Did you know that every year, a staggering 1,200 tons of gold, valued at an astronomical $41 billion, find their path to the dazzling city of Dubai? This influx makes Dubai a key player in the global gold market. Here, precision and prosperity blend as smoothly as the threads of a luxurious garment. With today’s gold rate in Dubai at AED 332.75 per gram for 24K and AED 308.75 for 22K gold, investing in gold has never been easier or more appealing.

Dubai’s tax-free status for gold transactions offers lucrative opportunities without taxes. Gold prices have been rising, with predictions suggesting they could hit $3,000 in six months. This presents a golden chance to boost your portfolio with a symbol of wealth.

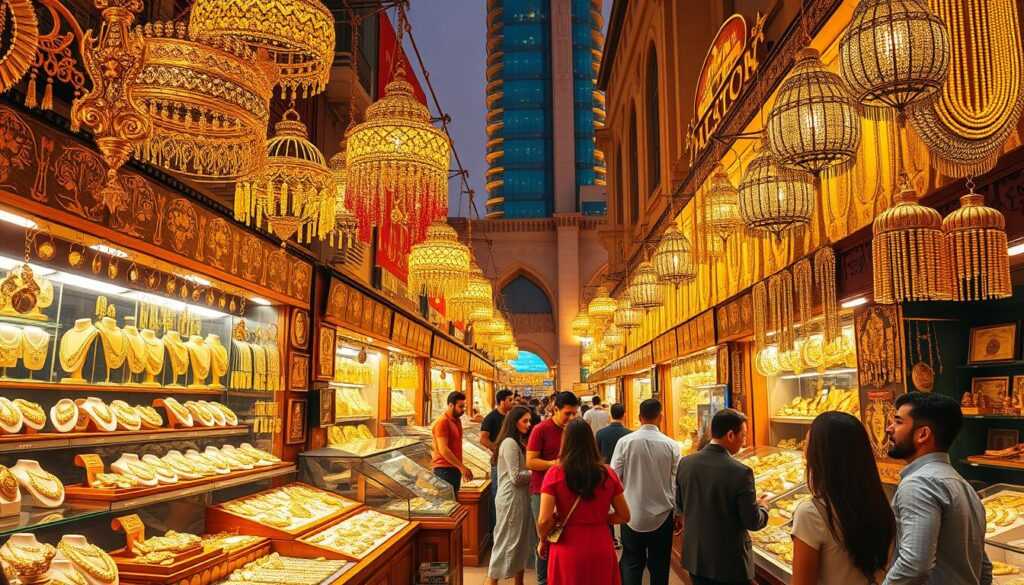

Whether you choose to explore Dubai’s Gold Souk or invest digitally, your journey to grow your wealth starts now. By working with top brokers like ICM Capital and Equiti, you can trade gold live. This lets you navigate the changing landscape of gold investment in the UAE.

Key Takeaways

- Dubai’s significant role in global gold imports signals vast potential for investors.

- Keep an eye on the constantly updated rates at Dubai’s Gold Souk to time your investments.

- Anticipated rise in gold prices can herald a fortuitous period for gold investors.

- The tax-free environment makes investing in gold Dubai highly advantageous.

- Choosing reputable brokers like ICM Capital and Equiti is crucial for secure and profitable gold investing experiences.

- Gold’s forecasted value increase suggests a prime opportunity to maximize your portfolio.

- Balance and stability are within reach by allocating a portion of your investment to gold.

Understanding Dubai’s Gold Market Dynamics

Dubai’s gold market is a mix of culture, economy, and investment. It shows how the Gold Souk and gold trading shape Dubai’s economy. This impact is not just immediate but also long-term, showing Dubai’s potential as a key economic sector.

The Role of the Gold Souk in Dubai’s Economy

Dubai’s Gold Souk is more than a market; it’s a key part of the city’s economy. It’s in the heart of Dubai’s historic area, filled with shops selling gold from all over. The lack of VAT on gold makes it more appealing, drawing in tourists and investors.

Importance of Gold in UAE’s Trade and Culture

In the UAE, gold is more than a commodity; it’s a part of culture and stability. Gold trading boosts Dubai’s economy, linking old markets with new finance. Dubai’s strict quality standards make gold investments safe and competitive worldwide.

