Did you know Dubai imports 1,200 tons of gold every year? This gold is worth around $41 billion. This shows Dubai’s big role in the global gold market. We’ll look at what affects gold prices in Dubai, a key place in the UAE gold market.

The Dubai Gold and Commodities Exchange (DGCX) is a big player in gold trading. It helps with futures contracts, making Dubai important in precious metals. Knowing how global events affect gold prices in Dubai is key for investors and buyers.

As of October 29, 2024, gold prices in Dubai are interesting. 24K gold, the purest, costs AED 333.50 per gram. 22K and 21K gold cost AED 308.75 and AED 299.00 per gram, respectively. These prices show local demand and global economic factors.

ICM Capital knows how important it is to stay updated in this changing market. As a global broker, we help you trade gold confidently. Open your account now to explore Dubai’s gold market.

Equiti, a global broker, also offers a chance to trade gold. They have the knowledge to help you understand gold price changes in the UAE market.

Key Takeaways

- Dubai imports 1,200 tons of gold annually, worth $41 billion

- DGCX plays a crucial role in gold futures trading

- Current 24K gold rate: AED 333.50 per gram

- Global economic events significantly impact Dubai gold rates

- ICM Capital and Equiti offer opportunities for gold trading

- Understanding market dynamics is crucial for investors

Understanding Dubai’s Gold Market

Dubai’s gold market is a bright spot in the global gold trade. It has become a major center for gold transactions. Gold imports and exports are key to the country’s economy.

Dubai’s Position in Global Gold Trade

Dubai’s location and strong infrastructure make it a major player in gold trade. The UAE gets a lot of its gold from international markets. Over a third of its imports are gold reserves.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Key Players in the UAE Gold Market

The UAE gold market is supported by both local and international players. India, Switzerland, and the USA are major markets for UAE gold. These relationships are helped by government policies and international efforts.

Gold Import and Export Dynamics

The UAE’s gold trade is complex and always changing. Gold prices have hit new highs, with Indian prices doubling in five years. This affects the UAE’s gold trade a lot.

| Factor | Impact on UAE Gold Market |

|---|---|

| Central Bank Demand | Increased demand supports prices |

| US Federal Reserve Rate Cuts | Supportive of gold prices |

| Chinese Demand | Expected recovery due to economic stimulus |

| Short-term Market Volatility | Potential for technical correction |

For those interested in gold trading, Equiti offers a platform to trade live on gold. As a global broker with licenses from the UAE, Equiti provides a safe way into the UAE gold market.

Today Gold Rate in Dubai: Factors Influencing Gold Price Fluctuations

Gold prices in Dubai are influenced by many global and local factors. The current gold rate in Dubai shows a balance between demand and supply. This balance is shaped by both local and international forces.

Recently, the Dubai gold market has seen big price changes. For example, 24-carat gold hit AED330.50, and 22-carat gold reached AED306. These changes come from different factors affecting gold prices.

Global economic conditions are key in setting gold rates. In October 2024, spot gold was at $2,754.25 per ounce. U.S. gold futures also rose by 0.3% to $2,768.40. These global trends affect Dubai’s gold market, changing local prices.

In the UAE, demand and supply greatly impact gold rates. High demand for jewelry during festivals and weddings pushes prices up. Investments and the balance between local production and imports also play a role.

| Factor | Impact on Gold Rate |

|---|---|

| U.S. Interest Rates | 92% chance of rate cut in November 2024 |

| U.S. Treasury Yield | 10-year yield at 4.244% (3-month high) |

| Global Gold Price | $2,730.38 per troy ounce (Oct 25, 2024) |

Geopolitical tensions and currency changes add more complexity to gold pricing. A weaker U.S. dollar makes gold cheaper for Dubai buyers. This can increase demand and prices.

- Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.

- Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

Gold is seen as a ‘safe haven’ asset, moving opposite to stock markets. When uncertainty grows, investors turn to gold, boosting its value.

Knowing these factors helps investors understand Dubai’s gold market. For those wanting to make the most of these trends, reputable brokers offer gold CFD trading with good leverage ratios.

Supply and Demand Dynamics in the UAE

The UAE gold market is all about finding the right balance between supply and demand. We’ll look at what drives this balance, from jewelry needs to investment plans and mining trends.

