Did you know Dubai’s gold market trades over 300 tons of gold every year? This is worth a whopping $12 billion. This shows Dubai’s big role in the global gold trade. As we look at gold investment for beginners in Dubai, we see its special benefits.

Dubai is great for gold investors because it has no taxes and safe places to store gold. When we look at different gold investment options, Dubai stands out. Its location and wide range of products offer unique chances. Let’s see why investing in gold in Dubai could be your key to financial safety.

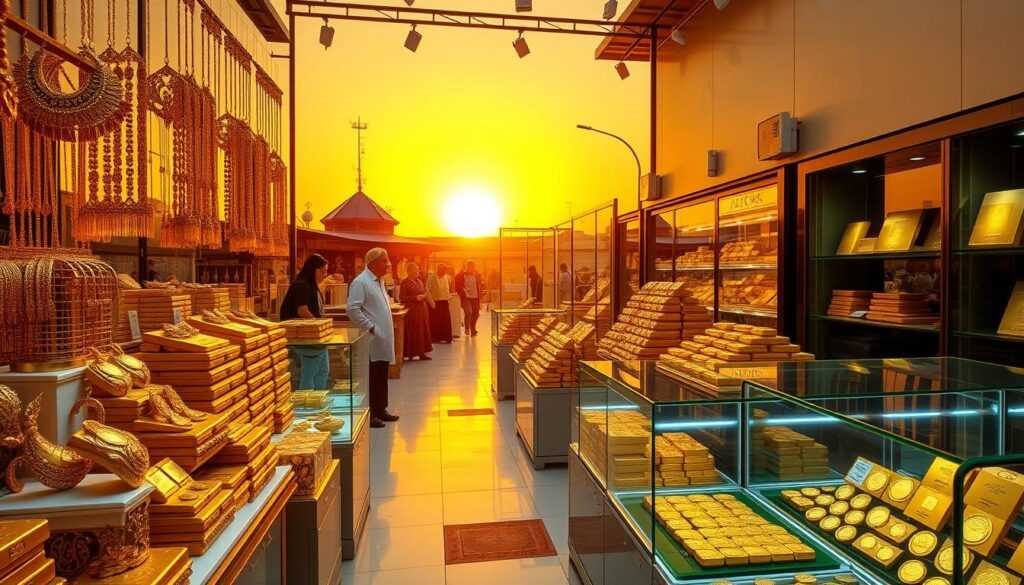

The gold rate in Dubai today is influenced by global and local factors. From the lively Gold Souk to modern trading sites, Dubai mixes old and new. We’ll help you understand gold prices in Dubai, so you can make smart choices in this profitable market.

Key Takeaways

- Dubai trades over 300 tons of gold annually

- Tax-free environment attracts gold investors

- Diverse investment options available

- Gold serves as a hedge against economic uncertainty

- Dubai’s gold market combines tradition with modern trading

Open your account now with ICM Capital and trade Live on gold with a global multi-regulated broker authorized by the Abu Dhabi Global Markets (ADGM). For another excellent option, consider opening an account with Equiti, a global broker holding multi-international licenses and authorized by the Securities and Commodities Authority of the UAE.

Understanding Dubai’s Gold Market

Dubai’s gold market is a global leader in precious metals. It’s known for its unique aspects that attract gold traders and investors worldwide.

The City of Gold: Dubai’s Unique Position

Dubai is called the “City of Gold” for good reason. It imports about 1,200 tons of gold every year, worth $41 billion. This makes Dubai a major player in the global gold market.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

Factors Influencing Gold Prices in Dubai

Gold prices in Dubai change due to several factors. The Dubai Gold and Commodities Exchange (DGCX) sets prices. Global events, political tensions, and investor feelings also affect gold prices.

| Gold Purity | Percentage | Common Use |

|---|---|---|

| 24k | 99.9% | Gold bullion Dubai |

| 22k | 91.7% | Gold jewelry Dubai |

| 21k | 87.5% | Gold jewelry Dubai |

Dubai Gold Souk: A Hub for Gold Trading

The Dubai Gold Souk is the center of gold trading in Dubai. It has a wide variety of gold items, from small earrings to big necklaces. Prices are good, and the market follows strict rules for fair trade and quality.

Opening an account with ICM Capital or Equiti is a good idea for trading gold. Both are global brokers approved by UAE authorities. They offer safe platforms for investing in gold.

Gold Rate Today in Dubai: Comparing Gold Investment Options for Beginners

Dubai’s gold market offers many investment choices for beginners. With 24K gold priced at AED 332.75 per gram, there are several options to explore. We’ll look at physical gold, gold ETFs dubai, and gold mutual funds dubai to help you decide.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and is authorized by the Abu Dhabi Global Market UAE

⇒ Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and is authorized by Securities and Commodities Authority of the UAE.

Physical gold is a favorite in Dubai. The Gold Souk, known as the “City of Gold,” offers tax-free purchases of bars, coins, and jewelry. This tangible asset gives a sense of security but needs safe storage.

Gold ETFs dubai are a good choice for easier management. These funds track gold prices without the need for physical storage. ICM Capital, a global broker, offers gold ETF trading options.

