Did you know Dubai imports 1,200 tons of gold every year? This gold is worth about $41 billion. This shows how important the UAE is in the global gold market. We’ll look at how gold can help secure your financial future.

The Dubai gold market is a big deal for investors around the world. It’s known for being tax-free and strategically located. Knowing the current gold rate in UAE is key for smart investment choices.

We’ll help you understand gold investments in Dubai. From the Dubai Gold Souk to the Dubai Gold and Commodities Exchange (DGCX), there are many chances. We’ll show you how gold can strengthen your financial portfolio.

Key Takeaways

- Dubai imports 1,200 tons of gold annually, worth $41 billion

- The UAE offers tax-free gold investments and secure storage

- Gold often retains value during economic downturns

- Dubai’s gold market provides competitive prices and diverse products

- Ideal gold allocation in an investment portfolio is 5-10%

- Gold serves as a hedge against inflation and market volatility

- Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.

- Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

Ready to start your gold investment journey? Open your account now with ICM Capital and trade Live on gold with a global multi-regulated broker authorized by the Abu Dhabi Global Markets (ADGM). For another excellent option, consider Equiti, a global broker holding multi-international licenses and authorized by the Securities and Commodities Authority of the UAE. Let’s embark on this golden opportunity together!

Understanding the UAE Gold Market

The UAE gold market is a global leader, with Dubai at its heart. We’ll dive into its details and its global influence.

Dubai’s Position in Global Gold Trade

Dubai is known as the “City of Gold.” It imports 1,200 tons of gold every year, worth $41 billion. This makes Dubai a major player in the UAE gold market. The Dubai Gold and Commodities Exchange (DGCX) is a key spot for gold futures trading, drawing investors worldwide.

Factors Influencing Gold Rates in UAE

Many things affect gold rates in the UAE. Global events, economic stability, and currency values are key. The US dollar’s strength and central bank policies also play big roles. Recent global tensions and US Federal Reserve rate cuts have made gold prices go up.

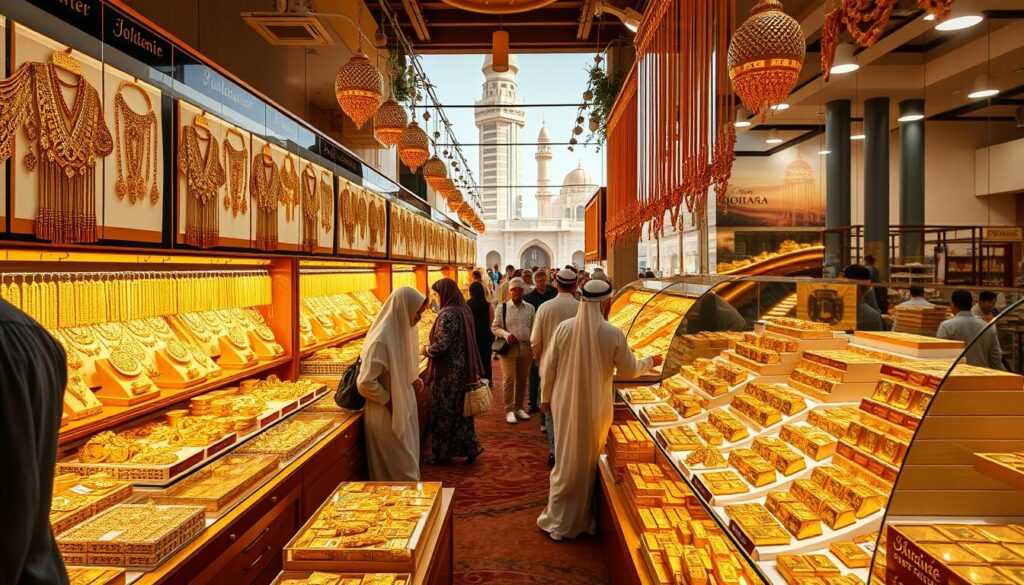

Gold Souk: The Heart of UAE’s Gold Market

The Dubai Gold Souk is the heart of the UAE’s gold trade. It has hundreds of shops with a wide range of gold products. The Dubai Jewelry Group updates prices three times a day, ensuring fair deals. Investors can find gold in various purities, with 24k being the purest and most expensive.

| Gold Purity | Description | Price Range |

|---|---|---|

| 24k | Purest form, 99.9% gold | Highest |

| 22k | 91.7% gold | Medium |

| 21k | 87.5% gold | Lowest |

The UAE gold market offers many investment choices. You can invest in physical gold, ETFs, or futures contracts. Dubai’s tax-free environment and secure storage make it a top choice for gold investors globally.

