better choices by studying these factors.

Global Market Influences

Global markets play a big role in gold prices in the UAE. The US dollar’s strength, world economic conditions, and oil prices all matter. For instance, a strong US dollar lowers gold prices. But, economic worries like inflation or recessions can make gold prices go up.

Local Demand and Supply Dynamics

In the UAE, local demand and supply also affect gold prices. Demand goes up during festivals and weddings, raising prices. But, more gold available can lower prices. Here are the gold prices in UAE as of June 7, 2024:

| Gold Carat | Price (AED per gram) |

|---|---|

| 24-carat | 275.60 |

| 22-carat | 252.63 |

| 21-carat | 241.15 |

| 18-carat | 206.70 |

| 14-carat | 160.77 |

| 12-carat | 145.00 |

| 10-carat | 117.59 |

This shows how different carat gold prices change in the UAE. Investors watch these trends closely.

Geopolitical Factors

Geopolitical events also influence gold prices. Political instability, trade disputes, and policy changes can cause price swings. For example, Middle East tensions can make gold prices rise as investors seek safe assets.

Knowing these factors helps investors make smart gold investments. They can use current trends and predictions to guide their strategies.

Benefits of Investing in Gold Bullion

Gold bullion offers many benefits. It acts as a safe-haven asset during tough economic times. It also helps in fighting inflation and diversifying your portfolio. Over the years, gold has shown its value, especially when other assets fail.

Safe-Haven Asset

Gold has been a safe-haven asset in many financial crises. For example, during the Global Financial Crisis, gold prices went up by over 25%. Meanwhile, the S&P 500 Index fell by more than 50%.

Gold prices have gone up in six out of the eight biggest stock market crashes in the last 40 years. This shows gold’s reliability as a store of wealth in uncertain times.

Inflation Hedge

Gold is known for fighting inflation. When the dollar’s value drops, gold often goes up. Between 2008 and 2012, gold prices rose by more than 100% during a financial crisis.

The Federal Reserve Bank of Chicago found that gold prices go up when people are pessimistic about the economy. Adding gold to your portfolio can protect it from inflation.

Diversification

Adding gold to your portfolio can reduce risk. Financial advisors suggest putting 5% to 10% of your investments in gold. Gold ETFs, which hold physical gold, make it easy to invest in gold without storage worries.

The goal is to balance returns and risks. For example, a portfolio with gold can do better during stock market volatility or currency instability It offers better protection than a portfolio full of stocks or bonds.

Here’s a detailed comparison of the benefits:

| Benefit | Description | Historical Performance |

|---|---|---|

| Safe-Haven Asset | Provides stability during financial downturns and crises | Gold prices increased during 6 of the past 8 biggest market crashes |

| Inflation Hedge | Protects against diminishing dollar value during high inflation periods | Increased by over 100% from 2008-2012 |

| Portfolio Diversification | Reduces overall portfolio risk by balancing different asset classes | 3%-6% allocation in gold recommended by experts |

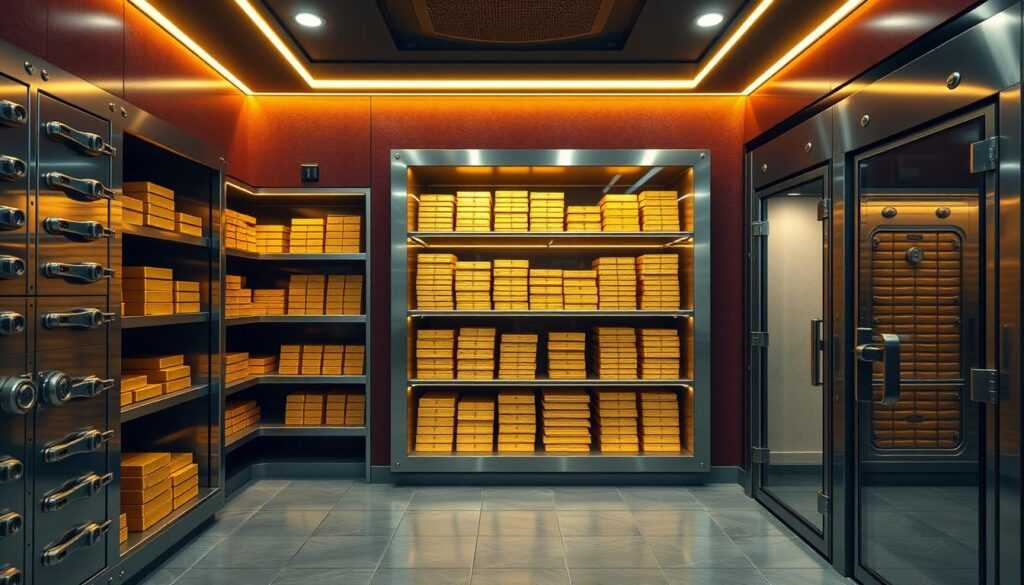

Top Bullion Storage Options in UAE

Investors in the UAE have many safe ways to store physical gold. It’s important to keep your assets safe. Safe deposit boxes and private vault services are good choices.