Gold mutual funds dubai are another option for beginners. These funds invest in gold-related securities, offering diversification. Equiti, a global broker, provides access to various gold-related investment products.

| Investment Type | Advantages | Considerations |

|---|---|---|

| Physical Gold | Tangible asset, tax-free in Dubai | Storage and security concerns |

| Gold ETFs | Easy trading, no storage needed | Management fees, no physical ownership |

| Gold Mutual Funds | Professional management, diversification | Higher fees, market volatility |

Gold investments can act as a hedge against inflation and economic uncertainty. Dubai’s unique position in the global gold market makes it attractive for investors.

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now.” – Warren Buffett

Physical Gold Investments in Dubai

Dubai, known as the City of Gold, offers many options for investing in gold. We’ll look at physical gold investments, a favorite among many in the UAE.

Gold Bars and Coins

Gold bullion Dubai is a top choice for investing. Bars and coins vary in size, fitting different budgets. The purity of gold bars is usually 99.5% to 99.99%, making them a solid investment.

“Open your account now with ICM Capital and trade Live on Gold with a global broker who holds international licenses and authorized by the Abu Dhabi Global Market UAE.”

“Open your account now with Equiti and trade Live on Gold with a global broker who holds international licenses and authorized by the Securities and Commodities Authority of the UAE.”

Gold Jewelry as an Investment

Gold jewelry Dubai has two uses: for beauty and as an investment. It’s a cultural treasure, but remember, craftsmanship costs can impact resale value. Pure gold jewelry (24 karat) tends to hold its value better than lower karat pieces.

Pros and Cons of Physical Gold Ownership

Investing in gold Dubai has its benefits and downsides:

- Pros:

- A tangible asset you can hold

- Protection against inflation

- Cultural significance

- Cons:

- Storage and security concerns

- No regular income like dividends

- Potential for theft

Dubai’s tax-free status makes gold prices attractive, drawing buyers from across the region. Whether you prefer gold bullion, jewelry, or other forms, physical gold can enrich your investment portfolio.

“Gold is a way of going long on fear.” – Warren Buffett

Gold ETFs and Mutual Funds in Dubai

In Dubai, Gold ETFs and mutual funds are top choices for investing in gold. They let you invest in gold without needing to store it physically. This makes them popular among investors in the UAE.

Gold ETFs in Dubai are easy to get into and clear to understand. They cost very little, with fees ranging from 0.5-1%. Today, there are about 24 gold funds and ETFs available. For example, ICICI Prudential Gold ETF and Kotak Gold ETF have seen returns over 28% since last Diwali.

Gold mutual funds in Dubai offer expert management. They invest in both physical gold and gold-related stocks. ICICI Pru Regular Gold Savings Fund and Quantum Gold Saving Fund have returned 27.42% in the same time frame. Experts advise putting 5-10% of your portfolio into these for a balanced mix.

To begin investing in gold ETFs or mutual funds, open an account with ICM Capital. This global broker is authorized by the Abu Dhabi Global Markets (ADGM). Or you can choose Equiti, licensed by the Securities and Commodities Authority of the UAE. Both offer safe ways to dive into Dubai’s lively gold market.

⇒ Open your account now with ICM Capital and trade Live on Gold with a global multi-regulated broker and authorized by the Abu Dhabi Global Markets (ADGM) ⇐

FAQ

Why is Dubai considered a hub for gold trading and investment?

Dubai is known as the “City of Gold.” It has a booming gold industry. It also offers a tax-free environment, competitive prices, and secure storage. These factors make it a top choice for gold trading and investment.

What factors influence gold prices in Dubai?

Several factors affect gold prices in Dubai. These include supply and demand, interest rates, the US dollar’s strength, and major world events.

What is the Dubai Gold Souk, and why is it significant?

The Dubai Gold Souk is a famous market. It offers a wide range of gold products, from small earrings to large necklaces, at competitive prices. It meets the high demand for gold, mainly during festivals and weddings. The market is well-regulated, ensuring fair prices and quality products.

What are the different gold investment options available in Dubai?

Dubai offers various gold investment options. These include physical gold (bars, coins, jewelry), Gold ETFs, gold mutual funds, and trading through futures or options. Each option has its own benefits, catering to different investor needs and risk levels.

What are the advantages of investing in physical gold in Dubai?

Investing in physical gold in Dubai has several benefits. It allows for direct control over a tangible asset, holds cultural value, and offers competitive prices due to Dubai’s tax-free status. Yet, it also poses challenges like storage, security risks, and the lack of financial returns like dividends or interest.

How do Gold ETFs and mutual funds in Dubai work?

Gold ETFs provide a way to invest in gold without needing physical storage. They offer flexibility and transparency through exchange trading. Gold mutual funds, on the other hand, offer professional management and invest in a mix of physical gold and gold-related stocks. They cater to investors who prefer diversified exposure.

What are some reputable brokers authorized to trade gold in the UAE market?

ICM Capital and Equiti are two global brokers authorized to trade gold in the UAE market.