Current Gold Rate Trends in UAE

The UAE gold market is showing a positive trend. As of October 30, 2024, gold in Abu Dhabi costs AED 334.75 per gram for 24 karat. This rise is due to global issues like political tensions and economic worries.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

| Karat | Price per gram (AED) | Price per 10 grams (AED) |

|---|---|---|

| 24K | 334.75 | 3,347.50 |

| 22K | 309.75 | 3,097.50 |

| 21K | 300.00 | 3,000.00 |

| 18K | 257.00 | 2,570.00 |

Gold investments have seen significant gains. Those who invested two years ago have seen a 56.8% return. This shows gold’s value as a safe investment.

Central banks globally are buying more gold. In 2023, they bought over 1,000 tonnes. Experts think gold prices could hit $3000 in six months, thanks to strong demand.

This is a great chance for UAE investors. We suggest looking into gold ETFs or sovereign gold bonds for easy and liquid investments.

Start trading gold now with ICM Capital or Equiti. These global brokers offer safe platforms for your gold investments.

Gold as a Safe-Haven Asset

Gold is known as a safe-haven asset, shining bright in uncertain times. It keeps its value when the economy is down. This makes it a popular choice for investors.

Economic Resilience of Gold

Gold has shown its worth many times. In the last five years, its price has doubled. The last year saw a 24% increase. This shows gold’s strength against economic troubles.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE

⇒ Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Gold’s Performance During Market Volatility

Gold often does better than other assets when markets are shaky. Its value goes up when interest rates are low. This is why investors turn to gold when things are uncertain.

Hedging Against Inflation with Gold

Gold is a good way to protect against inflation. It keeps its value over time. The returns on gold bought on Dhanteras in India are impressive:

| Time Span | Return |

|---|---|

| 1 year | 30.6% |

| 5 years | 103.5% |

| 15 years | 393.6% |

| 30 years | 1533.5% |

Gold prices are expected to hit $3000 in six months. Its role as a safe-haven and inflation hedge is clear. We suggest adding gold to a diversified portfolio.

Open your account now with ICM Capital or Equiti and trade Live on gold with global multi-regulated brokers authorized by the Abu Dhabi Global Markets (ADGM) and Securities and Commodities Authority of the UAE.

Gold Rate Today in UAE: Securing Your Financial Future with Gold Investments

Gold investments in the UAE are a strong way to secure your money. The current gold rate trends make it a good choice against economic ups and downs. Over the years, gold has shown impressive growth, making it a solid long-term investment.

“Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

| Time Period | Gold Return |

|---|---|

| 2023 (1 year) | 30.6% |

| 2014-2024 (10 years) | 184.9% |

| 1994-2024 (30 years) | 1533.5% |

These numbers show why more people are turning to gold investments. In the UAE, gold is seen as a low-risk investment. This makes it appealing for those wanting stability in their portfolio.

Experts recommend putting 5% to 10% of your investments in gold. This helps balance the potential gains with the risk. It fits well with the UAE’s investment scene, which offers a range of options.

Thinking about investing in gold? Here are some options:

- Physical gold (bars, coins, jewelry)

- Gold ETFs

- Gold mining stocks

- Gold futures contracts

Each option has its own benefits, catering to different investor needs and risk levels. Remember, spreading your investments is crucial.

Ready to begin your gold investment journey? Open an account with ICM Capital or Equiti. Both are authorized by UAE regulatory bodies, allowing you to trade gold confidently.

Diversifying Your Portfolio with Gold

Gold is key for diversifying and managing risk in your portfolio. We’ll look at balancing risk with gold, finding the right amount of gold, and comparing gold ETFs to physical gold.

Balancing Risk with Gold Investments

Gold is a strong tool for managing risk in your investments. It often moves differently than stocks and bonds, acting as a shield against market ups and downs. Adding gold to your portfolio can help spread out risk and protect against big market drops.