Consumer Demand for Jewelry

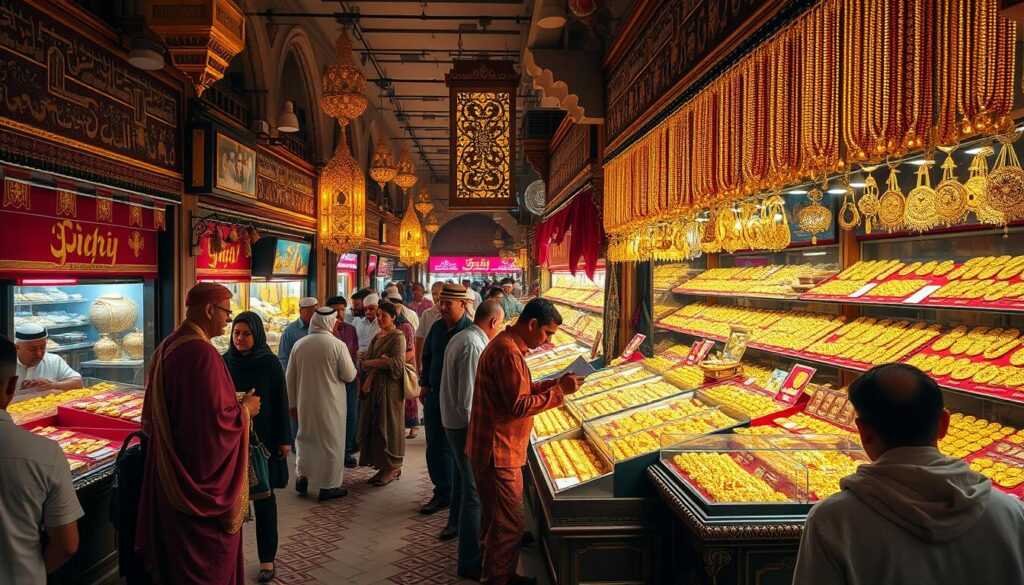

Jewelry demand is key in the UAE gold market. Dubai, with over 300 gold shops, is a major gold trading center. Gold jewelry is a big part of global demand, with China and India leading the way.

Institutional Investments

Investment demand also shapes gold prices. When the economy is uncertain, investors and banks look to gold as a safe choice. ICM Capital, a global broker, offers gold trading opportunities in this market.

Domestic Production vs. Imports

The UAE mines some gold but mostly imports it. It gets most of its gold from Africa and Europe. This reliance on imports affects Dubai’s gold prices.

| Factor | Impact on Gold Rates |

|---|---|

| Jewelry Demand | High influence, drives nearly 50% of transactions |

| Investment Demand | Significant during economic uncertainty |

| Domestic Production | Limited impact due to low output |

| Imports | Major influence, primary source of supply |

Knowing about supply and demand is vital for those in the UAE gold market. With Equiti, a global broker, you can trade gold live. Use these insights to your advantage.

Global Economic Factors Impacting Dubai Gold Rates

Global economic conditions greatly affect Dubai’s gold rates. Inflation, interest rates, and the overall economy play big roles. Central bank policies, mainly from major economies, also impact gold prices in the UAE.

Recently, gold prices have gone up. In the UAE, 24-carat gold now costs AED330.50. This rise follows the global trend, with spot gold hitting a record high of $2,780. These changes are linked to economic indicators and market sentiments.

“Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

The U.S. Federal Reserve’s interest rate decisions affect gold prices. Traders think there’s a 92.6% chance of a rate cut in November. This could make gold even more attractive, with prices possibly reaching $2,800 this year.

Equiti, a global broker, sheds light on these market trends. They say adding gold to investment portfolios can protect against economic ups and downs.

“Gold prices are expected to reach around Rs 85,000 per 10g in the next 6 months, reflecting the metal’s role as a safe haven during uncertain economic times.”

In India, gold prices have jumped from Rs 68,000 per 10g in July 2024 to Rs 76,000 in October 2024. This 12% increase shows how global markets affect Dubai’s gold rates.

| Year | Gold Investment Return |

|---|---|

| 2023 (1 year) | 30.6% |

| 2022 (2 years) | 56.8% |

| 2004 (20 years) | 1103.1% |

| 1994 (30 years) | 1533.5% |

As global economic worries grow, central banks are buying more gold. They bought over 1,000 tonnes in 2023. This, along with festive-season buying in countries like India, keeps pushing gold prices up, influencing Dubai’s market.

Geopolitical Tensions and Their Effect on Gold Prices

Geopolitical tensions greatly affect gold prices in Dubai. Global events can cause big changes in gold rates. This makes gold a safe choice when times are uncertain.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE

⇒ Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Middle East Conflicts

Conflicts in the Middle East directly impact gold prices. Wars can lead to slower global growth and higher inflation. This makes gold more appealing. In Dubai, a key gold trading center, these tensions can push prices up as investors look for stability.