Gold is also key in UAE’s trade and culture, playing a big role in festivals and daily life. This shows Dubai’s deep cultural and economic roots, making it a major player in global gold markets.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Now, let’s look at the economic benefits of investing in Dubai’s gold market:

| Feature | Benefit |

|---|---|

| Tax-Free Purchases | No VAT, enhancing investment returns |

| Competitive Prices | Lower than many regions, thanks to Dubai’s strategic trading position |

| Real-Time Gold Pricing | Reflects global market shifts, offering investment agility |

| Global Liquidity | Ease of converting gold into cash |

| High Purity and Quality | Assured by stringent regulatory standards |

Dubai’s market is great for both new and experienced investors. It combines tradition, flexibility, and economic benefits, making it a top choice for investors.

Current Trends in Gold Rate Today in Dubai

If you’re watching the gold rate in Dubai, you know it changes a lot. The gold rate in Dubai and the UAE is affected by world economic news and political issues. For example, today, 24K gold is AED 331.75 per gram, a bit higher than before. This shows gold investments can be both risky and rewarding.

The gold rate today in UAE and India often move together. This is because they share similar market views and economic actions. The gold rate today in Dubai is strong, but global events like rising U.S. inflation make gold more attractive to investors.

Experts predict the gold price forecast will go up soon. They think this because of ongoing global tensions and gold’s role as a safe asset during economic uncertainty. If you’re thinking about adding gold to your portfolio, watching these trends is key.

Gold is still very popular, but silver is gaining interest too, mainly during big sales times. Yet, gold is still at the heart of investment talks. It’s seen as a key for keeping value and fighting inflation over the long term.

For those looking to invest, working with trusted brokers in the UAE is a good idea. Companies like ICM Capital, Equiti, and ATFX offer valuable insights and safe trading spaces. These are important for making the most of gold rate changes.

In short, knowing the latest about the gold rate today in Dubai is crucial, whether you’re an experienced investor or new to precious metals. Gold is a solid part of a well-rounded investment plan. It offers both stability and profit chances in the world’s financial ups and downs.

“Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

“Trade Live on Gold with ATFX with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

Strategies for Investing in Gold: An Investor’s Guide

Thinking about gold investment strategies means you have many choices. These choices can really affect how well your portfolio does. Whether you’re investing in gold Dubai or somewhere else, knowing the difference between physical gold and digital gold trading is key.

Physical Gold vs. Digital Gold: What’s Right for You?

Physical gold includes bars, coins, and jewelry. It’s something you can hold and store. People often choose it for its real value and as a collectible. On the other hand, digital gold trading lets you invest in gold without worrying about storage. This includes things like ETFs and futures contracts, which track gold’s market value but don’t require physical gold.

Timing the Market: Best Practices for Gold Investments

Knowing when to buy or sell gold is as important as choosing what type to invest in. Dollar-cost averaging — investing a fixed amount regularly — can help avoid timing mistakes. It’s a good strategy in the unpredictable world of gold investments.

Here’s a table to help you understand different investments. It shows why adding gold to your portfolio is important for balance:

| Investment Type | Typical Investment Term | Risk Level | Annualized Returns |

|---|---|---|---|

| Physical Gold | Long-term | Low to Moderate | Varies with market price |

| Digital Gold ETFs | Medium to Long-term | Moderate | Track the price of gold |

| Stocks | Long-term | High | 6% – 10%* |

| Bonds | Short to Medium-term | Low | 3% – 5%* |

Dubai’s tax-free gold trading makes it a great place to invest in gold. Always think about your financial goals, how much risk you can take, and how long you plan to invest before making any decisions.

Gold Investment UAE: Benefits and Opportunities

The benefits of investing in gold in the UAE are clear. The country’s strong economy and gold’s role as a safe asset make it attractive. Gold investments in the UAE are not just a cultural symbol but also a way to protect and grow wealth.

Gold prices in the UAE are stable but responsive. Financial advisors often suggest gold for diversifying portfolios. Gold can protect against inflation and economic ups and downs. It keeps its value even when the world is uncertain.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

Working with trusted brokers like ICM Capital, Equiti, and ATFX adds security to your investments. These brokers are authorized by UAE regulatory bodies. They offer access to global markets and timely insights to boost your gold investment returns.

In 2021, shares of International Holding Company PJSC (IHC) in the UAE saw huge growth. They went from AED 1,400 to AED 152,200. This shows the potential for growth in the market, with gold investments adding stability to your portfolio.

| Investment Type | Potential for Returns | Market Stability | Recommended for Portfolio (%) |

|---|---|---|---|

| Gold | High | High | 5-10% |

| Equities (e.g., IHC) | Very High | Medium | 20-30% |

| Bonds | Medium | High | 20-40% |

| Real Estate | High | Variable | 15-25% |

Exploring the UAE’s gold market could be key to your investment strategy. By partnering with experienced financial entities and staying updated on gold prices in UAE, you gain both traditional security and growth opportunities.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE (ADGM).