Optimal Gold Allocation in Your Portfolio

A good portfolio mixes stocks, bonds, and gold. Experts suggest a 5-10% gold allocation in your portfolio. This helps manage risk and aims for good returns. The right percentage depends on your financial goals and how much risk you’re willing to take.

Gold ETFs vs. Physical Gold: Pros and Cons

When investing in gold, you can choose between Gold ETFs and physical gold. Gold ETFs are easy to trade and save on storage costs but might have fees. Physical gold gives you direct ownership but requires thinking about storage and security.

| Gold ETFs | Physical Gold |

|---|---|

| Easy to trade | Direct ownership |

| Low storage costs | No annual fees |

| May have annual fees | Storage and security needed |

Open your account now with ICM Capital or Equiti to trade live on gold. These platforms are authorized by the Abu Dhabi Global Markets (ADGM) and Securities and Commodities Authority of the UAE. They offer great chances for both gold ETFs and physical gold, meeting your diversification needs.

Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE. Similarly, you can open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by Securities and Commodities Authority of the UAE.

Strategies for Investing in Gold in UAE

Investing in gold in the UAE needs careful planning and market knowledge. We’ve put together effective gold investment strategies. They help you understand the UAE gold market and make smart choices.

Timing is key when buying gold. Watch global economic events and geopolitical tensions. They greatly affect gold prices. The UAE gold market is very sensitive to these changes.

For physical gold, visit trusted dealers in famous gold souks or malls. Always check the gold’s purity with hallmarks. Also, ask for a receipt that shows the item’s weight and purity.

- Compare prices at different shops before making a purchase

- Consider craftsmanship along with gold weight for jewelry investments

- Open an account with regulated brokers for gold trading

If you’re into gold trading, think about opening an account with ICM Capital or Equiti. Both are approved by UAE financial authorities. They offer strong platforms for gold investments.

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in the year you buy it than they were in the year you sold it.” – Warren Buffett

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Physical Gold | Low | Moderate |

| Gold ETFs | Moderate | Medium to High |

| Gold Mining Stocks | High | High |

Remember, diversification is key. Gold can be a great addition to your portfolio. But it should be part of a wider investment strategy. Tailor it to your financial goals and risk tolerance.

Conclusion

We’ve looked into the UAE gold market and its benefits. Dubai is a key player in global gold trading. This makes it a great place for those wanting to invest in gold for financial security.

Gold’s value is clear across the globe. In India, families own over 25,000 tonnes of gold. This shows the UAE market’s potential too. Gold prices have hit new highs, promising a bright future for investments.

Investors in the UAE have many choices. You can buy physical gold, Gold ETFs, and more. The rise in Gold ETF popularity shows a shift in how people invest. This trend supports the UAE’s strong gold market outlook.

Want to invest in gold for your future? Open an account with ICM Capital or Equiti. Both are authorized in the UAE. They offer live gold trading, helping you explore the UAE gold market’s potential.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

What makes Dubai a major hub for gold trading?

Dubai is known as the “City of Gold” for its huge gold trade. It imports about 1,200 tons of gold each year, worth around billion. Its location and tax-free policies make it a key place for gold trading.

How is the gold rate in Dubai determined?

The gold rate in Dubai is set by global prices and local demand. The Dubai Jewelry Group updates prices in the Gold Souk three times a day. They consider global events, currency values, and supply and demand.

What investment options are available for gold in Dubai?

In Dubai, you can invest in physical gold like bars, coins, and jewelry. You can also invest in gold ETFs, futures on the Dubai Gold and Commodities Exchange (DGCX), or stocks of gold mining companies.

Why is gold considered a safe-haven asset?

Gold is seen as a safe asset because it keeps its value during tough times. It protects against inflation and currency loss. It’s a valuable store of wealth.

How can gold help diversify an investment portfolio?

Gold can spread risk and protect against market ups and downs. It often moves differently from stocks and bonds. A balanced portfolio might include stocks, bonds, and 5-10% gold.

What are the differences between investing in gold ETFs and physical gold?

Gold ETFs are easy to trade and save on storage costs but have fees. Physical gold offers direct ownership but requires storage and security. Your choice depends on your investment goals and risk level.

What factors should be considered when investing in gold in the UAE?

When investing in gold in the UAE, check current rates and compare prices. Verify purity and buy from trusted dealers. Also, consider global events, tensions, and currency rates that affect gold prices.