U.S. Presidential Elections

U.S. elections have a big impact on gold prices in Dubai. The uncertainty around these elections can make markets more volatile. For example, recent U.S. elections and job number drops helped gold prices rise. ICM Capital, a global broker, offers chances to trade gold during these times.

International Trade Disputes

Trade disputes between big economies can affect gold prices. These conflicts can lead to changes in currency values, which then changes gold prices. A weaker U.S. dollar usually means higher gold prices, making it more appealing to buyers using other currencies.

| Factor | Impact on Gold Price |

|---|---|

| Middle East Conflicts | Increased demand, higher prices |

| U.S. Elections | Market volatility, potential price surge |

| Trade Disputes | Currency fluctuations, price adjustments |

Gold stays a popular investment choice as tensions keep rising. Open your account now with ICM Capital. Trade live on gold with a global broker authorized by the Abu Dhabi Global Markets (ADGM).

Currency Fluctuations and Gold Rates

Currency changes greatly affect gold prices in Dubai. The UAE dirham, tied to the US dollar, has a big impact. Since gold prices are set in US dollars, changes in exchange rates matter a lot to UAE buyers.

When the US dollar gets stronger, gold prices in Dubai often drop. But if the dollar weakens, gold rates go up. This shows how important it is to watch the market.

Currency movements aren’t just about the US dollar. Changes in the Euro, Saudi Riyal, Indian Rupee, and British Pound also play a role. For example, on October 29, 2024, gold rates in Dubai per gram were:

| Karat | Price (AED) |

|---|---|

| 24K | 333.50 |

| 22K | 308.75 |

| 21K | 299.00 |

| 18K | 256.25 |

These prices show how global and local factors mix together. Equiti, a global broker, offers live gold trading in this changing market.

It’s key for investors and buyers in Dubai to understand these currency changes. Dubai’s role as a big gold trading center, with over 300 shops, makes it even more important to keep up with exchange rates and gold prices.

Central Bank Policies and Gold Prices

Central bank policies are key in shaping gold prices worldwide, including in Dubai. Big financial decisions can change gold market rates and how investors act.

Federal Reserve Interest Rate Decisions

The Federal Reserve’s interest rate decisions greatly affect gold prices. In 2022, when rates went up, gold prices fell. Now, with a 92.6% chance of a rate cut in November, we’re watching closely. Lower rates often boost gold prices as investors seek alternatives to low-yielding assets.

European Central Bank Monetary Policy

The European Central Bank’s monetary policy also affects Dubai’s gold market. Quantitative easing can make inflation fears rise, making gold more appealing as a safe haven. We’ve seen these policies push gold prices up, showing economic concerns.

UAE Central Bank Gold Reserves

The UAE Central Bank’s gold reserves and buying decisions impact local gold rates. In 2023, central banks bought over 1,000 tonnes of gold, showing gold’s role as a hedge against economic uncertainty. We expect this trend to continue in 2024, possibly driving prices higher.

For those wanting to make the most of these market changes, ICM Capital offers a platform to trade gold live. As a global multi-regulated broker authorized by the Abu Dhabi Global Markets (ADGM), they provide a secure way to engage with the gold market. Equiti, licensed by the Securities and Commodities Authority of the UAE, also offers a way to trade gold in this dynamic environment.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

What is Dubai’s position in the global gold trade?

The UAE is a major player in the global gold trade. In 2019, gold imports hit billion. It’s a key hub for gold transactions, with a third of imports being gold reserves.

Who are the key players in the UAE gold market?

Jewelry demand drives nearly half of UAE gold transactions. Banks and investors also buy large amounts of gold when the economy is uncertain.

How does the UAE meet its gold supply requirements?

The UAE imports most of its gold, mainly from Africa and Europe. Domestic production is not enough to meet demand.

What factors influence gold price fluctuations in Dubai?

Many things affect gold prices in Dubai. These include the local and global economy, politics, currency changes, demand, and where gold comes from.

How does consumer demand for jewelry affect gold rates in Dubai?

Jewelry demand is huge in the UAE. It’s nearly half of all gold transactions, which greatly influences gold rates.

How do global economic factors impact Dubai gold rates?

The global economy has a big impact on Dubai gold rates. This includes interest rates, inflation, and economic growth.

How do geopolitical tensions affect gold prices in Dubai?

Tensions like the U.S. election and Middle East conflicts make gold more appealing. This drives up prices in Dubai.

How do currency fluctuations influence gold rates in Dubai?

Currency changes, like in the US dollar and UAE dirham, are key. They directly affect gold prices in Dubai.

How do central bank policies impact gold prices in Dubai?

Central bank policies, like those from the Federal Reserve and UAE Central Bank, are crucial. They influence gold prices through interest rates and gold purchases.