Safe Deposit Boxes

Many banks offer safe deposit boxes for storing gold bullion. These boxes have strong security, like access control and constant watch. They protect your gold from theft or damage, giving you peace of mind.

When picking a safe deposit box, think about how easy it is to get to your gold. Also, check if it’s insured against risks.

Private Vaults

Private vault services are known for their high security and privacy. They offer special storage for bullion investors. These services meet the highest security standards.

GVS Group is a top choice for secure storage of precious metals like gold. They’ve been in business for over 20 years. They use Wertheim safes, a leader in security since 2003.

GVS Group offers many benefits, including:

- International delivery services for fast and wide delivery of orders.

- The chance to buy/sell gold and silver anytime at fixed rates tied to live prices.

- Regular audits by a tax expert to check inventory twice a year.

- High-security storage, with gold bars in armored cabinets and strong masonry.

GVS Group has vaults in cities like Dubai, Vienna, Singapore, and Zurich. This ensures your investments are safe worldwide. When choosing private vaults, look at security, access, and insurance.

Choosing between safe deposit boxes and private vaults depends on your needs. Make sure your provider offers strong security, easy access, and good insurance. These options protect your gold from risks, keeping it safe and easy to get to.

Liquidity and Marketability of Gold Bullion

The UAE’s gold market is very attractive because of its liquidity and marketability. Gold is recognized worldwide, making it easy to sell. This ease is due to the global bullion market’s established systems.

Ease of Selling

Gold bars and coins come in various sizes, from small to large. This variety makes selling gold flexible. The SPDR Gold Shares (GLD) ETF also makes buying and selling gold easy, like trading stocks.

In the UAE, the market’s infrastructure supports smooth gold transactions. This ensures high bullion liquidity.

Market Timing and Trends

Knowing market trends is key to selling gold at the right time. Gold futures and options offer flexibility in buying or selling. The market is influenced by many factors, including global demand and geopolitical events.

Gold-backed ETFs have seen high demand, showing market trends. Investors who follow these trends can make better decisions. Trading gold ETFs, which track gold prices, adds to the market’s appeal.

Timing is crucial when selling gold. Keeping an eye on market trends and prices helps investors make smart choices. This approach can lead to higher profits in the gold market.

Tax Implications for Gold Investors in UAE

Knowing the tax rules for gold investments in the UAE is key to making more money. The UAE’s tax laws aim to draw in investors from around the world. They offer a tax break for gold bullion and coins traded between registered businesses.

The UAE has a 5% VAT for gold, diamonds, and jewelry bought by consumers. But, businesses get a break through a reverse charge. This makes investing in gold more appealing by lowering taxes.

In 2022, the UAE brought in about USD $28.5 billion worth of gold. Gold exports were around USD $16.2 billion. Dubai’s 0% corporate and income tax in Free Zones also helps businesses.

The Emirate Refinery in Dubai can refine 200 tonnes of gold a year. This boosts the gold infrastructure for investors. Gold is also a big part of Dubai’s culture, keeping the market stable.

The UAE’s tax rules on gold investments are good for investors. They help keep taxes low and profits high. These rules help make the UAE a top place for gold trading.

For more on UAE gold investment taxes, check out this detailed guide.

Choosing the Right Platforms for Gold Trading

In the UAE, picking the right gold trading platforms is key. There are 43 online brokers to choose from, with 7 top ones reviewed. Look for platforms that offer good trading options, research tools, and customer support. Here are three top platforms to help you grow your investment.

ICM Capital

ICM Capital is a top choice for gold trading. It has a strong online trading system and international licenses. It’s recognized by the Abu Dhabi Global Market and offers tools for trading gold assets like CFDs, ETFs, and futures.

ICM Capital has competitive fees for gold CFDs, from 1.5 pips to 2 pips. It also has great customer support, available 24/5 through live chat, email, and phone.

⇒ Open your account now with ICM Capital and trade Live on gold with a global broker who holds international licenses and is licensed by the Abu Dhabi Global Market

Equiti

Equiti is a well-known name in gold trading, verified by the Securities and Commodities Authority of UAE. It offers a variety of gold trading options and advanced research tools. The platform is designed for users, with real-time market data and analytics.

The customer support team is available 24/5, ready to help traders through multiple channels.

These platforms offer valuable tools and resources for navigating gold trading. By using ICM Capital, Equiti, investors can improve their strategies and see significant returns in the UAE gold market.

Evaluating Bullion Dealers and Online Platforms

When you invest in gold bullion, it’s key to check out bullion dealers and online platforms. Their trustworthiness directly affects your investment. You need to carefully evaluate them to avoid risks. Let’s look at what matters most: their reputation, how clear they are about prices, and their customer service.