⇒ Try your account with Equiti and Trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Trade Live on Gold with ATFX with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE (SCA).

Trade Gold with Confidence: Partnering with Top UAE Brokers

Investing in gold in Dubai connects you to a world of luxury and stability. It’s crucial to pick a broker in Dubai that’s reliable and regulated. With gold online trading, knowing the trading landscape helps you make better choices.

When you start trading, team up with top brokers like ICM Capital, Equiti, and ATFX. They are known for their transparent and regulated trading environments. This is thanks to UAE’s authorities like ADGM and SCA.

Opening Your Account with Trusted Brokers like ICM Capital

Open your account with ICM Capital and start trading gold live. They are a global, multi-regulated broker authorized by the Abu Dhabi Global Markets (ADGM). Their platform offers competitive spreads and fast order executions for a smooth trading experience.

Gold Market Analysis and Forecasting Tools

Using advanced tools for market analysis and forecasts can greatly improve your trading. Brokers like Equiti and ATFX offer these tools. For example, Equiti’s platform is backed by strong technology for precise gold market analysis, key for gold online trading.

| Broker | Minimum Deposit | Spreads Starting From |

|---|---|---|

| ICM Capital | $200 | $0.18 |

| Equiti | $100 | $0.16 |

| ATFX | $100 | Competitive |

With the right knowledge and a good partner, gold online trading can be exciting and profitable. Dubai’s luxury and a reliable broker set you up for successful investments with great returns.

Conclusion

As the financial world changes, your journey into commodities must be smart and informed. The gold rate today in Dubai shows a great chance, mirroring the success of the S&P 500 and Dow Jones. With the gold investment UAE growing, now is the perfect time to get involved.

Looking into gold’s future, gold rate forecasting is key to understanding its value. Gold stands out as a stable choice, even when stocks are shaky. To make the most of it, work with trusted brokers. Open your account with ICM Capital and start trading gold with a global broker.

Investing in Dubai’s gold market means growing your wealth. Your choice to invest shows you’re confident and forward-thinking. Golkunda Diamonds & Jewellery shows how profitable gold investments can be. Whether in stocks or gold, diversifying can lead to big gains. With hard work and careful planning, your investment today can secure a bright future.

⇒ Open your account now with ICM Capital and Trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

What is the gold rate today in Dubai?

As of November 4, 2024, gold in Dubai costs AED 331.75 per gram for 24K. For 22K, it’s AED 307.25. Remember, gold prices change often due to world economic shifts.

How can I maximize my portfolio by investing in gold in Dubai?

Adding gold to your portfolio can reduce risk. Dubai’s tax-free environment is great for investing in gold. You can buy physical gold or try digital options like ETFs. Using dollar cost averaging can also help your investment grow.

What role does the Gold Souk play in Dubai’s economy?

The Gold Souk is key to Dubai’s gold trade and economy. It sets gold prices three times a day, following global trends. It also keeps Dubai’s reputation as a top gold trading spot.

Why is gold important in UAE’s trade and culture?

Gold boosts UAE’s non-oil GDP, with Dubai importing 1,200 tons yearly. It’s also a symbol of wealth and status in UAE culture, used in jewelry and gifts.

How does one follow the current trends in the gold rate today in Dubai?

To stay updated on Dubai’s gold rates, watch the Gold Souk prices, updated three times a day. Financial news and gold analysts also offer insights and forecasts.

What should I consider when investing in physical gold versus digital gold?

Physical gold needs storage and security for bars, coins, and jewelry. Digital gold, like ETFs, offers liquidity and trading ease without storage worries.

What are the best practices for timing the market in gold investments?

Watch global economic signs like inflation and currency changes. Use dollar cost averaging to invest steadily, no matter the market.

What are the benefits and opportunities of gold investment in the UAE?

Gold investment in the UAE is tax-free and stable. The UAE’s strong economy is a good base for gold investments. Gold also diversifies your portfolio well.

How can I start trading gold with ICM Capital or Equiti in the UAE?

Start by opening an account with ICM Capital or Equiti, needing a $100 minimum deposit. Learn about the trading platform, leverage, and spreads before trading.

What gold market analysis and forecasting tools are available in the UAE?

The UAE offers tools like technical charts and live updates from brokers like ICM Capital and Equiti. These help predict gold prices and guide investment choices.