Reputation and Credibility

Knowing a dealer’s reputation is vital. Companies like ISA Bullion are known for being reliable. Look at what others say and professional reviews. A trusted platform means a safer place for your money.

Pricing Transparency

It’s also important to see how dealers price their bullion. Compare the prices they charge above the market rate. Make sure they explain how they set these prices. Clear pricing builds trust and makes choosing easier.

Customer Service

Great customer service can make your investment better. Companies like ICM Capital offer help with everything from buying to learning. Good service means a smooth experience and more confidence in your choice.

| Dealer | Reputation Rating | Pricing Transparency | Customer Service |

|---|---|---|---|

| ISA Bullion | 7.5/10 | Moderate | Very Good |

| ICM Capital | 9/10 | High | Excellent |

| Equiti | 8.5/10 | Moderate | Good |

Key Strategies for New Gold Investors

Starting your gold investment journey in the UAE needs careful planning. It’s important to understand the market well. New investors should create strong strategies based on market research, decide on the right time to invest, and spread their investments.

Market Analysis and Research

Good investment strategies start with thorough market research. It’s key to look at past prices, global factors, and local demand. Since gold is traded worldwide, staying informed on international trends is crucial.

Regular analysis helps find good investment chances and spot risks. This way, you can make smart choices.

Long-Term vs. Short-Term Investment

Choosing between long-term and short-term investments depends on your goals and how much risk you can take. Long-term gold investments are safer and protect against inflation. Short-term trading can be riskier but offers chances to make quick profits.

Both methods need constant watching and adjusting to market changes. This ensures your strategy stays effective.

Diversification Strategies

Diversifying gold investments is key to reducing risks and increasing returns. Gold adds value to a portfolio. It should not be more than 5% of your investments but can go up to 10% in volatile markets.

Mixing physical gold with other investments like Gold ETFs, mutual funds, and mining stocks can make your portfolio stronger. This mix can help it grow and stay stable.

Conclusion

We’ve looked into gold bullion investment in the UAE, covering many angles. Success in this market comes from knowing global and local trends, making smart choices, and using platforms like Bullion. These platforms help investors of all levels.

The UAE’s tax-friendly setup and strategic location boost its market appeal. Gold has grown about 84% in value over the last decade. This shows gold is a solid investment choice.

We’ve talked about different ways to invest in gold, like physical bullion, ETFs, and mutual funds. Each has its own benefits and things to think about. It’s key to spread out investments to reduce risks and increase gains.

Knowing when to invest, understanding world events, and keeping an eye on the economy are also crucial. These help investors make smart choices.

To wrap up, our advice is to do thorough research and diversify. The UAE offers great opportunities for investors, thanks to its modern setup and trading platforms. Staying updated and flexible will help both new and experienced investors succeed in the gold market.

FAQ

Why is Dubai considered a strategic hub for gold trading?

Dubai’s location at the crossroads of Asia, Africa, and Europe is key. It also has a tax-friendly environment and advanced infrastructure. This includes the Dubai Gold and Commodities Exchange (DGCX) and traditional souks.

What are the tax benefits for gold investors in the UAE?

The UAE offers big tax benefits. Investors don’t pay value-added tax (VAT) on gold bullion and coins. This makes it very attractive for investors worldwide.

What types of gold investments are available in the UAE?

In the UAE, you can invest in physical gold, like bars and coins. You can also invest in gold ETFs, mutual funds, gold mining stocks, and futures and options.

How can I maximize profit through gold bullion investment opportunities in the UAE?

To make the most profit, understand when to enter the market. Use different investment strategies and watch market trends. Platforms like ISA Bullion help with clear pricing and a wide range of products.

What factors influence gold price trends in the UAE?

Gold prices in the UAE are affected by global markets, local demand and supply, and politics. Keeping an eye on these factors helps make smart investment choices.

What are the benefits of investing in gold bullion?

Gold bullion is a safe asset during economic ups and downs. It also protects against inflation and diversifies your portfolio.

What are the top bullion storage options in the UAE?

Safe storage options include bank safe deposit boxes and private vaults. These provide protection and peace of mind for your gold.

How liquid and marketable is gold bullion in the UAE?

Gold bullion is very liquid and marketable globally. Knowing when to buy and sell is key to making profits and managing your investments well.

Which platforms are recommended for gold trading in the UAE?

ICM Capital, Equiti, and IS Bullion are top choices. They offer secure online trading, strong customer service, and follow strict rules.

How can I evaluate potential bullion dealers and online platforms?

Look at a dealer’s reputation, pricing, and customer service. Reliable platforms like ISA Bullion provide great client services for a safe trading experience.

What strategies should new gold investors in the UAE consider?

New investors should analyze the market and do ongoing research. They should choose between holding gold long-term or trading it short-term based on their goals and risk level. Diversifying across different gold products is also wise.